My Brother is a trader ,engaged in the business of trading of grains. He purchases grains from farmers and sell it in Mandi.

My queries are-

1) Since he purchase grains from farmers . Can he make payment for it to farmers in excess of Rs 10000?

2) When he sell such grains in Mandi . He received Cash or has option to receive cheque but the the cheque is given on individual name i.e. on brother's name ,not on firm's name.Now how to handle this situation. Should he accept payment in cash or cheque ?

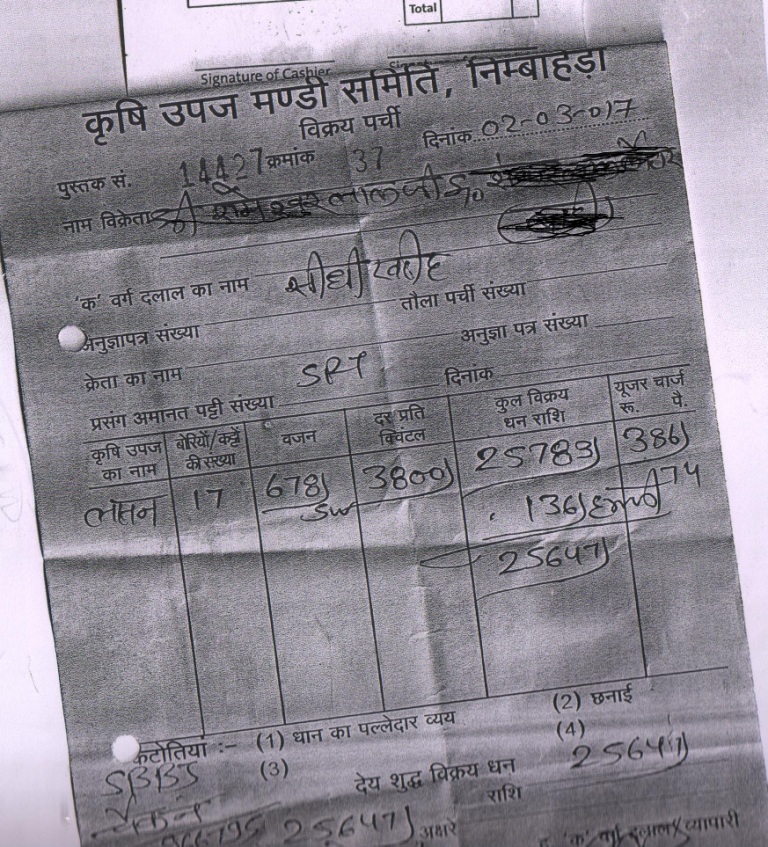

3) He does not issue any bill/invoice to Mandi Trader while selling the grains. Mandi traders just issue VIKRAY PARCHI. See the Image

4) Where to show details of inward supply from farmers and outward supply in GST Return?

1) Since he purchase grains from farmers . Can he make payment for it to farmers in excess of Rs 10000?

Yes for agriculture products purchased from farmers, cash payment is allowed.

2) When he sell such grains in Mandi . He received Cash or has option to receive cheque but the the cheque is given on individual name i.e. on brother's name ,not on firm's name.Now how to handle this situation. Should he accept payment in cash or cheque ?

In case of proprietorship there is no difference between person and firm. He can deposit this money in his own account. I will suggest to open a separate bank account for this purpose and include it in business books of accounts.

3) He does not issue any bill/invoice to Mandi Trader while selling the grains. Mandi traders just issue VIKRAY PARCHI. See the Image

As per GST rules, tax invoice has to be issued if GST registration is obtained. Since there is no GST charged on grains, Mandi may not take invoice. But your brother should prepare invoice for each sale and keep for records.

4) Where to show details of inward supply from farmers and outward supply in GST Return?

You need to show outward supplies (sales) under exempted sales in GSTR-3B, similarly for purchase show under exempted purchases. There are option for exempted outward and inward supplies in GSTR-3B.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion