Can we put multiple tax for the same item?

Can we charge multiple taxes in a tax invoice for same item?

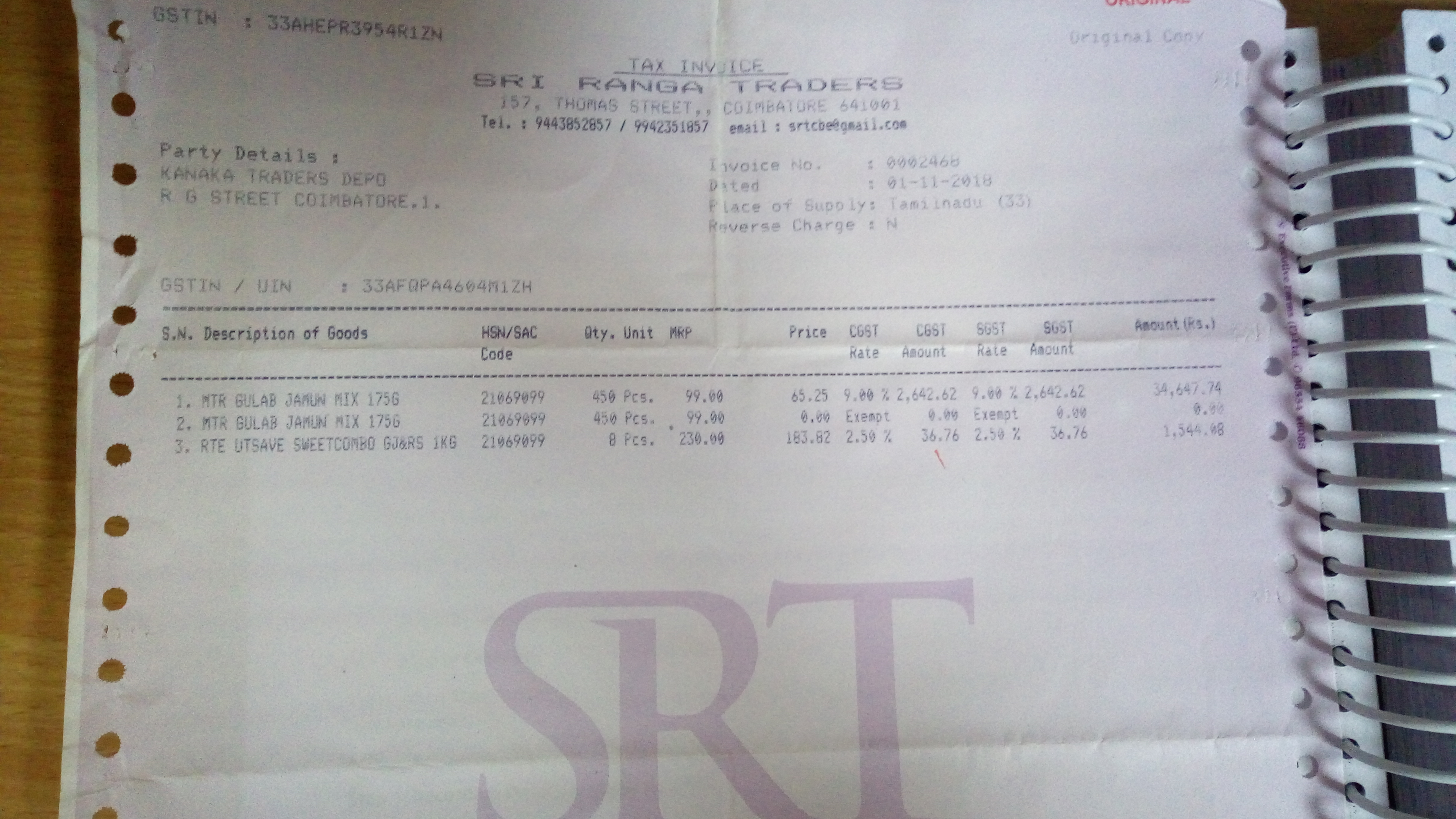

Your question is not clear. I think you are confused about tax heads. CGST and SGST are charged. These are not multiple taxes but GST only.

Under GST we charge CGST and SGST each at 50% of GST rate.

In your case GST was applicable at 5%, so 2.5% SGST and 2.5% CGST is charged.

Probably the question is regarding the item "MTR Gulam Jamun Mix 175g" which has been billed with 18% GST and also under EXEMPT. The sale is probably Buy-One-Get-One Scheme.

I would also like to know if we can bill in such a way?. Or is there any better way of doing it ?.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion