What is GSTIN?

What does each character in GSTIN represent?

How many characters are used in GSTIN?

GSTIN or Goods and Services Tax identification number is the identification number given to each registered person.

GSTIN is the registration number which will be on your registration certificate.

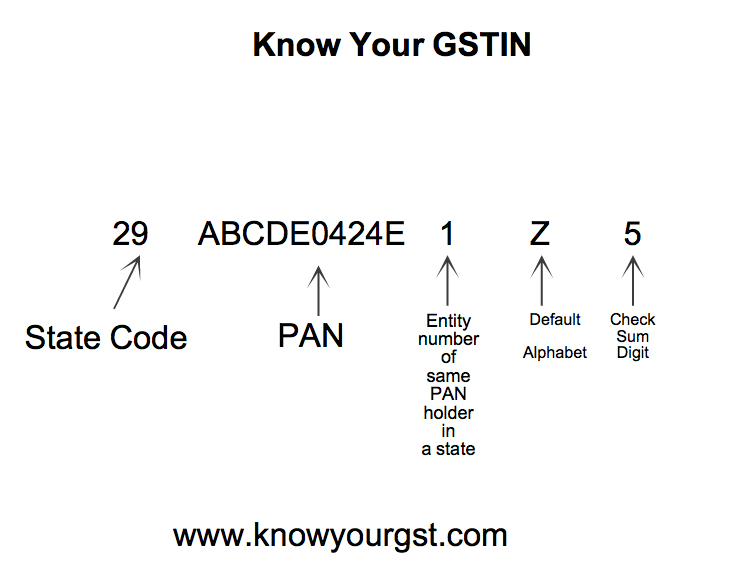

Total 15 characters forms a GSTIN.

First 2 characters are state code. For example 29 is the state code for Karnataka in present VAT system which will continue for GST also.

Next 10 digits will be PAN of registered person.

13 character represents the unit number of registered person in the state.

14 and 15 are default numbers given which will be utilised in future for any classification.

Dear Taxpayer(s),

Greetings! In the GST regime, each Tax Payer has been assigned a countrywide-wise Goods and Service Taxpayer Identification Number (GSTIN). GSTIN is 15 digit, alpha numeric identity where the first two numeric digits is the state code.

The GSTIN for different taxpayers has been made unique to identify different type and category of taxpayers, for Normal Taxpayer, Casual Tax Payer, SEZ, TDS, UIN etc. Following are some formats which a GSTIN can take.

- The state code is followed by the 10 digit PAN number (For TDS, it can be either PAN or TAN) followed by another 3 alpha numeric digits. Sample GSTIN for Normal Taxpayer, Composition Taxpayer, Casual Taxpayer etc. :

e.g. 07AAAAA1234A1Z1

- For Non-resident Foreign Taxpayers or Non-resident online service provider, the state code is followed by 2 digit year, 3 digit country code and 5 digit serial number per year and another 3 alpha numeric digits . Sample GSTIN for Non-resident Foreign Taxpayers and Non-resident online service provider :

e.g. 0717USA12345NF1

- For UN Bodies, Embassies etc. and other notified persons, the term used is UIN. For the UIN, The state code is followed by two digit year, 3 digit country code and 5 digit serial number and another 3 digit of alpha numeric character. Sample UIN for Embassies, UN Bodies and other notified person etc.:

e.g. 0717AUS12345UN1

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion