GST registration procedure

Last udpated: Jan. 22, 2018, 7:34 p.m.The GST registration is made simple. As per me compared to earlier laws, registration under GST is simplest.

I have tried to cover the registration provision of CGST ACT, 2017 as well as Registration rules along with application rules to provide a guide on registering your business under GST law.

This guide will be updated from time to time, if any new changes are notified by government.

This guide is divided into different sections. You can read full guide or skip to a particular section.

- Understanding the registration procedure to register under GST

- List of documents required for GST registration along with authorisation formats

- Decoding the provisions of CGST Act, 2017 as applicable to registrations

Understanding the GST REGISTRATION RULES and procedure to register under GST

GST registration rules are released to documents the gst registration procedure. These rules have defined the GST registration procedure in detailed manner.

Registration procedure under GST

PART A

- Every person liable to register under GST shall apply for registration using the form GST REG-01. This form needs to filed online either at common portal or through a facilitation center.

- Person applying for registration should declare these details in Part A of application form GST REG 01:

- Permanent Account Number (PAN),

- Mobile number,

- E-mail address,

- State or Union territory

- PAN number provided will be verified by GST portal with PAN database

- One time password (OTP) will be sent to mobile and email for verification.

To fill the part A of application you need to go to GST portal.

Once on GST portal click on Register Now.

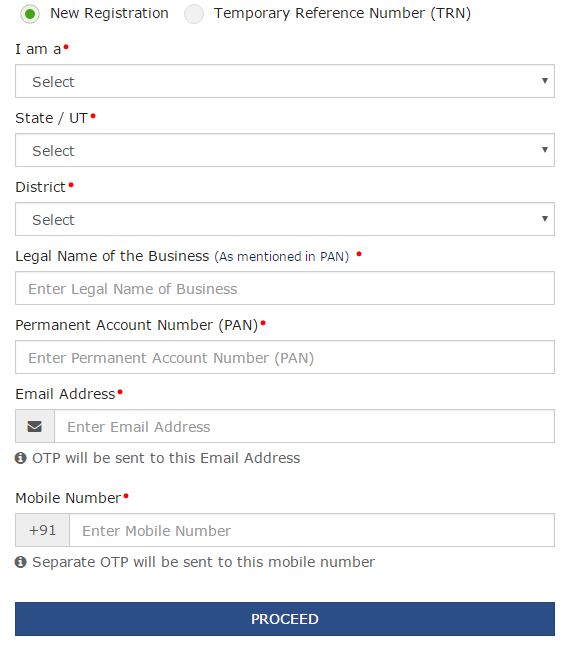

Following screen will open to provide details.

Select new registration in this form.

Fill the form with correct details. Select Tax payer in first field.

Select State, District.

In legal name provide the name given in PAN. It should be noticed that your PAN will be validated against the name provided. For individual give the correct name as given in PAN application. The name provided should match with PAN database.

Provide correct E-mail and Mobile number. You will receive OTP.

After filling the form, click on proceed.

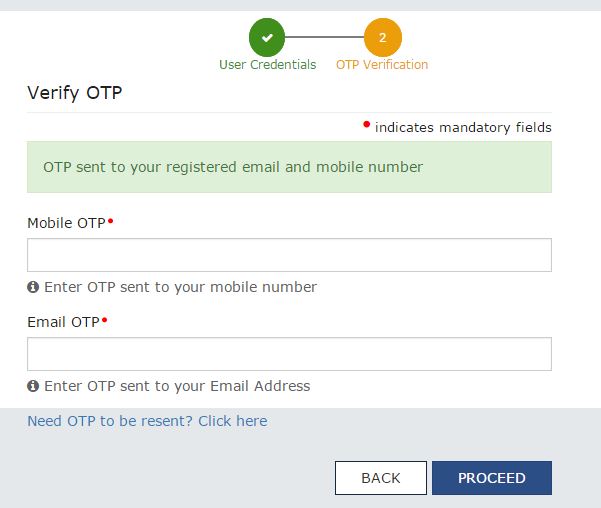

An OTP will be sent to your mail box and mobile number.

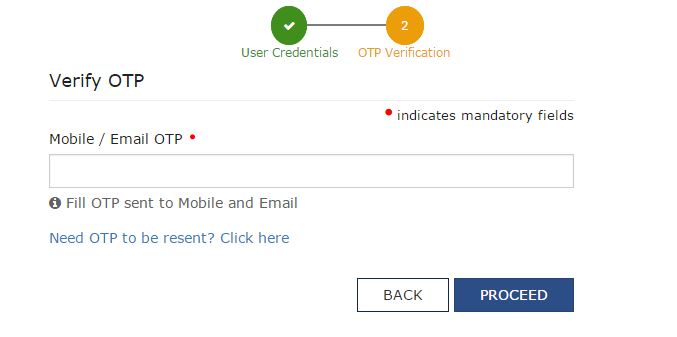

The following screen will open. Fill the OTP.

Fill the OTP sent to your mail box. After providing correct OTP, click on proceed.

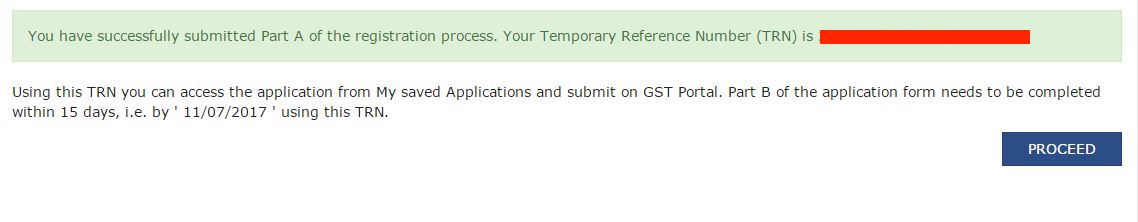

The following confirmation page will open.

You will receive a TRN in confirmation. Copy this Temporary Reference Number (TRN). However you will also receive TRN in your mail box.

Click on PROCEED button.

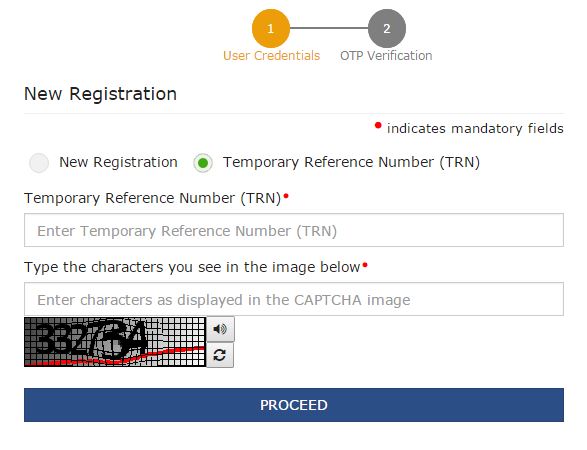

After clicking on proceed, a new page will open. Provide your TRN, you will receive an OTP to your mobile and mail. It will be same.

Fill the TRN and Captcha and click on Proceed. Following screen will open for OTP confirmation.

After successfully verification of PAN, mobile number and email provided, applicant will be provided a temporary reference number. Using this reference number applicant need to fill the PART B of application form.

Once you have done with this process for initial GST registration. Next you have to fill the PART-B of application. This is most important form for GST registration and most of the important details for registration needs to be provided here.

PART B

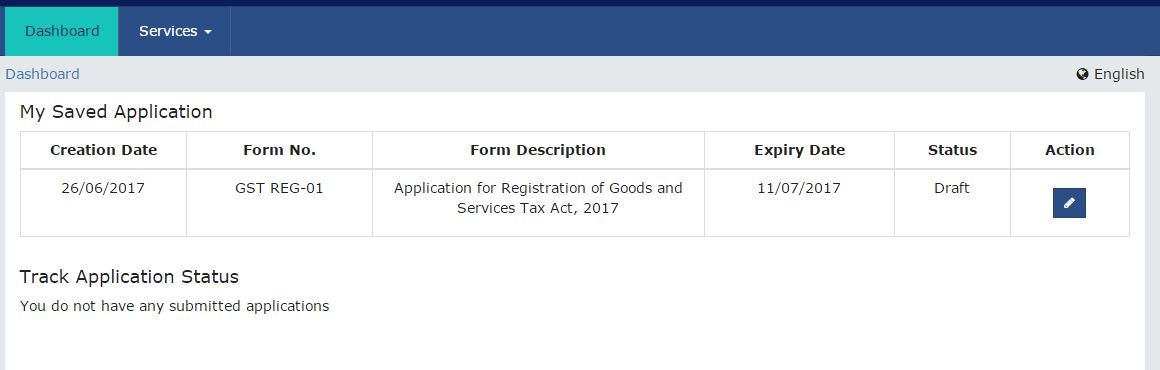

After above steps, you will get below screen.

Here click on Pencil Icon button to fill the application. After clicking on this icon an application for GST registration will open.

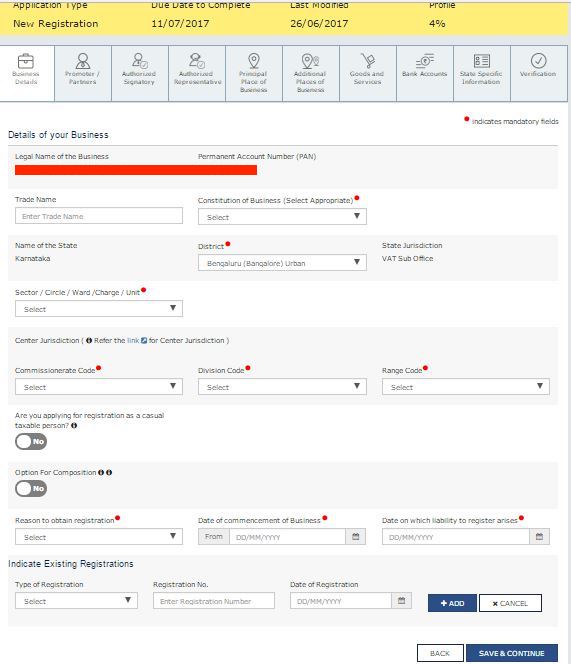

This is you application form for GST.

Fill each section of this application.

In application, you need to correctly fill the following details.

- Business Details

- Proprietor/Partners Details

- Authorised Signatory details

- Authorised representative details

- Principal place of business

- Additional places of business

- Goods and Services details

- Bank Accounts details

- State specific details

- Verification details

You should sign and upload the documents on portal for further processing of application.

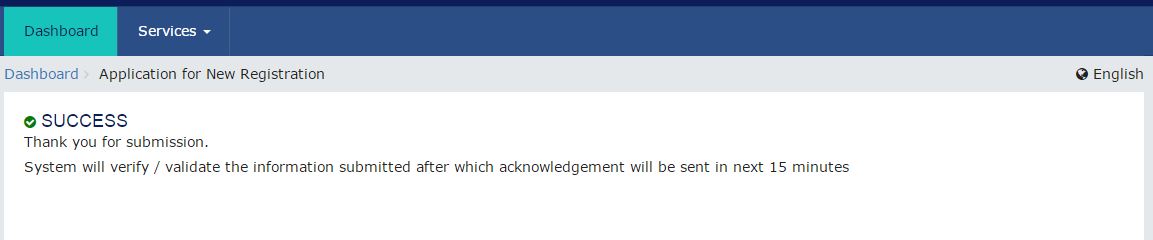

You will get below confirmation after successfully signing and submission of GST registration application.

Check the status of application after few minutes. You will get following screen, confirming the successful submission of application.

Once the application is submitted, acknowledgement will be issued in FORM GST REG-02.

For time being the role of applicant is over here. After the application is uploaded and an acknowledgement is given, the application will be forwarded to proper office who will check the application.

If everything is found to be correct, the application will be approved and registration will be granted within 3 working days of making the application.

If application is found to be in correct in terms of information or documents, a notice will be issued by officer in FORM GST REG-03 within 3 working days of making an application, applicant should respond to the notice within 7 working days in FORM GST REG-04.

If the officer is satisfied with the reply of applicant, within 7 working days from receipt of application may approve the application.

If officer is not satisfied with the reply, he may reject the application and inform to applicant in form GST REG-05.

If proper office fails to take action within days specified above, the application will be deemed to be accepted and approved.

Once the application is approved, a certificate of registration in FORM GST REG-06 showing the principal place of business and additional place(s) of business shall be made available to the applicant on the Common Portal and a Goods and Services Tax Identification Number (GSTIN) shall be assigned in the following format:

- two characters for the State code;

- ten characters for the PAN or the Tax Deduction and Collection Account Number;

- two characters for the entity code; and

- one checksum character.

The certificate of registration will be digitally signed by officer.

List of documents required for GST registration

If you are applying for GST registration, along with application GST REG-01 you need to upload scanned documents specified in application. The basic information required to be filled in part A of application are:

- Permanent Account Number (PAN),

- Mobile number,

- E-mail address,

- State or Union territory

With Part B, you need to submit the documents listed in application form. Following list of evidence documents needs to be attached or uploaded while filing the application for GST registration:

Photographs

- Proprietary Concern – Proprietor

- Partnership Firm / LLP – Managing/Authorized/Designated Partners (personal details of all partners is to be submitted but photos of only ten partners including that of Managing Partner is to be submitted)

- HUF – Karta

- Company – Managing Director or the Authorised Person

- Trust – Managing Trustee

- Association of Person or Body of Individual –Members of Managing Committee (personal details of all members is to be submitted but photos of only ten members including that of Chairman is to be submitted)

- Local Authority – CEO or his equivalent

- Statutory Body – CEO or his equivalent

- Others – Person in Charge

Proof of registration or Constitution of Taxpayer

Partnership Deed in case of Partnership Firm, Registration Certificate/Proof of Constitution in case of Society, Trust, Club, Government Department,

Association of Person or Body of Individual, Local Authority, Statutory Body and Others etc.

Proof of Principal/Additional Place of Business

- For Own premises –

Any document in support of the ownership of the premises like Latest Property Tax Receipt or

Municipal Khata copy or copy of Electricity Bill. - For Rented or Leased premises –

A copy of the valid Rent / Lease Agreement with any document in support of the ownership of

the premises of the Lessor like Latest Property Tax Receipt or Municipal Khata copy or copy of

Electricity Bill. - For premises not covered in (a) & (b) above –

A copy of the Consent Letter with any document in support of the ownership of the premises

of the Consenter like Municipal Khata copy or Electricity Bill copy. For shared properties also,

the same documents may be uploaded.

Bank Account Related Proof

- Scanned copy of the first page of Bank passbook / one page of Bank Statement

- Opening page of the Bank Passbook held in the name of the Proprietor / Business Concern –containing the Account No., Name of the Account Holder, MICR and IFSC and Branch details.

Authorization Form for registration under GST

For each Authorised Signatory mentioned in the application form, Authorization or copy of Resolution of the Managing Committee or Board of Directors to be filed in the following format:

Format of Declaration for Authorised Signatory (Separate for each signatory)

- I/We --- (Details of Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc)

<< Name of the Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc>>hereby solemnly affirm and declare that <<name of the authorized signatory>> to act as an authorized signatory for the business << GSTIN - Name of the Business>> for which application for registration is being filed/ is registered under the Goods and Service Tax Act, 2017. All his actions in relation to this business will be binding on me/ us.

Signatures of the persons who are Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc.S. No. Full Name Designation/Status Signature

1.

2.

Format of Acceptance as an authorized signatory

I <<(Name of the authorized signatory>> hereby solemnly accord my acceptance to act as authorized signatory for the above referred business and all my acts shall be binding on the business.

Place Signature of Authorised Signatory

Date (Name)Designation/Status

Application needs to be signed by authorised person, following persons can sign the application using a digital signature certificate (DSC).

- Proprietorship - Proprietor

- Partnership - Managing / Authorized Partners

- Hindu Undivided Family - Karta

- Private Limited Company - Managing / Whole-time Directors and Key Managerial Persons

- Public Limited Company - Managing / Whole-time Directors and Key Managerial Person

- Society/ Club/ Trust/ AOP - Members of Managing Committee

- Government Department - Person In charge

- Public Sector Undertaking - Managing / Whole-time Director and Key Managerial Person

- Unlimited Company - Managing/ Whole-time Director and Key Managerial Person

- Limited Liability Partnership - Designated Partners

- Local Authority - Chief Executive Officer ( CEO) or Equivalent

- Statutory Body - Chief Executive Officer ( CEO) or Equivalent

- Foreign Company - Authorized Person in India

- Foreign Limited Liability Partnership - Authorized Person in India

- Others - Person In charge

Signing with Digital Signature Certificate (DSC) is compulsory for Private Limited Company, Public Limited Company, Public Sector Undertaking, Unlimited Company, Limited Liability Partnership, Foreign Company, Foreign Limited Liability Partnership.

Cost of getting GST registration is nill. Government does not charge any fee for GST registration.

Physical verification of business premises in certain cases

Where the proper officer is satisfied that the physical verification of the place of business of a registered person is required after grant of registration, he may get such verification done and the verification report along with other documents, including photographs, shall be uploaded in FORM GST REG-29 on the Common Portal within fifteen working days following the date of such verification.

Physical verification is not compulsory requirement and only if officer has doubts to believe he can inspect the premises, however a reports has to be submitted on GST portal along with photographs.

Decoding the provisions of CGST Act, 2017 as applicable to registrations

Chapter VI of CGST Act, 2017 contains provisions regarding registration under CGST Act, 2017. This chapter contains following sections:

- CHAPTER VI - REGISTRATION

- Section 22 - Persons liable for registration

- Section 23 - Persons not liable for registration

- Section 24 - Compulsory registration in certain cases

- Section 25 - Procedure for registration

- Section 26 - Deemed registration

- Section 27 - Special provisions relating to casual taxable person and non-resident taxable person

- Section 28 - Amendment of registration

- Section 29 - Cancellation of registration

- Section 30 - Revocation of cancellation of registration

Section 22 specifies the person who are liable for registration. As per this section following suppliers are required to get registration.

- Every supplier, if his annual supplies/turnover exceeds 20 lakh rupees. However in case of special states, the limit is 10 lakh rupees.

- Every person who is holding registration under existing laws such as VAT, Service Tax etc.

- If the registered business is transferred as going concern, the transferee or successor should get himself registered under the act.

- In case of amalgamation or demerger, the transferee upon receipt of certificate of incorporation from ROC should get the business registered, registration will have effect from day of registration.

Section 23 specifies the persons who are not liable to registration even if they qualify under section 22.

As per this section following persons are not liable to registration:

- A person who is exclusively engaged in supplying of goods or services which are not liable to tax or wholly exempt under CGST Act or IGST Act.

- A person who is into agriculture or cultivation supplying to the extent of production from cultivation land.

- Further government may specify after recommendation from council through a notification a class of person to be exempted from registration requirements.

Section 24 specifies the situation or supplies where a person should get compulsory registration regardless of section 22

As per this section following categories of person should register:

- persons making any inter-State taxable supply;

- casual taxable persons making taxable supply;

- persons who are required to pay tax under reverse charge;

- person who are required to pay tax under sub-section (5) of section 9;

- non-resident taxable persons making taxable supply;

- persons who are required to deduct tax under section 51, whether or not separately registered under this Act;

- persons who make taxable supply of goods or services or both on behalf of other taxable persons whether as an agent or otherwise;

- Input Service Distributor, whether or not separately registered under this Act;

- persons who supply goods or services or both, other than supplies specified under sub-section (5) of section 9, through such electronic commerce operator who is required to collect tax at source under section 52;

- every electronic commerce operator;

- every person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered person; and

- such other person or class of persons as may be notified by the Government on the recommendations of the Council.

Interesting to note person specified in 9, 10 and 11. Every seller on E-commerce portal, as well as every E-commerce portal needs to get registration done. Even the companies providing online information and database access in India needs to get registration done.

Section 25 speaks about procedure of registering under CGST Act, 2017. We will discuss this section in details under a separate heading below.

Section 26 provides that

- Grant of registration or the Unique Identity Number under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act shall be deemed to be a grant of registration or the Unique Identity Number under this Act subject to the condition that the application for registration or the Unique Identity Number has not been rejected under this Act within the time specified in sub-section (10) of section 25.

- Notwithstanding anything contained in sub-section (10) of section 25, any rejection of application for registration or the Unique Identity Number under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act shall be deemed to be a rejection of application for registration under this Act.

Supplier will be deemed to be registered if his application is not rejected.

Section 27 is about special provisions applicable to casual taxpayers and non-resident tax payers

- The certificate of registration issued to a casual taxable person or a nonresident taxable person shall be valid for the period specified in the application for registration or ninety days from the effective date of registration, whichever is earlier and such person shall make taxable supplies only after the issuance of the certificate of registration:

Provided that the proper officer may, on sufficient cause being shown by the said

taxable person, extend the said period of ninety days by a further period not exceeding

ninety days. - A casual taxable person or a non-resident taxable person shall, at the time of submission of application for registration under sub-section (1) of section 25, make an advance deposit of tax in an amount equivalent to the estimated tax liability of such person for the period for which the registration is sought:

Provided that where any extension of time is sought under sub-section (1), such

taxable person shall deposit an additional amount of tax equivalent to the estimated tax

liability of such person for the period for which the extension is sought. - The amount deposited under sub-section (2) shall be credited to the electronic cash ledger of such person and shall be utilised in the manner provided under section 49.

Casual tax payers can start business only after registration certification is provided, they also need to deposit estimated tax before registration, however this advance deposit of tax will be credit to his electronic tax ledger.

Section 28 allows a person to amend his registration in case of change in any information provided at the time of registration.

Section 29 is provides about cancellation of registration obtained under this act.

Registration can be cancelled under this section by proper officer upon his own motion or an application filed by registered person. This section in normal speaks about cancellation of registration in case of application by registered person where business is stopped or person is no longer required to pay tax or any other case. Officer can also cancel registration in cases such as registration obtained by fraud etc.

- However liability to pay outstanding tax does not become null only by cancellation of registration.

Section 30 provides about revocation of cancellation of registration.

In this part of article I have analysed the registration provisions contained under the CGST, Act 2017. It must be noted that Act is supreme and rules or procedures are just the facilities to implement the act. Rules and procedures cannot override anything provided in act.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

It is best article on GST registration procedure. Best part is you have not only written the procedure one can follow practically but also given the text as contained in act and rules notified by government.

It is interesting to see that inspection is not made mandatory, which happens now under current VAT and Excise laws. Government should reduce physical interaction between tax payers and department as much as possible. Corruption will come down doing this.

Sir, my turnover is below 10 lac and sale is retail sale where each invoice billing will be maximum 3000/ rupees. but my purchase is out of state though purchase bill will be at maximum 10-25 thousand,since it is inter state purchase i have registered myself under gst. In which format should i raise the sale invoice and what information must be provided in return. I have not opted for composite scheme,GSTR 1 due date showing 05/09/2017.how to upload sale invoice. is it to be scanned?