Annual Returns under GST

Last udpated: Feb. 8, 2023, 5:42 p.m.In a growing economy like India, it is very much important to maintain a transparent and fair business environment that can help build a strong foundation for economic progress. With this motto, compliance is required by every Person who is required to abide by certain law.

Under GST, Taxpayers are the persons who are required to abide by the GST Law. The Government has introduced GST Regime of Indirect Taxation in July 2017 with a view to ensure fulfilment of several objectives with few among them being Smooth flow of Tax Credit, Transparency, Tax Payer friendly compliance, Uniform Taxation across the country.

GST Law (includes CGST Act, Rules, Respective State/ Union Territory GST Act, IGST Act and other notifications and circulars as may be notified from time to time) requires all the Tax Payers to perform their business activities ensuring that they abide by the law in the form of Filing periodical returns, Statements, Paying Taxes on time, other sort of documents on demand for an explanation. One among such compliance is filing Returns. Returns can be Monthly Returns, Quarterly Returns, Returns by Composition Dealers, Annual Returns, Final Returns.

The Provisions relating to Annual Return are covered under section 44 of the Central Goods and Services Act, 2017. As per Section 44, every Registered Person (other than an INPUT SERVICE DISTRIBUTOR, CASUAL TAXABLE PERSON, NON RESIDENT TAXABLE PERSON, PERSON WHO IS REQUIRED TO PAY TAX UNDER SECTION 51 OR, 52) shall furnish an Annual Return in prescribed form and in prescribed manner within prescribed time that may include a Reconciliation Statement. (prescribed under Rule 80 of the CENTRAL GOODS AND SERVICES TAX RULES, 2017)

The Reconciliation Statement has to provide a reconciliation of values of supplies made and received during the year and such reconciliation has to be done with the Audited Financial Statements of such Tax Payer.

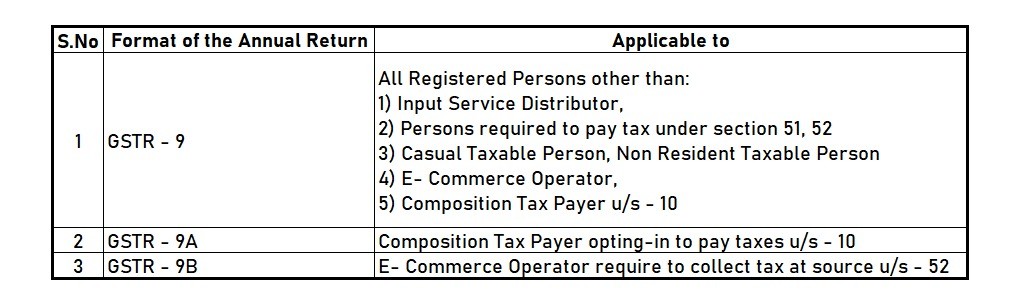

As per Rule 80 of the CENTRAL GOODS AND SERVICES TAX RULES, 2017 the Annual Return has to be filed with 31st day of December of the subsequent financial year electronically or, through a facilitation centre notified by the Commissioner in the following forms:

Prescribed format of Annual Return as applicable to various Tax Payers

In addition to the Annual Return, the Registered Person who is required to file Annual Return in Form GSTR - 9 is also furnish a self-certified Reconciliation Statement in Form GSTR - 9C if his Aggregate Annual Turnover during the financial year (for which Annual Return has been filed) exceeds Rs. 5,00,00,000/-.

In addition to the Annual Return, the Registered Person who is required to file Annual Return in Form GSTR - 9 is also furnish a self-certified Reconciliation Statement in Form GSTR - 9C if his Aggregate Annual Turnover during the financial year (for which Annual Return has been filed) exceeds Rs. 5,00,00,000/-.

The threshold limit of Turnover is only applicable for GSTR - 9C and not for Annual Return in the forms stated above and every Tax Payer in general has to file Annual Returns.

However, the Central Board of Indirect Taxes and Customs has exempted, for the Financial Year 2021-2022, the Registered person whose Turnover is upto Rs. 2,00,00,000/- from the requirement of filing Annual Return u/s - 44 of the CGST Act, 2017 read with Rule 80 of the CGST Rules, 2017. The notification can be seen here :

We are open to serve you on any GST Related Services on a remote basis. You can contact us on Linked-in. We sincerely appreciate your interest in going through this article.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

- GSTR 9 Table 4 Information

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.