Fake Invoices Fraud Detected Affecting 200 Crore Igst

Reported under GST on 18/12/2018GST department has detected a fraud which could be around 200 crore. Officials have stated that bogus trading of around 1100 crore was carried out by multiple firms in state of Madhya Pradesh, Guj…

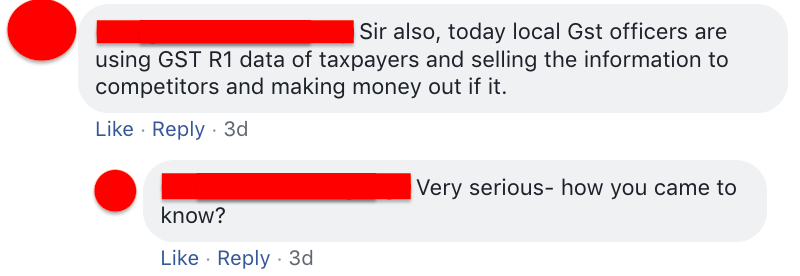

Gst Portal Updates Use Policy, Terms And Conditions To Avoid Data Scrapping

Reported under GST on 15/12/2018GST portal has updated its user policy and terms to avoid any misuse of portal and data of tax payers.

As per sources, GSTN has received various complains of data scrapping and even site…

Do Not Miss!!! Due Date For Income Tax Advance Tax Is Knowcking

Reported under Income-Tax on 13/12/2018Due to pay Income Tax Advance Tax is just 2 days away. Everyone who has tax liability of more than 10,000 in assessment year 2019-20 is liable to pay Advance tax in 4 installments and December 15 …

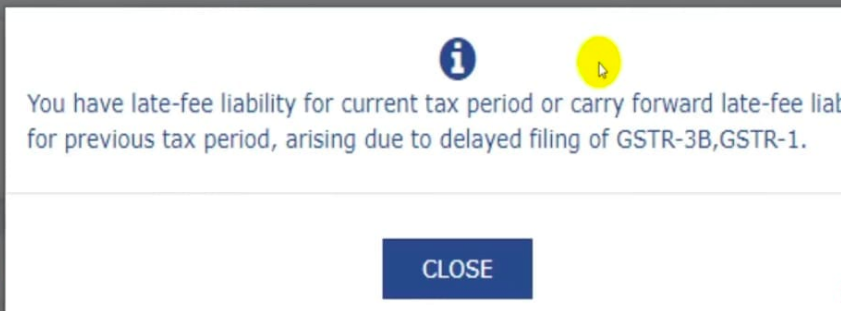

Late Fee Gstr-1 Started And Tax Payers Are Shocked

Reported under GST on 11/12/2018GST portal has started showing warning for late filing fee on GSTR-1 and late fee is being charged now. Till now late filing fee was charged only on delay in filing of GSTR-3B.

However f…

Nps Withdrawal Made At Par Tax Free To Ppf, Epf

Reported under Income-Tax on 11/12/2018NPS withdrawal made at par tax free to PPF, EPF

The Cabinet has approved changes to National Pension Scheme or NPS which will m…

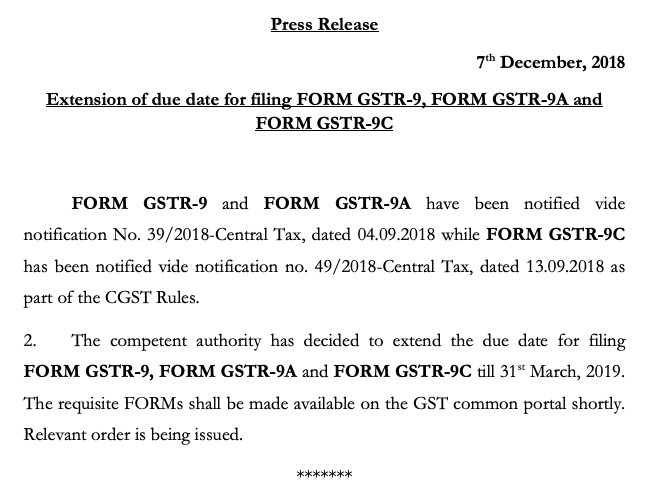

Gstr-9 Due Date Is Extended, New Due Date Is March 31,2019

Reported under GST on 08/12/2018CBIC has extended the due to file GST Annual Returns. GST annual return is a final statement for a financial year to be fil…

Knowyourgst Launches Android Mobile Application For Gst

Reported under General on 07/12/2018KnowyourGST.com has launched mobile application for Android mobile holders.

Users on site requested multiple times for launch a mobile app to read various topics and search GST numbers f…

Gst Practitioner Exam Govt Extended Eligibility Criteria

Reported under GST on 04/12/2018The National Academy of Customs, Indirect Taxes and Narcotics (NACIN) has been authorized to conduct an examination for confirmation of enrollment of Goods and Services Tax Practitioners (GSTPs) i…

Vat Annual Returns And Audit Form 240 Is To Be Filed

Reported under GST on 30/11/2018VAT (Value Added Tax) though does not exist any more but still one need to comply with annual filings. Karnataka government has specified the dealers who need to file annual returns and audit stat…

Corruption And Frauds Under Gst That Can Break Your Business

Reported under GST on 30/11/2018Goods and Services Tax or GST, the most promising step taken to ease indirect taxation in India. However the implementation has many loopholes that can result in closer of your business.

Gst E-Way Bill Bulk Generation Tool Is Now Simplified. Now You Can Add Master List For Suppliers, Clients And Also For Commodities

Reported under GST on 24/11/2018GST E-Way Bill Bulk generation tool is now simplified. Now you can add Master list for Suppliers, Clients and also for Commodities.

Generate E-way bill using this simple excel tool…

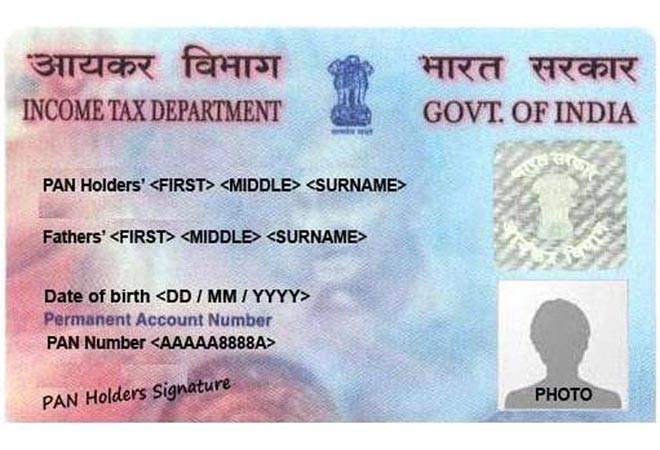

Pan Card Will Be Compulsory For Non-Individual Business Owners

Reported under Income-Tax on 22/11/2018PAN or Permanent Account Number is the main document and ID, every business owner must have for various business related functions and compliance. However now government is in full swing to bring …

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by