GST Annual Return 9 Guide

Last udpated: Dec. 7, 2018, 9:05 p.m.GST Annual Return is the final return for a financial year that taxpayers have to file every year regardless of their turnover.

Annual returns is a requirement that is mandated by GST laws.

What is Annual Return GSTR-9 under GST?

Annual Return is a summary of GST transactions done by a registered taxpayer. Every tax payer were required to file Return as per their capacity as registered under GST. That is, Regular person is supposed to file GSTR 3B monthly & GSTR 1 as per their relevant turnover, GSTR 4 to be filed by Composition dealer at every quarter. GSTR 8 by E commerce operator & so on. This tax payer now required to reconcile their GST return submitted for FY 2017-18 with their books of accounts & any changes in their if any have to show & file it under GSTR 9.

Annual return is a consolidated statement with details of all inward and outward supply and final tax liability. It cannot be revised and modified once filed, it is your last statement for a year to report all supplies and tax liability.

What is the due date of filing GST Annual Return and what is late filing fee if not filed on or before due date?

Due date for filing GST annual return is December 31 of every year. A person registered under GST has to file Annual return on or before December 31 of every year.

Late filing fee is Rs. 100 per day if GST annual return is not filed on time.

GST Annual Return GSTR-9 is most significant return as it is a single consolidated form, which taxpayers have to file to report their transactions done during a year.

Applicability of GST Annual Return GSTR-9

Annual Return GSTR-9 is applicable to every registered person under GST. Every registered person has to file GSTR-9.

GSTR-9 or annual return is even applicable to person registered under composition levy scheme.

As per section 44(1) of the CGST Act 2018, every registered person, other than an Input Service Distributor, a person paying tax under section 51 or section 52, a casual taxable person and a non-resident taxable person, shall furnish an annual return for every financial year electronically in such form and manner as may be prescribed on or before the thirty-first day of December following the end of such financial year.

Person exempted from GSTR-9 (Annual Return)

Every registered taxpayer is required to file GST Annual Returns, however following taxpayers are exempted from filing annual return in form GSTR-9.

- Input Service distributor

- Person Paying Tax u/s 51 (TDS)

- Person Paying Tax u/s 52 (TCS)

- Casual Taxable Person

- Non-Resident Taxable Person.

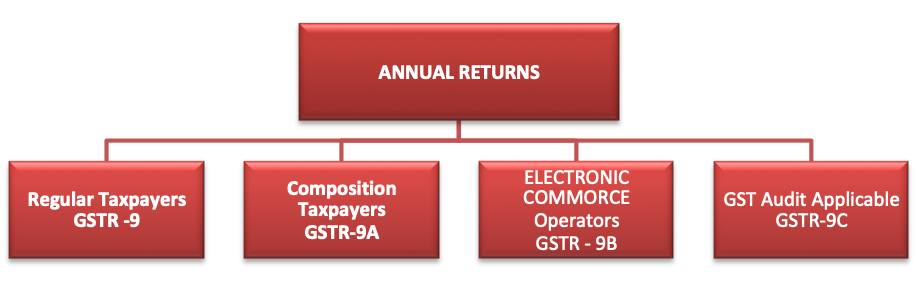

What are different types of annual return forms and their applicability?

There are 4 types of sub-forms in GST Annual Returns and are applicable to different class of registered taxpayers.

- GSTR-9

- GSTR-9A

- GSTR-9B

- GSTR-9C

GSTR-9 is to be filed by a regular taxpayer who has been filing GST returns under normal schemes and have filed returns such as GSTR-3, GSTR-1 etc.

GSTR-9A is applicable to a person paying tax under composition levy scheme. Composition registered person has to file form GSTR-9A.

GSTR-9B is to be filed by a taxpayer registered as an E-commerce operator. E-commerce operators are one running E-commerce portal and they need to file form GSTR-9B.

GSTR-9C is to be filed by taxpayers who are required to be audited by a chartered accountant. GSTR-9C is applicable to tax payer who have made supplies more than Rs. 2 crore in a financial year and are required to get their accounts audited by a chartered accountant or a cost accountant. Along with GSTR-9C even audit report is to be filed.

Procedure to file GSTR-9 online on GST portal

GST Annual returns can be filed online on GST portal directly or can be filed using offline utilities provided on portal. One can either file GST annual return online or offline using utility, however in my opinion filing annual return online is much easier as most of information will be prefilled.

GSTR-9 filing online key points

- Online facility to download system computed GSTR-9 as PDF format will be availableBased on GSTR-1 and GSTR-3B filed during the year,

- Similarly Based on GSTR-1& GSTR-3B filed during the year , consolidated summary of GSTR-1 will be made available to download in PDF.

- Based on GSTR-3B and GSTR-1 of the year. In each table of GSTR-9, values will be auto-populated to the extent possible.

- All the values will be editable with some exceptions (table 6A, 8A and tax payment entries in table 9).

- ‘Nil’ return can be filed through single click.

GSTR-9 Offline utility key points

- Offline tool to be downloaded from the portal.

- System computed JSON fileAuto-populated GSTR-9 to be downloaded from the portal before filling up values.

- Table 6A and table 8A will be non-editable.

- Barring tax payment entries in table 9. Other values will be editable

- Up on filling up the values, JSON file to be generated and saved.

- After logging on the portal, the JSON file to be uploaded.

- Error after processing the file, if any will be shown.

- Error files to be downloaded from the portal and opened in the Excel tool.

- After making corrections, file will again be uploaded on the portal.

- Correction can be made online also except table 17 & 18 (if the number of records exceeds 500 in each table.)

- After filing, return can be downloaded as PDF and/or Excel.

Annual return cannot be revised, therefore return should be filed after reconciling the information provided in the return and in the books.

Annual Return for 9C is to be prepared by Chartered Accountant or Cost Accountant?

- Preparation of the return shall be done in Excel tool which is to be provided for.

- Auditor will generate JSON file after attaching DSC.

- Other documents which includes Profit and Loss statement/ Income and expenditure statement etc. to be uploaded.

- Turnover values will be based on GSTR-9 in few tables.

- A PDF of such values will be made available to taxpayer. Auditor may have the same from the taxpayer for use in preparing GSTR-9C.

- Up on Filing on the portal processed and error, if any,will be indicated. For correction file will be download to make correction. Corrections as required will be made &File to be uploaded again as it was uploaded originally.

- Download option will be available at draft stage and after filing as well in PDF.

- Navigation option to make payment will be available which can be made through GST DRC-03.

Let’s go through with some of Practical aspects under GSTR-9 form

- Name of the taxpayer will be auto-populated at the time of return filing under GSTIN Section.

- Taxpayer Legal name of the registered person will be auto-populated. Sub-section 2C of Table 2 states whether the registered person is liable to do statutory audit, it is to be make YES, if conducted, else NO

- Dated of Audit Conducted to be provided in this section.

- Name of the auditors of the entity who have audited the accounts, need to be mentioned here.

- Inward Supply of Goods and Services purchased during the financial year must be provided in this section. Along with the HSN / SAC codes applicable and the taxable value of such goods and services, details shall be obtained from Form GSTR-2. This has been divided into the following heads:

- Total value of purchases on which ITC is availed (Inter-State)

- Total value of purchases on which ITC is availed (Intra-State)

- Total value of purchases on which ITC is availed (Imports)

- Total value of purchases from Compositing Deales

- Other Purchases on which no ITC is availed

- Sales Returns

- Other Expenditure (Expenditure other than purchases)

- Outward supply Details of all supplies and sales made during the year needs to be provided here. Such details are also mentioned in Form GSTR-1 This has again been divided into the following heads & to be disclosed as per list below:

- Total value of Inter-State Supplies on which IGST is paid

- Total value of Intra-State Supplies on which SGST and CGST is paid

- Total value of supplies as Exports It contains information of export of goods and services made during the year on which IGST is paid.

- Total value of supplies on which NO GST is paid under Exports It is the export of goods and services made during the year on which no IGST is paid

- Value of other supplies on which NO GST is paid, OR to take it differently, the supply of goods and services made during the year without any GST paid on it. Furthermore Exempted Outward supply to be shown under Part D, Nil Rated supply to be shown under Part E & Non –GST Supply under Part F

- Purchase Returns made during the year

- Any other income earned by tax payer during the year other than supplies mentioned in the above points, should be mentioned in this section.

- Return Reconciliation to be made after furnishing all the information, the system will auto-reconcile the transactions and will determine the tax liability payable against the tax actually paid. The system will also populate the amount of tax difference, interest and penalty, if any.

- Apart from above if there is any other payable, the same will be auto-populated in othersection. It may include arrears or any liability because of the assessment.

- Break-up of gross-profit, profit after tax and net profit needs to be mentioned under Profit as per the Profit and Loss Statement section

Nut & Bolt of the Game

- Notification No 39/2018 dated 04th September 2018, clearly mentions that only details for the period July 2017 to March 2018 are to be provided in GSTR-9.

- Except late fee and Payment No payment is to be made with annual return Taxpayer can make payment while filing GSTR 9C of taxes based on auditors recommendation but in that case also payment will be made by form DRC-03 and Navigation option to make payment will be available in GSTR 9C which will be linked with GSTR DRC-03

- If a Taxpayer has obtained multiple GST Registrations whether in one state or more than one state, it shall be treated as a distinct person & in respect of each such registration as per section 25(4) of CGST Act & therefore GSTR-9 is required to be filed separately for each such GSTIN.

- GST were implement On 1st July 2017 that is GST Period comprises of 9 months & sec 35(5) use expression Financial Year, & in absence of information till yet, it reasonable to comprise turnover limit for audit Rs 2Cr for the whole of the Financial Year which would include the first quarter of FY 2017-18.

- Due Date of Annual Return is 31.12.2018.

- Annual return cannot be revised, therefore return should be filed after reconciling the information provided.

- Upon failure to file Annual Return late fee shall be payable which is Rs 200/- per day, bifurcated into Rs100 under SGST & Rs 100 for CGST, subject to maximum 0.25% of turnover in a state as per sec 47 (2) of CGST Act.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.