I visited a hotel / guest house in Pondichery. They said i need to pay room rent of rs 3000 by card or cash, but 18% GST by cash. When asked, the reception person said GST amount has to go in different account, which they didn't have the swipe machine ready and thus they collect cash to deposit in another account. He said the bill with GST will be send through email and collected my email ID. Is it correct that GST has to be collected separately by such guest house hotels. Please clarify this is correct to collect separate. Never come across such in other places.

There is something wrong here.

You have paid 3000 for how many days?

GST is exempted if room charges are less than Rs. 1000 per day. If you stayed for more than 3 days, then there is no GST chargeable on your bill.

Further there could be a chance that hotel may not pay GST collected from you to government since card payment does not include GST and you have paid in cash.

You should wait for Invoice. Check that Invoice contains GST details of hotel. If you smell something fishy, you should complaint to GST department, they will take suitable action. But again it will be difficult for you to prove that you have paid any amount in cash. Did they give you any receipt?

You should have made payment with card.

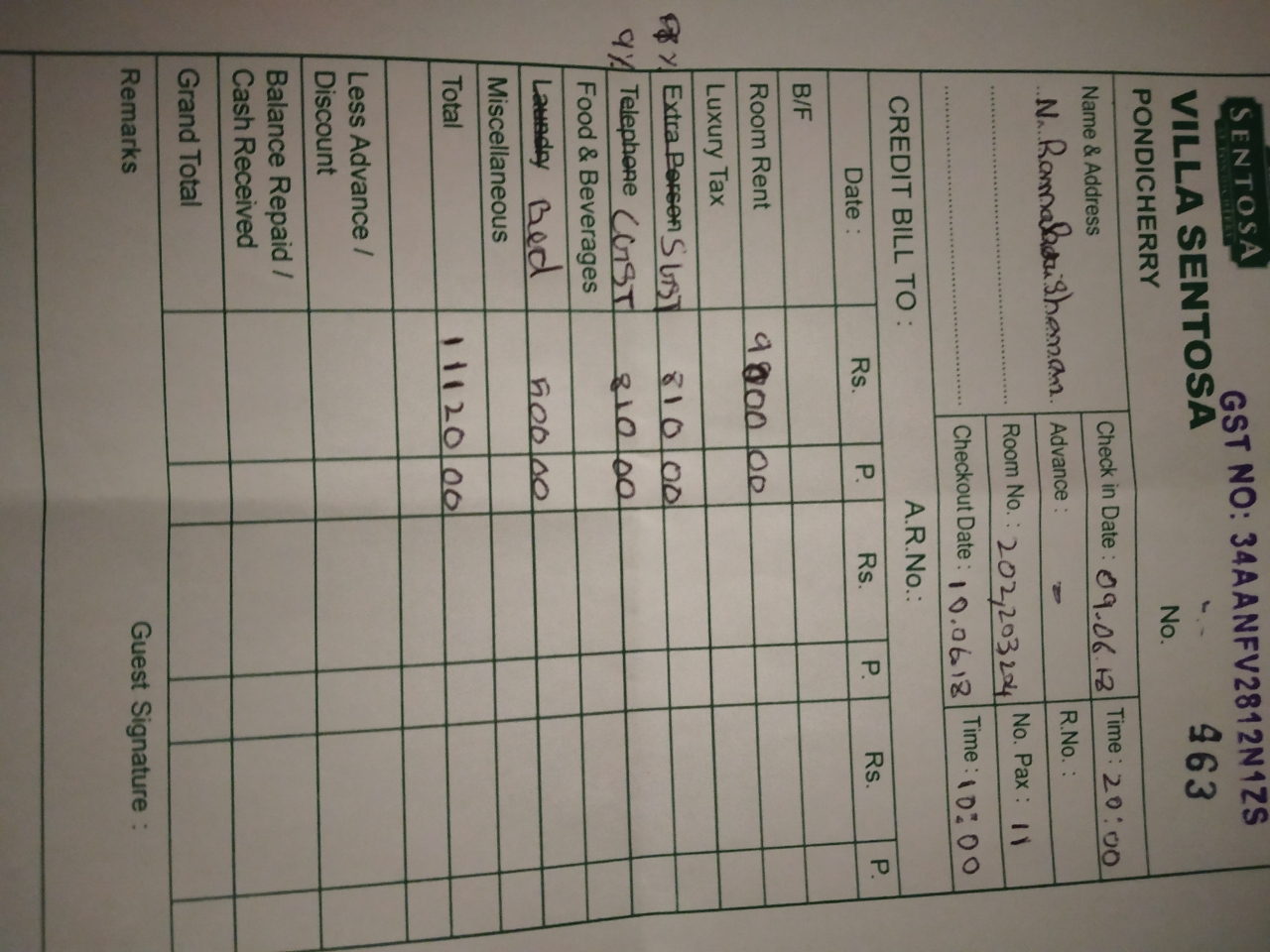

We stayed for one night only and the rent said to us while we walked-in was rs.3000+GST per night. we are 3 families and hired 3 rooms While leaving he made such confusion to pay through credit card for 9000 and balance cash. On demand, yesterday i could able to collect the receipt. Immediately i verified the GST number at your site and found unavailable. Then I asked for GST certificate copy, which they provided to me. Both bill as well as GST certificate attached herewith for your review and advice. If complaint to be made with GST department, then what email ID or phone number should i contact.

We stayed for one night only and the rent said to us while we walked-in was rs.3000+GST per night. we are 3 families and hired 3 rooms While leaving he made such confusion to pay through credit card for 9000 and balance cash. On demand, yesterday i could able to collect the receipt. Immediately i verified the GST number at your site and found unavailable. Then I asked for GST certificate copy, which they provided to me (34AANFV2812N1ZS). Handwritten bill is attached herewith for your review and advice, in which 9000 paid through card and balance 2120 paid by cash as demanded (i.e., cash towards GST + extra bed). If complaint to be made with GST department, then what email ID or phone number should i contact.

Hi, I found it strange that in the government website (https://services.gst.gov.in/services/searchtp), based on GSTIN number is found to be ACTIVE in their database, whereas the same is unavailable reverse if I use your website search (i.e., GSTN number not traceable using either PAN or Name).

Request the administrator to remove the attached bill, as the hotel management called me to apologized for the error by their staff and said will refund the cash amount received by their caretaker.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion