Government To Refund Money For Technical Errors To Taxpayers

Reported under GST on 01/04/2019Elections are approaching and central government is in mood to impress GST tax payers. Businessmen are angry with government as it has charged late filing fee but did not compensate for technical …

Forthcoming Changes In E-Waybill System (Date: 25-03-2019)

Reported under GST on 29/03/2019The National Informatics Centre (“NIC”) has made new changes in E-Way Bill System dated March 25, 2019, which will be made effective in Next Version which will be implemented v…

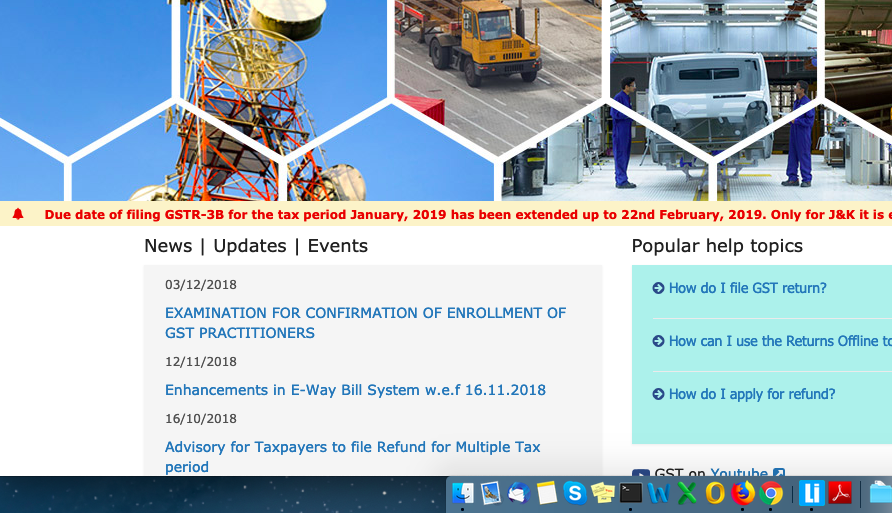

Gstr-3b Due Date Is Extended

Reported under GST on 20/02/2019Due date to file GSTR-3B which was today has been extended to 22 Feb 2019.

We have been following this matter closely and decision came after KnowYourGST twitted the difficulties faced b…

Gst Registration Turnover Limit To Be Increased To 40 Lakhs

Reported under GST on 10/01/2019In GST council meeting conducted today the major decision was to give relief to small traders.

For those dealing in Goods, turnover limit for GST registration is increased to Rs. 40 lakh…

What Is Wrong With Gst Council? A Bad Move To Further Damage Government Reputation.

Reported under GST on 03/01/2019GST council in its recent meeting decided to waive late filing fee for return from July 2017 to September 2018. However, the decision benefited those who did not file returns yet.

Those …

Due Date To File Gst Annual Returns Extended Fruther To June 2019 And Other Favorable Decisions

Reported under GST on 22/12/2018GST council in meeting held on 22 December 2018 has decided to extended due date to file GST Annual R…

31st Gst Council Meeting Rate Cut Highlights

Reported under GST on 22/12/2018Today on 22/12/2018, 31st council meeting was conducted. Arun Jaitley, Finance Minister of India briefed about key points of meeting. The major highlight of meeting was rate cuts of var…

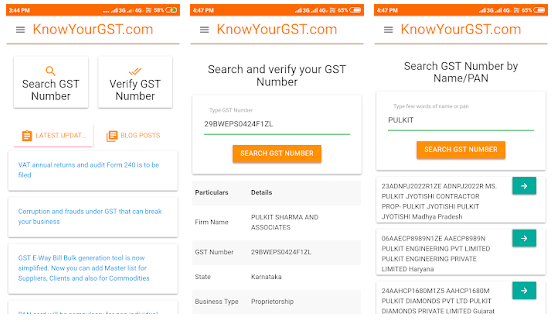

Mobile App To Search And Verify Gst Numbers

Reported under GST on 21/12/2018These Things Will Get Cheaper After Gst Council Meeting

Reported under GST on 21/12/2018Good news for consumers as prices will be cut down for most of items falling within 28% rate slab as government is planning to bring most of the items under 18% rate slab.

The upcoming G…

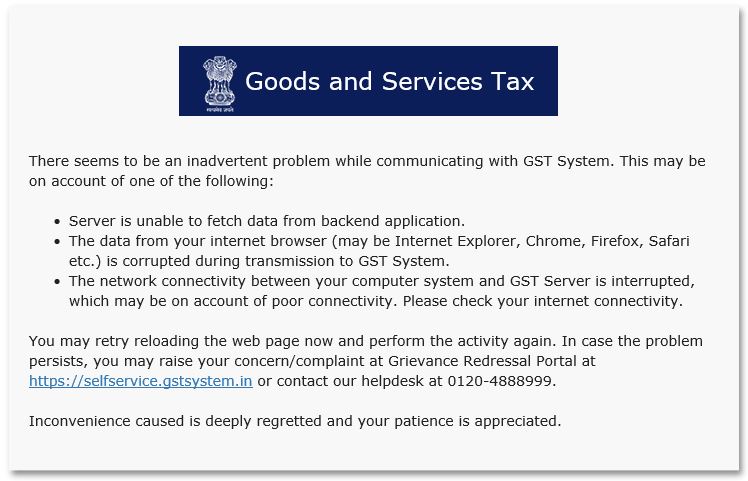

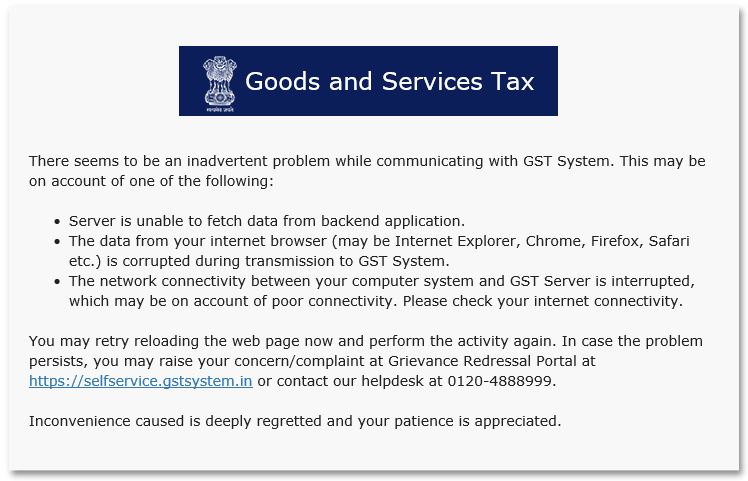

Gst Server Down Again, Taxpayers Agry

Reported under GST on 20/12/2018Today is last date to file GSTR-3B returns and GST portal is gone on sleep.

The portal is not responding and error messages are being thrown for different returns and tax payers.

…

3 Caught In A Gst Fraud Of Rs. 687 Crores

Reported under GST on 20/12/2018Gstn Will Soon Start Sending Notices For Mismatch Of Returns

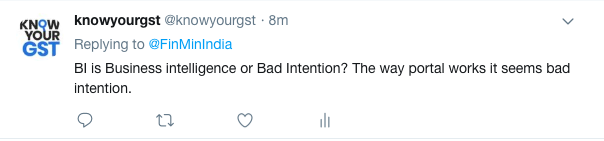

Reported under GST on 18/12/2018GSTN is working on Business intelligence tools to compare data of various returns filed by Tax payers and scrutinize details. Tweet my finance minister of India Arun Jaitley indicates that Tax Pay…

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by