GST Registration Online

Last udpated: Feb. 2, 2018, 11:46 a.m.GST (Goods and Services Tax) registration can be done online in very simple steps.

You can hire a consultant who can do this job for you, or you can do it yourself.

Almost every service that can be completed online, is made easier and similar is the case with GST registration.

You need to visit GST website, register your self and fill the registration application.

Do I need GST registration?

Before you proceed for GST registration, first thing to check is whether you need GST registration or not.

If you are into business or profession, you need GST registration because either law mandates it or your business partner requires it.

For example, GST law requires GST registration in case your turnover in a year cross Rs. 20 lakhs (Rs. 10 lakhs in special states).

Similarly many companies do not hire or engage any business who do not have GST registration.

If you are thinking to deal with any big organisation, having GST number is must as these companies do not entertain unregistered suppliers or vendors.

Even if you are selling goods online through portals such as Amazon, Flipkart etc. you need to have GST registration. Amazon for instance does not allow unregistered sellers on portal.

I can say that you need to have GST registration if:

- You have crossed exemption limit under Law

- Law specifically require you to register under GST

- Your business partner does not engage unregistered vendors

It should be noted that in case of online seller, law has been amended and person having turnover below 20 lakhs is not required to get registration.

Documents required for GST registration

Before your proceed on GST portal for GST registration, you need to have following documents and information.

- PAN of business or proprietor

- Address proof of business

- Id proof, address proof and photo of proprietor/partners/directors

- Proof of business registration (Companies, Partnership firm)

- Bank account proof

- Authorisation form in cases other than proprietorship

Along with documents you need to have a mobile number and email id. All communication including GST registration certificate, login id, password and OTP will be sent on these mobile number and email id.

How to register GST online?

To register for GST, you to follow following steps.

Step 1 Filling PART A of registration application (basic details)

To register your business or profession under GST, you need to visit GST website.

When you are on GST website. You need to click on Register now button.

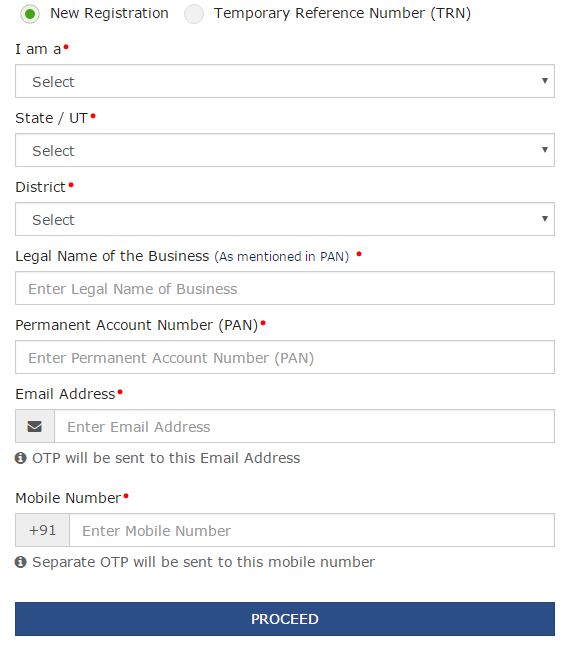

Following screen will open.

You need to click on New Registration. Fill this form.

Provide PAN number of proprietor in case of proprietorship business.

Legal name should match with correct name given at the time of getting your PAN.

It will show legal name mismatch error if name as per PAN records does not match with name entered on the screen.

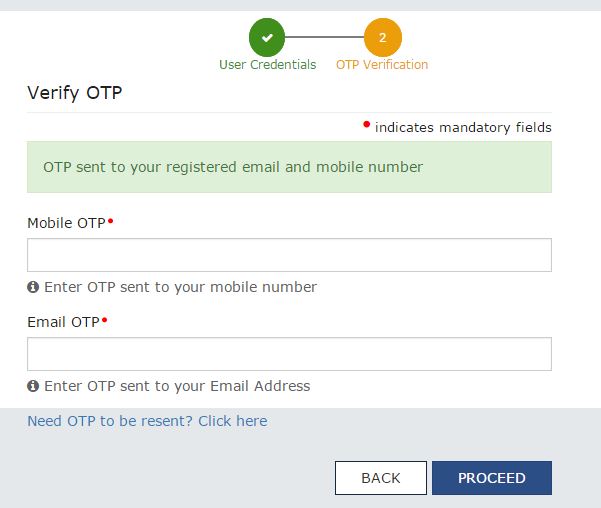

After filling this form, you will get an OTP (One Time Password) on your mobile and email id.

You need to fill OTP and click on PROCEED button.

With these steps, you have successfully filled the PART A of application.

Now you have to fill PART B of application.

Step 2 Filling PART B of registration application

Once you have completed above steps.

You now can proceed for filling PART B of registration application. To fill and submit PART B of application.

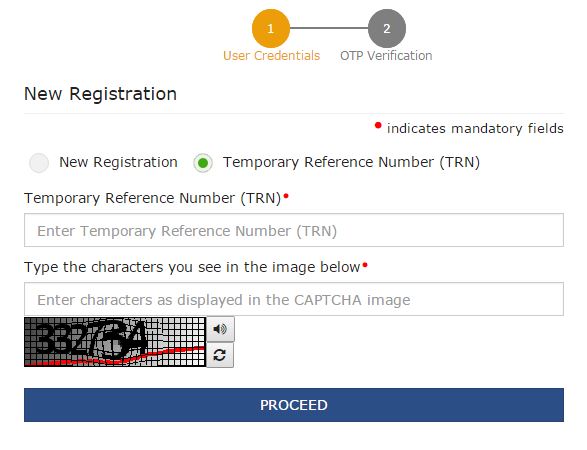

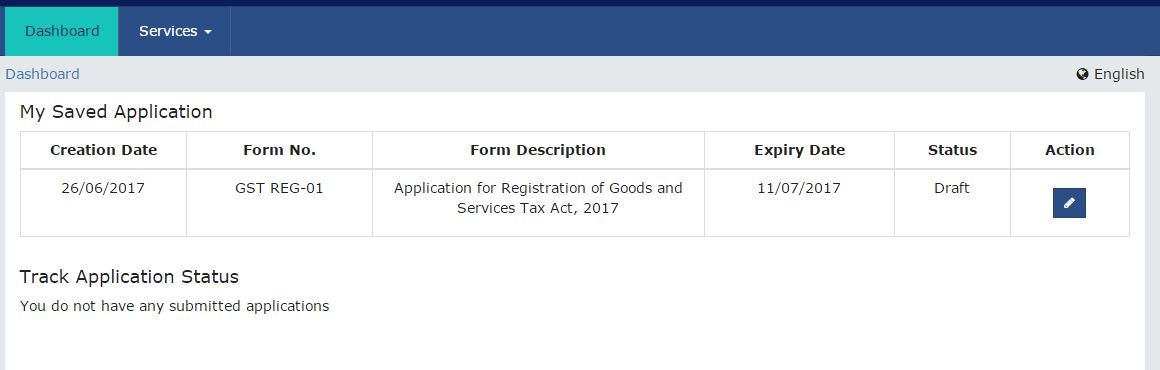

Again go to GST website, or alternatively when you pressed PROCEED button in above step, the screen with first image will open.

This time instead of New Registration, you need to click on Temporary Reference Number (TRN).

When you click on TRN, the following screen will open.

In this form you need to fill TRN and then captcha and PROCEED button.

TRN (Temporary Reference Number) is the reference number you get when you fill PART A of registration application.

You need to check your mail, you must have received a mail from GST department, in same mail your TRN will be given.

Copy TRN from mail and paste here.

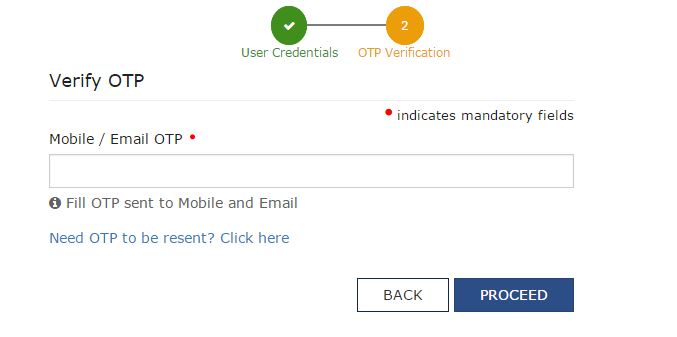

When you click on PROCEED button, again your will be asked OTP.

This time same OTP will be sent to both Mobile number and Email ID.

Click on proceed after entering OTP.

Now the main part of GST registration application will open.

Click on pencil icon given in blue color to edit PART B of application.

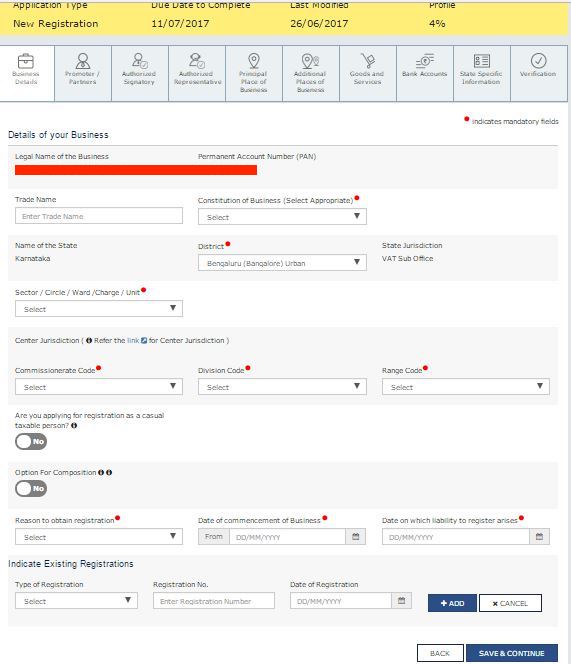

This is the main application you need to fill and attach your documents.

You need to fill following information in this form.

- Business Details

- Proprietor/Partners Details

- Authorised Signatory details

- Authorised representative details

- Principal place of business

- Additional places of business

- Goods and Services details

- Bank Accounts details

- State specific details

- Verification details

You can submit application either with EVC (mobile based OTP) or using a Digital Signature Certificate (DSC).

For LLP and Private Limited Companies, signing with DSC is compolsory.

Proprietors and partners can use EVC method to sign application.

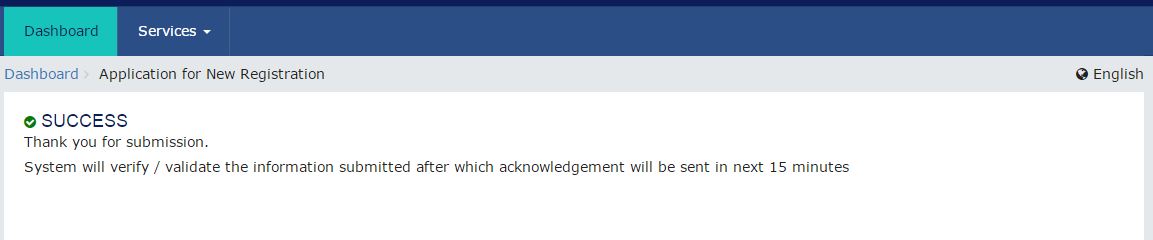

After successfully submitting application, following successful message will appear.

The application will be processed within 3 working days unless there is any problem with documents attached or information provided.

You will get an email once the application is processed or rejected.

Cost of GST registration

Government does not charge any fee for GST registration.

However, if you are getting your GST registration from a consultant then he will charge his fee.

Charges will depend on professional you hire. Normally professionals charge Rs. 5,000 to Rs. 25,000 for GST registration.

If you are registering a LLP or Company then you have to incur cost of Digital Signature Certificate (DSC).

You can purchase DSC online or buy from nearest available place. Cost of DSC will range from 1500 to 2500.

Self registration or hire a professional consultant?

You can do GST registration yourself without help of any consultant.

However to avoid any mistake and further delay in registration, you can also hire services of a consultant.

You are best at your job, consultants are best at their job.

At KnowyourGST, I write information to help people like you. I write valuable information so that you can minimize your costs of running business.

You will find various guides on GST-Registration, GST-Returns, E-way bill rules, you can read them to understand GST law in depth.

You can also avail GST registration services from KnowyourGST team. Professionals will handle your registration work.

Everything will be online and do not have to run here and there for help. Lets engage in a long term relationship.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

Is there is any option to attach any file on Knowyourgst Site?

Yes you can attach the file.

To attach you need to click on Write Article, on link field you will have upload file option.

Copy this link and you can use it on any post.