Anon

watch_later 26/06/19

Sir,

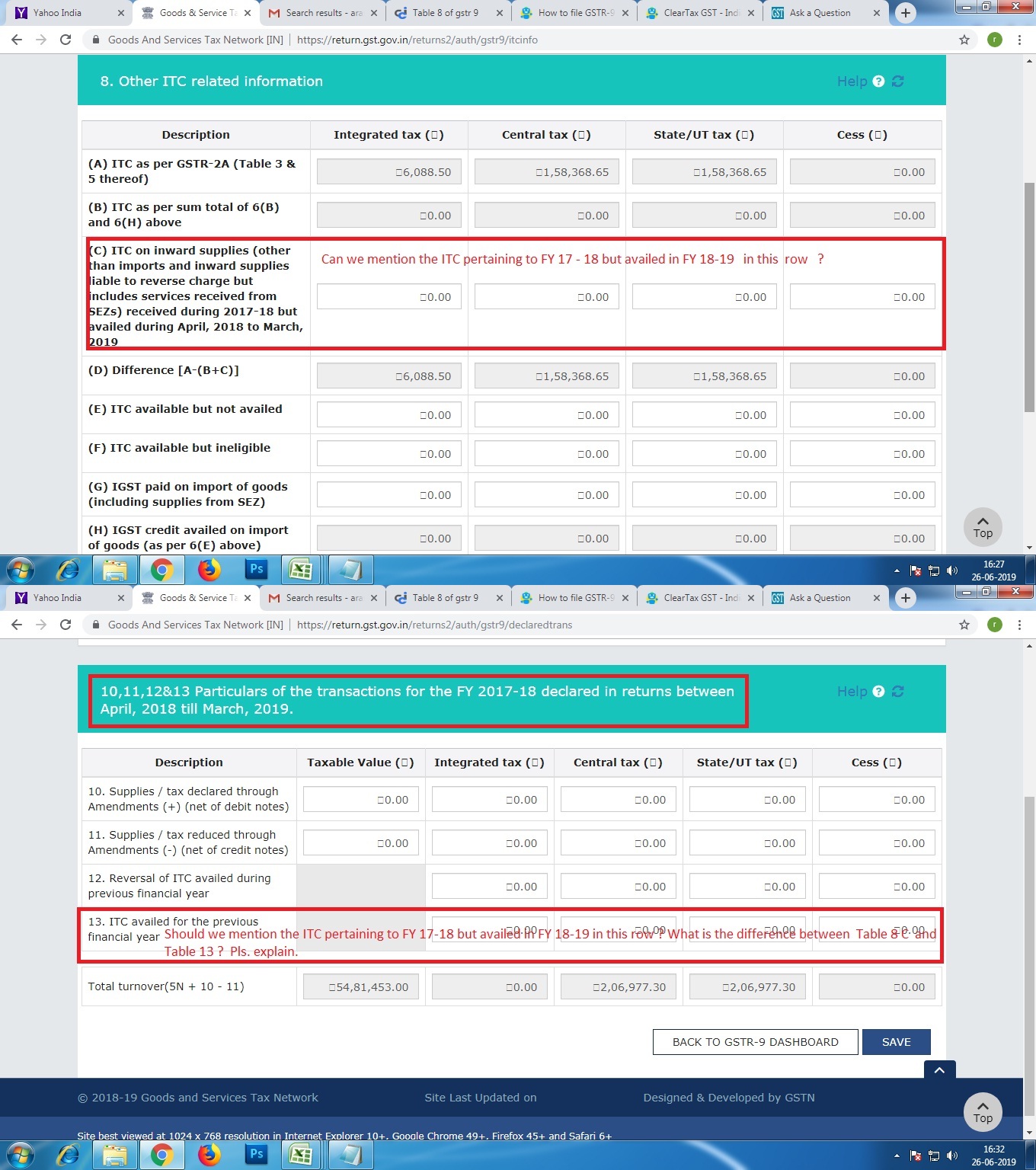

With reference to the filing of GSTR 9 for FY 17-18, I need clarification on the following issue.

If we have availed ITC for a bill pertaining to FY 17 -18 in FY 18 - 19 ( tru 3 B rtn. filed in that FY ), where should we mention that amount in GSTR 9, whether in Table 8 - C or in Table 13. Or both ? What is the difference between these two ( Table 8 - C and Table 13 ).

Please clarify the above.

With Regards.

No replies yet. Join the discussion.

Reply

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion