6 digit HSN code or 4 digit HSN code

Last udpated: March 17, 2021, 11:36 a.m.HS Code is an internationally accepted format of coding to describe a product. All around the world same HS codes are used to describe a product.

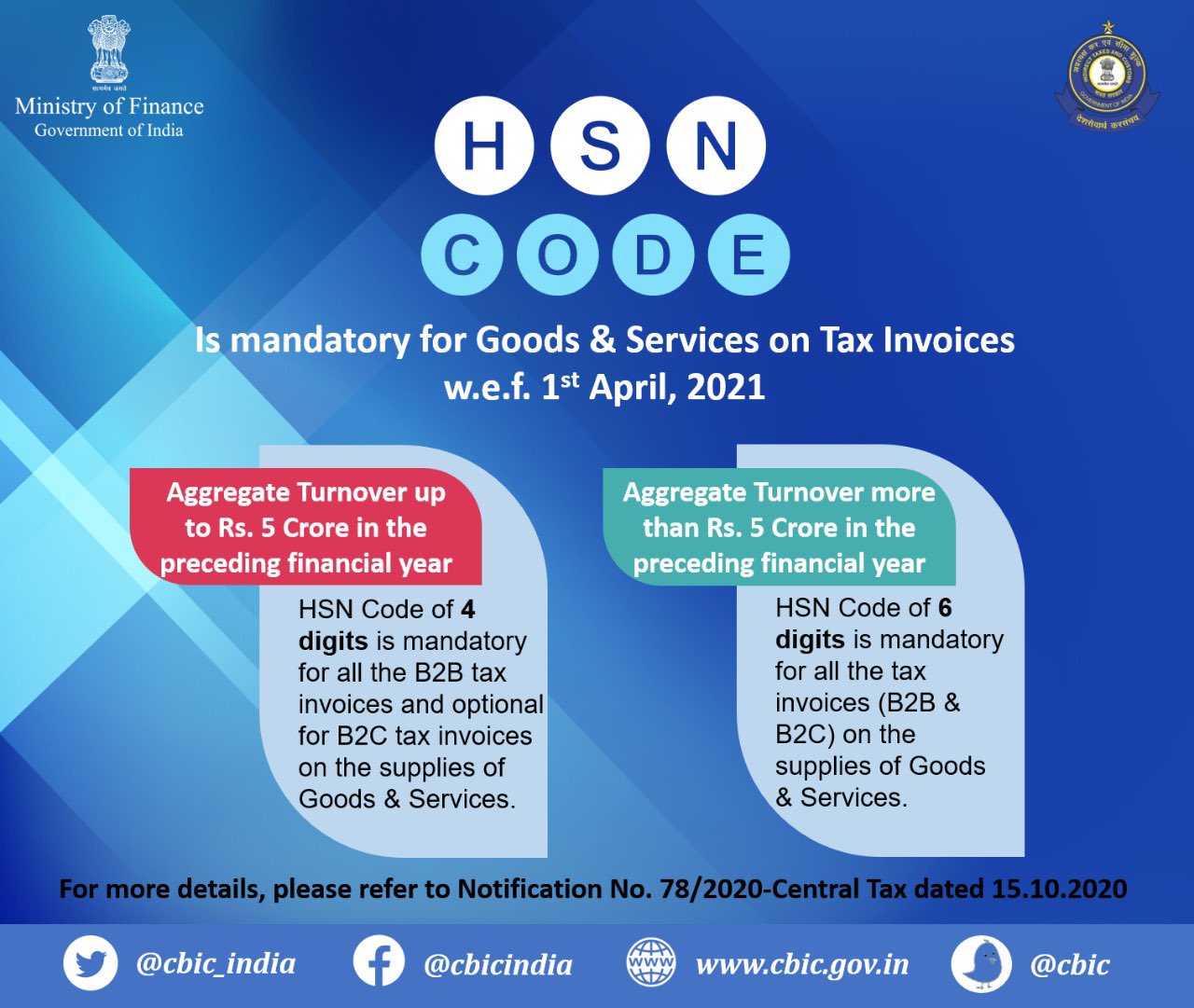

Till now we were using 4 digit HS code in tax invoices, however the rule is changing from April 1, 2021.

Now Tax Payers who have a turnover of more than 5 crores have to mention 6 digit HSN code in the invoice. For Taxpayers, with less than 5 crore turnover 4 digit HSN code will be applicable.

HS code is a very important part of a tax invoice. Government not only keep track of outward and inward materials through HS code but also at the national level can arrive at production and consumption of products.

Further, GST tax rates are based on HS codes and help to calculate tax liability at the server level and avoid any unwanted litigations.

It is therefor advised to update accounting systems with 6 digit HS code, otherwise one may face legal issues.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

- GSTR 9 Table 4 Information

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

Do we need to mention each and every item of the Import Invoice in making E way Bill from Customs to Factory OR we can mention Telecom Parts and then Total Qty. with Total Value

Do we need to mention each and every item of the Import Invoice in making E way Bill from Customs to Factory OR we can mention Telecom Parts and then Total Qty. with Total Value