What is a Digital Signature Certificate (DSC)?

Digital Signature is the digital form of your identity. A physical id is converted into digital format and used to authenticate your identity. For example, in India PAN is used widely to convert PAN number into a digital format (encrypted form) to identify user.

You provide your idenity details to CA and this document is converted into a digital form, you can use this digitally converted id to sign documents digitally. The document is converted into an encrypted form and every unique physically id will have a unique encrypted id. A DSC will be unique for every person based on document id provided by him.

You can generate DSC with any of identity document however MCA, GST, IT use pan based encrypted signature to authenticate your signature. Though you can generate DSC even if you do not have PAN (Permanant Account Number) issued by Income Tax Department but this DSC will be of no use in most of the cases.

A digital signature has 2 keys (in simple language 2 encrypted ids), one is public id and another private id.

When you sign any document using your DSC, public key will be attached with signed document and anyone can verify your signature. Private key is stored in your DSC and should not be disclosed to public. Private key is used to authenticate your digital sign.

What is use of Digital Signatures Certificate (DSC)?

DSC is your identity converted into digital form. You can affix(sign) your DSC on any document to sign it. DSC replaces your physical signature with Digital Signature.

Usage of DSC are:

- You can sign any document with your DSC and it will have same value as your physical signature.

- You can sign Invoices, Agreements, PO etc. with DSC.

- You can file your IT returns with DSC and you will not be required to post ITR-V to CPC for verification of ITR.

- You can sign your GST returns.

- You can apply for IEC (Import Export Code) with DSC.

- You can apply for various government services, government tenders.

- You can authenticate your consent and it will have save value as your physical signatures.

- DSC is unique and if stored safely chances of misuse are very low.

- Digital Signatures are safer then your actual physical identity as copying a digital signature is impossible without getting your DSC private key.

- You can use your DSC to authenticate documents from any place and any time with your computer.

DSC has various usage and with passage of time it will become more significant. With E-governance policy of government, DSC will be used for most of government services to authenticate your identity.

What are different types/classes of Digital Signature Certificate (DSC)?

Different classes of DSC are:

- Class-I

- Class-II

- Class-III

Increment in Class is for security reasons and each class of DSC have different usage. Class-I is most basic form digital id and it not used in any of government service.

Class-II is most used DSC and it is used for signing documents, filing IT returns, filing MCA forms and GST returns.

Class-III is used to tenders and is costly than Class-II DSC.

Class of Digital Signature Certificate (DSC) for Income Tax Filing

For filing income tax returns, tax audit reports you need Class-II Digital Signature Certificate (DSC).

Income Tax website accepts Class-II DSC and you can buy a valid Class-II certificate to file your IT returns or any other form such as Form 15CA.

Class of Digital Signature Certificate (DSC) for GST

You need Class-II DSC to file GST returns. GST website allows Class-II DSC for registration, returns and authentication.

You can buy DSC for authorised person to perform authentication at GST website.

Class of Digital Signature Certificate (DSC) for MCA

For filing various forms on MCA website you need a Class-II DSC. MCA was the first among to force usage of DSC for filing MCA forms.

You can buy DSC for directors, company secretary or key management person to file MCA forms.

You also need Class-II DSC to apply for DIN (Director Identification Number).

Class of Digital Signature Certificate (DSC) for IEC (Import Export Code)

You need Class-II DSC for applying IEC online.

Applicant or authorised person need to generate Class-II DSC using PAN to apply online for IEC.

How to buy a DSC and what options are available for purchasing a DSC?

Various options are available to buy DSC. You can purchase a DSC with following methods.

- Paper based application

- Aadhaar based OTP application

- Aadhaar based Bio-Metric application

Fastest way to generate a DSC is using Aadhaar based Bio-metric application form. Paper based application will take around 3-4 days to issue a DSC.

How to buy DSC online and what is the process to buy a DSC?

You can buy DSC online. You can buy a DSC on this website also. The general process to buy DSC depends on method your select.

Buying DSC with paper application

You need to fill application online and then take a print of the application. After taking print, affix your photograph and sign your application.

You need to attach ID proof and Address proof with application. The documents attached with application must be attested by a Bank Manager, Post Master or any Group ‘A’ /Group ‘B’ Gazetted officers.

You need to courier your application to seller of DSC. Upon receipt of application, and documents are found to be correct a DSC will be issued. DSC provider will courier your DSC in USB E-token.

Buying DSC with Aadhaar authentication

You can buy DSC with your Aadhaar based authentication. This is the most easiest method to apply for a DSC.

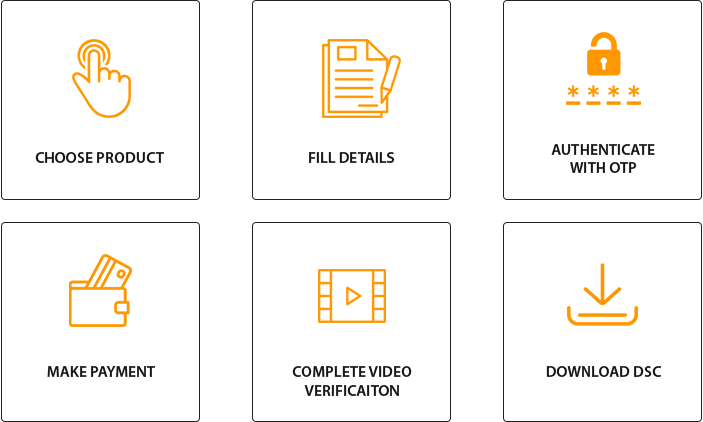

Process to order a DSC with Aadhaar VID is:

- Visit the website of DSC seller

- Apply for DSC with OTP option

- Provide your Aadhaar VID

- You will get an OTP

- Fill your OTP and proceed

- A form will open

- Fill your form, make sure you punch correct PAN

- Submit application

- Verify your mobile number

- Verify through video recording

- DSC will be approved

- Download your DSC in USB E-token

However, if you do not have USB E-token to download your DSC, you can also purchase USB token. Your seller will download DSC in USB E-token and send it to you. In most of the cases USB token is sent without DSC in it and you have to download DSC.

Documents required to buy a DSC

Physical copy of documents is required only if you are applying for DSC through paper application.

For Aadhaar based DSC application, no document is required and you need to provide only your document id.

Documents required for DSC are:

- Identity proof such PAN, Driving License etc.

- Address Proof such as latest bank statement, Aadhaar etc.

These documents needs to be attested by any of following:

- Group ‘A’ /Group ‘B’ Gazetted officers

- Bank Manager/Authorised executive of the Bank

- Post Master

Aadhaar is required for obtaining DSC?

Aadhaar is not compulsory. However the best and easiest method to buy a DSC is with Aadhaar.

Benefits of buying DSC with Aadhaar are:

- You will save 3-4 days

- No need to send any physical copy of document

- Everything will be done online

- You need to verify your mobile number and video recording

- No need of attestation on documents.

PAN is required for DSC?

PAN is compulsory to get a working DSC. Though you can still get a DSC without PAN but it will not be of any use as all government departments authenticate your signature with your encrypted PAN.

A DSC is generated by converting your physical identity to a digital identity. PAN is accepted for this and you should have PAN to get a valid and working DSC.

What DSC E-token? What are E-token drivers?

A E-token of USB token is a physical device protected by password to store your Digital Signature Certificate (DSC).

It is compulsory to store your Digital Signature in password protected USB token. You cannot download your DSC on your computer, you have to attach USB token to your computer before downloading DSC.

E-token is required for DSC?

Yes, E-token or USB token is compulsory to download a digital signature. For security reason you need USB token for download DSC.

How to download DSC after DSC is approved by CA?

Once your DSC application is approved, you will get an email to download DSC. Along with email you will also get message on your registered mobile number.

Process to download DSC depends on different DSC providers. However general procedure to download your DSC is:

- Connect USB token to computer

- Install USB token drivers

- Open download link in Internet Explorer

- Change IE setting to run scripts

- Provide your application ID

- Provide your Pincode given in address

- Provide your challenge code

- Click on Download

- Accept all dialogues shown

Your DSC will be downloaded in USB token. Remember USB token will be password protected. If you put password wrong for contineous 10 times, USB token will become useless.

BUY DSC FOR MCA, IT AND GST

Experience KnowyourGST services. Apply for DSC and get it on same day. We promise fastest delivery of your DSC.

Whatsapp - 73386 33003

Telegram - @knowyourgst

Contact us on Whatsapp and Telegram number 7338633003 for quick reply.