Anon

watch_later 24/02/19

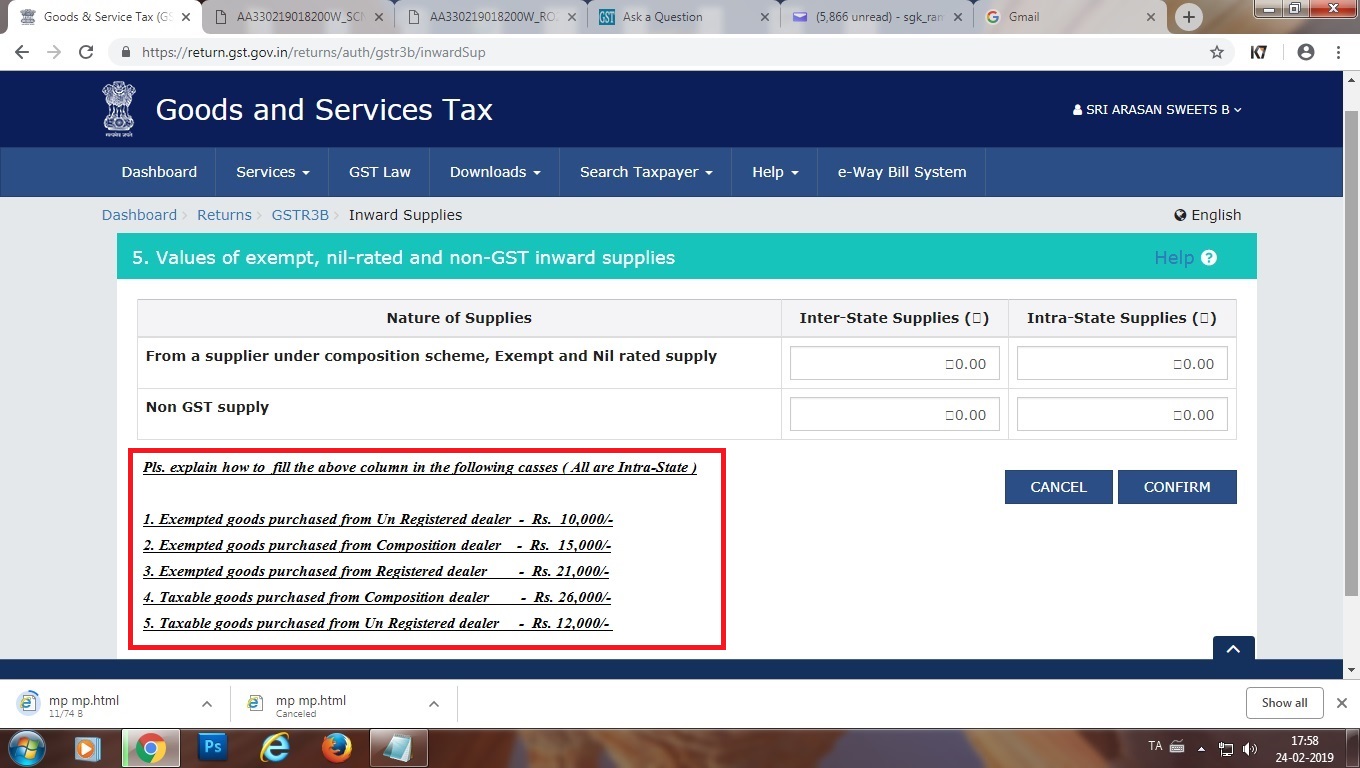

Sir,

How to fill the details in GSTR 3B in Table 5 - Values of exempt, nil-rated and non-GST inward supplies in the following cases ( All purchases are Intra - state ) :

1. Exempted goods purchased from Un Registered dealer

2. Exempted goods purchased from Composition dealer

3. Exempted goods purchased from Registered dealer

4. Taxable goods purchased from Composition dealer .

5. Taxable goods purchased from Un Registered dealer

Can we consolidate the value if we have purchases under various categories mention above for a single month ? Please advice.

No replies yet. Join the discussion.

Reply

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion