Annual Returns under GST

In a growing economy like India, it is very much important to maintain a transparent and fair business environment that can help build a strong foundation for economic progress. With this motto, compliance is required by every Person who is required…

by Tanooj Boddu 05/02/2023 under GST

KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

GST ( goods and services tax) is an Indirect Tax which replaced many Indirect Taxes in India. The good and services tax act was passed in 2017 and has been implemented since then. Before GST, taxes such as service taxes, state vats, entry taxes, …

by Renu Singhania 04/03/2022 under GST

DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

The GST policy wing has issued instructions 20/16/05/2021-GST dated 2nd November 2021. Following are the guidelines disallowing debit of Electronic Credit Ledger under Rule 86A of CGST Rules 2017: Commissioner, or an officer authorised by him, no…

by Shailendra Agharkar 04/12/2021 under GST

All About GSTR2B

WHAT IS GSTR2B? It is an auto drafted ITC statement made available to the tax payer on the basis of information furnished by their suppliers by way of GSTR1/IFF, GSTR5 (non-resident taxable person) and GSTR6 (input service distributer). This stat…

by Shailendra Agharkar 03/12/2021 under GST

UNDERSTANDING ON SEC-8, CGST ACT

Section -8 CGST ACT:- Understanding On (Composite and Mixed Supply). Sec -8 – Talks about the Tax liability in case of COMPOSITE AND MIXED SUPPLIES:- The tax liability on a composite or a mixed supply shall be determined in the following…

by Mohit Gupta 29/09/2021 under GST

UNDERSTANDING ON Sec-9 CGST ACT

Section -9 CGST ACT- Understanding On – Levy And Collection Sec-9 of CGST ACT is basically a charging section which ask for charging the tax on intrastate supplies of goods or services, Sec -9 says that GST would be charge on the…

by Mohit Gupta 21/07/2021 under GST

UNDERSTANDING ON Sec-7 CGST ACT

Sec-7-. (1) For the purposes of this Act, the expression “supply” includes–– (a) all forms of supply of goods or services or both such as sale, transfer, barter, exchange, licence, rental, lease or disposal ma…

by Mohit Gupta 19/07/2021 under GST

SECTION 8 COMPANY

Section 8 License Company Concept and Rules It is a Company which is formed under section 8 of Companies Act, 2013 and the main objects behind it’s formation is to promotion of commerce, art, science, sports, education, research, social wel…

by Cs Vivek Shukla 14/07/2021 under Startups

ONE PERSON COMPANY

“One Person Company” One Person Company [Section 2(62)] – "One Person Company" means a company which has only one person as a member. Section 3 of Companies Act, 2013 and Rules 1-7 of Companies (Incorporation) Rules…

by Cs Vivek Shukla 14/07/2021 under Company-Law

Extension of time limits of certain Compliances to provide relief to tax payers in view of pandemic

The Central Board of Direct Taxes, in exercise of its power under section 119 of the Income-tax Act, 1961 (hereinafter referred to as “the Act”) provides relaxation in respect of the following compliances: 1) The Statement of Financia…

by Naveed 22/05/2021 under Income-Tax

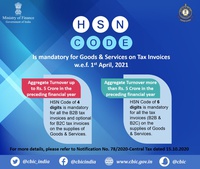

6 digit HSN code or 4 digit HSN code

HS Code is an internationally accepted format of coding to describe a product. All around the world same HS codes are used to describe a product. Till now we were using 4 digit HS code in tax invoices, however the rule is changing from April 1, 2…

CA, CS and CMA recognised as Postgraduate degree

University Grant Commission (UGC) has recognized CA, CS, and CWA equivalent to postgraduate degrees. Earlier these courses were recognized as professional courses only. Request to UGC was made by Institutes to recognize these courses as postgradu…

Proposed Amendment in Sec: 16 vide Finance Bill, 2021

Section 16 – No Input Tax Credit (ITC) to be availed unless reflected in GSTR-2A / 2B Section 16 (2) (aa) of the CGST Act is proposed to be inserted to provide that ITC on invoice or debit note should be availed only when such details are u…

by Bhagyashree Bhatt 03/03/2021 under GST

Dividend Income U/s 8 of Income Tax Act 1961 new provision

Sec 8- of Income Tax Act Divinded Income For the purpose of inclusion in the total income of an assessee- 1. Any dividend declared (final dividend) by a company or distributed or paid by it within the meaning of sec. 2(22)(a)/(b)/(c)/(d)…

by Aarav Ruparel 28/02/2021 under Income-Tax

E-Invoice in GST

E-Invoicing or ‘electronic invoicing’ is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. To whom it applicable: From 1st January 2021, e-Invoicing will be applicable…

by Pradyut Bag 22/01/2021 under GST

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Browse by Topics

- GST

- Income-Tax

- Company-Law

- Legal

- Startups

- Investment

- Economy

- Stock-Market

- Students

- General

- KYG-Invoicing

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by