Sir,

We are facing problem to file GSTR-3B in ITC Eligible. In the month of Oct-2017 we received input tax credit of Rs. 100.00 but due to non payment to the vendor with in 180 days now we reversed the same in month of March-18. during the month of March we received another ITC of Rs. 20.00 and put in 4 (A) (5) all other ITC field and also put ITC reversed of Rs. 100.00 in 4(B) (2) other ITC Reversal. now the net ITC Available calculated (A-B) = -80.00. We already have the sufficient ITC balance in my Electronic Credit Ledger to reverse the amount. But the problem is that when we reversed the ITC amount the figure will showing in Negative and also unable to save my GSTR-3B. Please suggest

Thanks and regards

Jitendra Agarwal

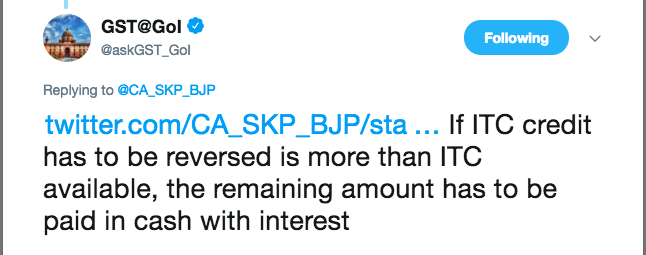

Got a reply from on Twitter from GST handle.

As per them you need to reverse ITC and negative amount should be paid with interest in cash.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion