Do Not Miss!!! Due Date For Income Tax Advance Tax Is Knowcking

Reported under Income-Tax on 13/12/2018Due to pay Income Tax Advance Tax is just 2 days away. Everyone who has tax liability of more than 10,000 in assessment year 2019-20 is liable to pay Advance tax in 4 installments and December 15 is the 3rd installment for payment of advance tax.

Advance tax is to be paid by every assesssee and now even tax payers opting for tax payment under section 44AD are required to pay Advance Tax.

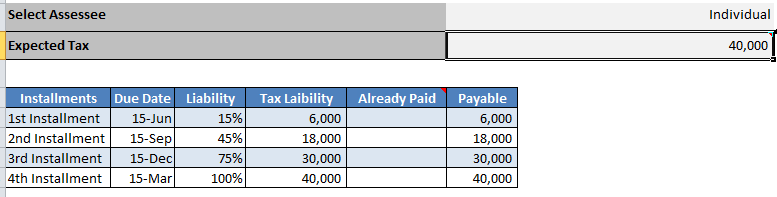

Due date for Advance Tax payment is given below.

| Installments | Due Date | Liability |

| 1st Installment | 15 June | 15% |

| 2nd Installment | 15 September | 45% |

| 3rd Installment | 15 December | 75% |

| 4th Installment | 15 March | 100% |

Further, below is the example of calculating liability on tax amounting to Rs. 40,000.

Tax payers are supposed to be paying advance tax as per installments and due dates mentioned under income tax act. Otherwise interest will be charged.

Interest on non payment or short payment of advance tax is 1% per month for every month of short payment or non payment of advance tax.

You can download advance tax calculator.

Related News

Income Tax Audit due date AY 2020-2021 extended

ITR Tax audit due date extended to November 2019

Tax Audit under 44AB due date extended

Income Tax Return filing due date extended

NPS withdrawal made at par tax free to PPF, EPF

PAN card will be compulsory for non-individual business owners

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by