Self assessment tax payment procedure

Last udpated: Jan. 11, 2019, 1:05 p.m.How income tax is collected by Central Government?

Income tax is collected by Central Government in the form of -

- Tax deducted at source (TDS)

- Tax collected at source (TCS)

- Advance tax

- Self assessment tax

What is self assessment tax under Income tax?

It is tax remaining to be paid after deducting advance tax and TDS/TCS.

Example - For the year 2018-19, income tax payable on total income is Rs 1,00,000/- Assessee has already paid advance tax of Rs 50,000/- during 2018-19. Various person have deducted TDS of Rs 20,000/- on his account.

Net income tax payable by assessee is -

| Total tax payable | Rs 1,00,000 |

| Less : Advance tax paid | Rs 50,000 |

| Less: TDS/TCS | Rs 20,000 |

| Net Tax Payable | Rs 30,000 |

Net tax payable of Rs 30,000/- is the self assessment tax. So, it is tax remaining payable after deducting taxes already paid.

How do I pay Self assessment tax?

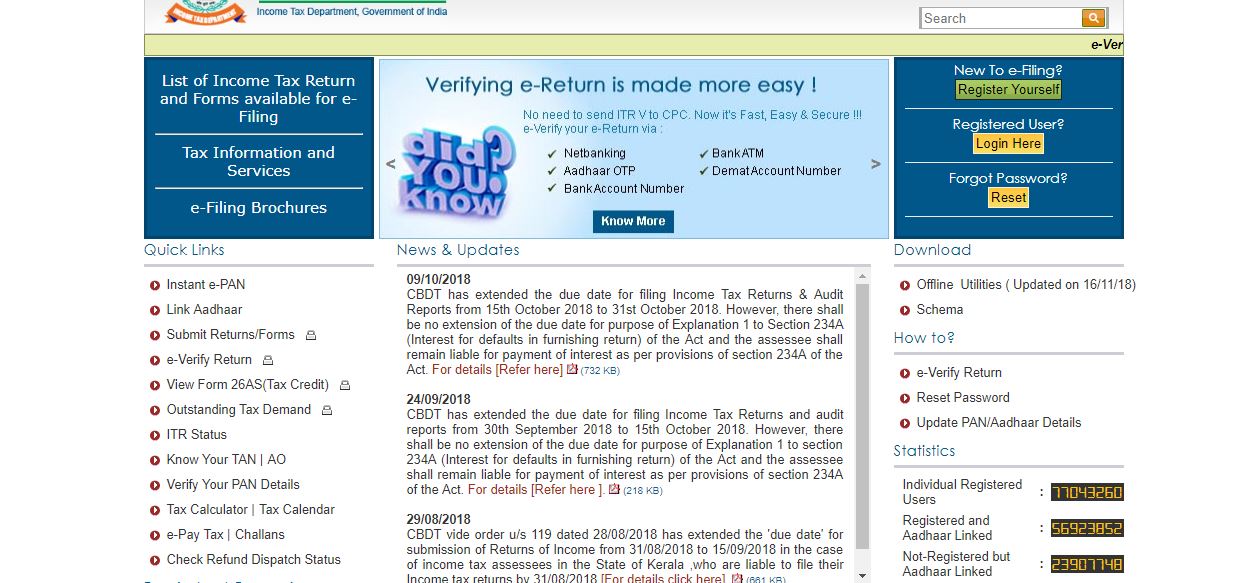

To pay advance tax visit https://www.incometaxindiaefiling.gov.in

Under 'quick links' click on 'e-Pay Tax'

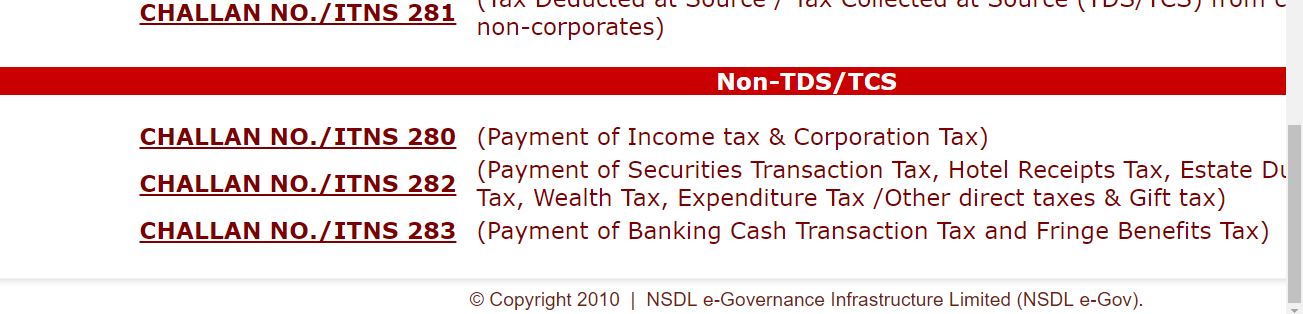

You will be then taken to NSDL website

Under 'Non-TDS/TCS' click on 'Challan No/ITNS 280'

Fill all the particulars of the form

- If you are 'Company' select 'Corporation Tax (Companies), in all other cases select 'Income Tax (Other than Companies)'

- Select appropriate assessment year.

'Assessment year' is the year following previous/financial year.

Previous year is same as financial year.

For example, if you are paying advance tax in 2018-19, then previous/financial year is 2018-19 and assessment year is 2019-20. - Fill your contact details, contact details need not match with those registered on Income tax website.

- Under 'Type of Payment' select 'Self assessment tax'

You can see that same form can also be used to pay advance tax, except TDS. - Fields not mentioned above are self explanatory.

- Review once, and click on 'proceed'.

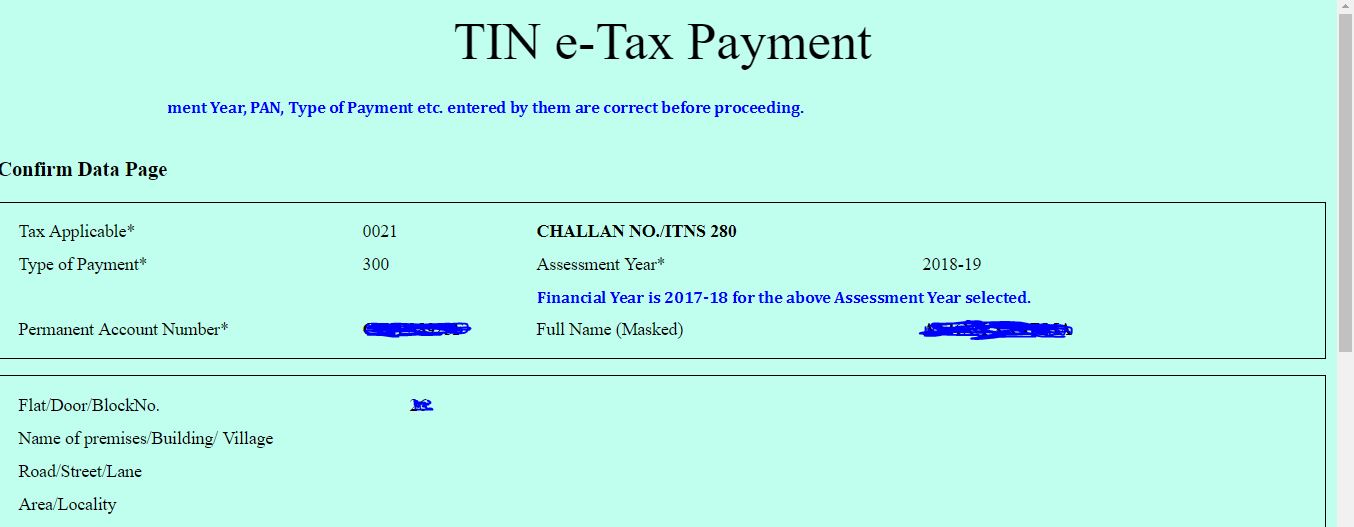

- After you click on proceed you will see below page

- See that your name and financial year displayed are correct

- Click on 'Submit to the Bank'.

- You will be redirected to your bank website, select mode of payment and hit 'submit'

- Enter login credentials, and then you will be taken to tax payment page, where you will have to enter tax amount.

- Fill tax amount, and hit 'confirm'.

- In next page, you will be asked to confirm. If everything is correct, hit 'confirm'.

- That's it. Download the receipt in PDF and save.

How do I pay self-assessment tax offline, if I do not have internet banking?

To pay advance tax offline, download challan 280. Fill the form and submit it to your banker.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Extension of time limits of certain Compliances to provide relief to tax payers in view of pandemic

- Dividend Income U/s 8 of Income Tax Act 1961 new provision

- Whether 'tips' received fall within the meaning of "Salaries" to attract TDS under section 192

- Mandatory requirement of furnishing PAN in all TDS statements, bills, vouchers and correspondence between deductor and deductee [Section 206AA] | AY 2019-20 onwards

- Furnishing of statements in respect of payment of interest to residents without deduction of tax [Section 206A] | AY 2019-20 onwards

- Person responsible for paying taxes deducted at source [Section 204] | AY 2019-20 onwards

- Common number for TDS and TCS [Section 203A] | AY 2019-20 onwards

- What if TDS is not deducted or paid [Section 201] | AY 2019-20 onwards

- Duties of Person deducting income tax [Section 200] | AY 2019-20 onwards

- Credit for tax deducted at source [Section 199] | AY 2019-20 onwards

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.