I am a composite dealer. I have to file GSTR4 for Q1 ( April to Jun 2018 )

I downloaded the B2B purchases from GSTR portal as JSON file and subsequently uploaded the same in GSTR4 .

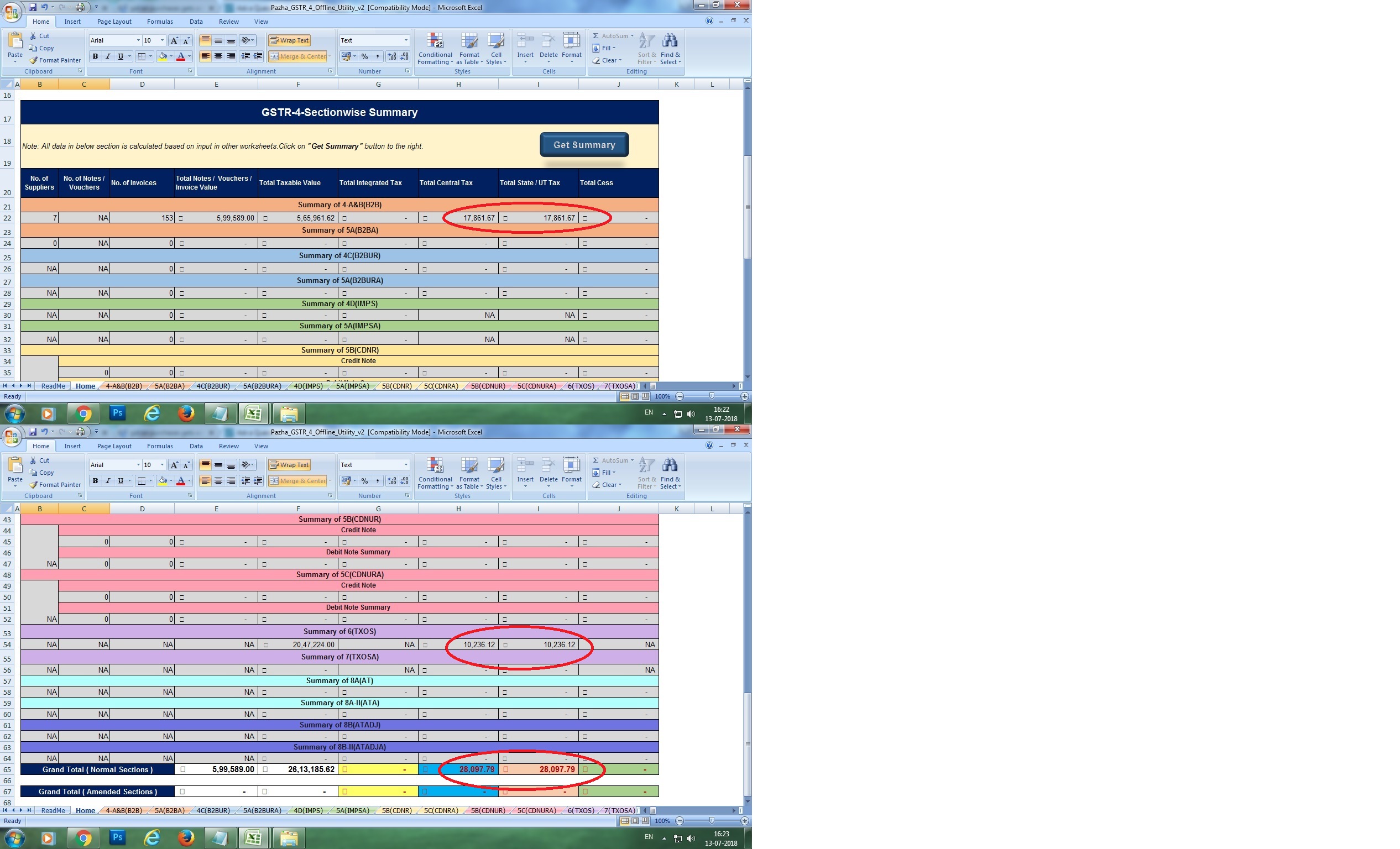

After processing the " Get Summary " button, the summary shows the No. of invoices, Total purchase value, taxable purchase value,etc. But, the TAX AMOUNT on my purhcases are shown in the tax column as Payable.

My supplier has already collected the GST on all these bills. Still, the tax amout is added to the GST payable on my Sales Turnover.

The " Reverse Charge " column in sheet 4A,4B is " No" and " Type " column is " Regular " for all the purchase bills.

What shall I do ?

Can I upload the GSTR 4 without giving the B2B purchases in Sheet 4A,4B ?

Read this question, Table 4A is not required in GSTR4.

As per government notification 4A is not required to be filed.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion