Sir,

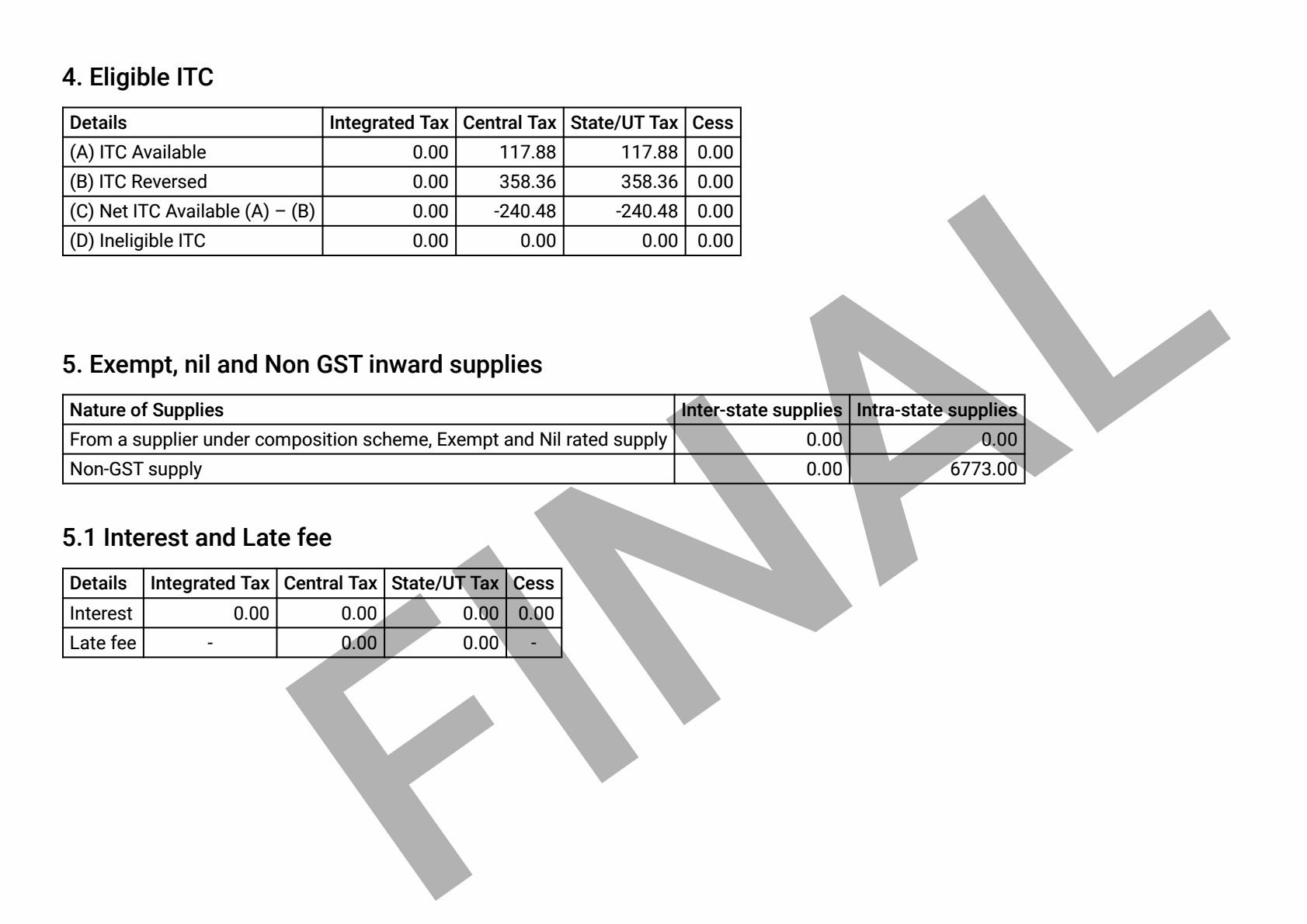

Our organisation has filed GSTR 3B for the month of November 2019 in which amount of ITC reversed (Rs.358.36) is more than the ITC availed (117.88) resulted in negative net ITC of Rs. 240.48 each (Sl No 4 - Eligible ITC) under Central Tax and State Tax. On that date we had sufficient balance of ITC in our credit but only ITC available for the month of Nov 19 only was taken for adjusting the ITC to be reversed. Hence the balance of Rs.240.48 each remained unadjusted as on today. So I have the following question which may please be answered :-

1. As the ITC of Rs.358.36 reversed has alrleady been taken in GSTR 3B filed for the month of November 19, is it correct to again reverse the balance of Rs.240.48 in the future returns.

2. Otherwise how it is to be rectified.

A copy of the relevant page is attached herewith

Thanking you,

With regards,

(Sathees Kumar A.V

Your disclosure is right since you have claimed the input available Rs.117/- & also reversed Input Rs.358/-. You need not do any thing other than this. These amount will automatically sits in credit ledger. The balance credit in the Credit ledger will be adjusted for any output tax you disclose in GSTR 3B.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion