Advance tax payment procedure

Last udpated: Jan. 10, 2019, 4:59 p.m.What is advance tax?

Under Income tax act, advance tax is the mechanism by which Central Government collects taxes payable in the assessment year in previous year itself.

Example : Tax payable for the financial year 2018-19 is payable in the assessment year 2019-20. To speed up the collection process Government collects Income tax in advance, that is in financial itself, 2018-19 in this case.

How do I pay advance tax online

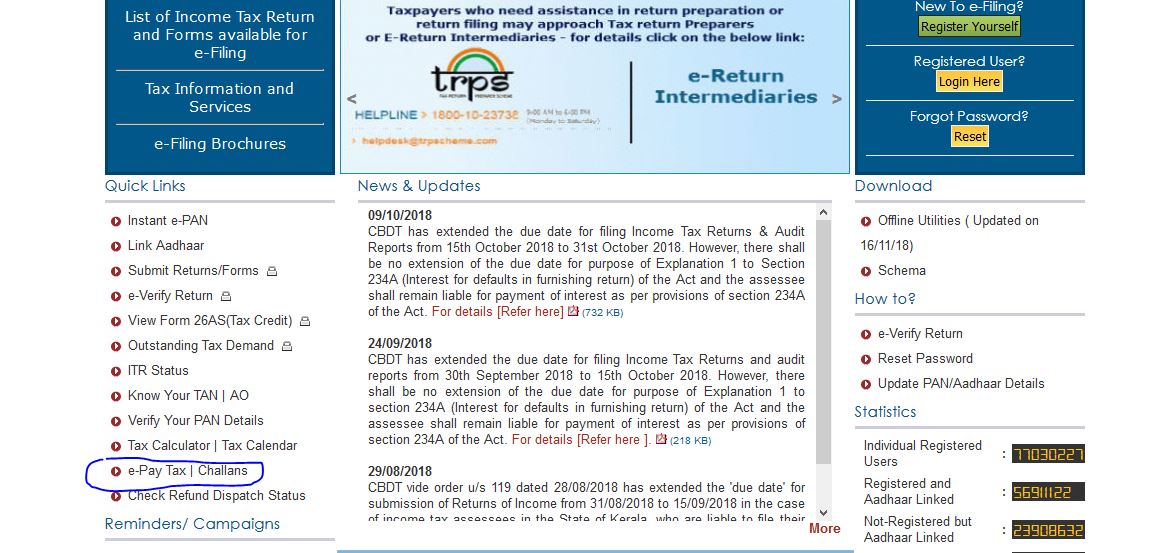

To pay advance tax visit https://www.incometaxindiaefiling.gov.in.

On left side of the page, click on 'e-Pay Tax' marked in blue color.

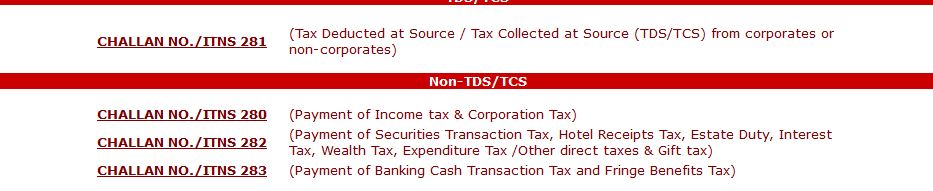

You will be then taken to NSDL website.

Click on 'Challan No/ITNS 280' shown below.

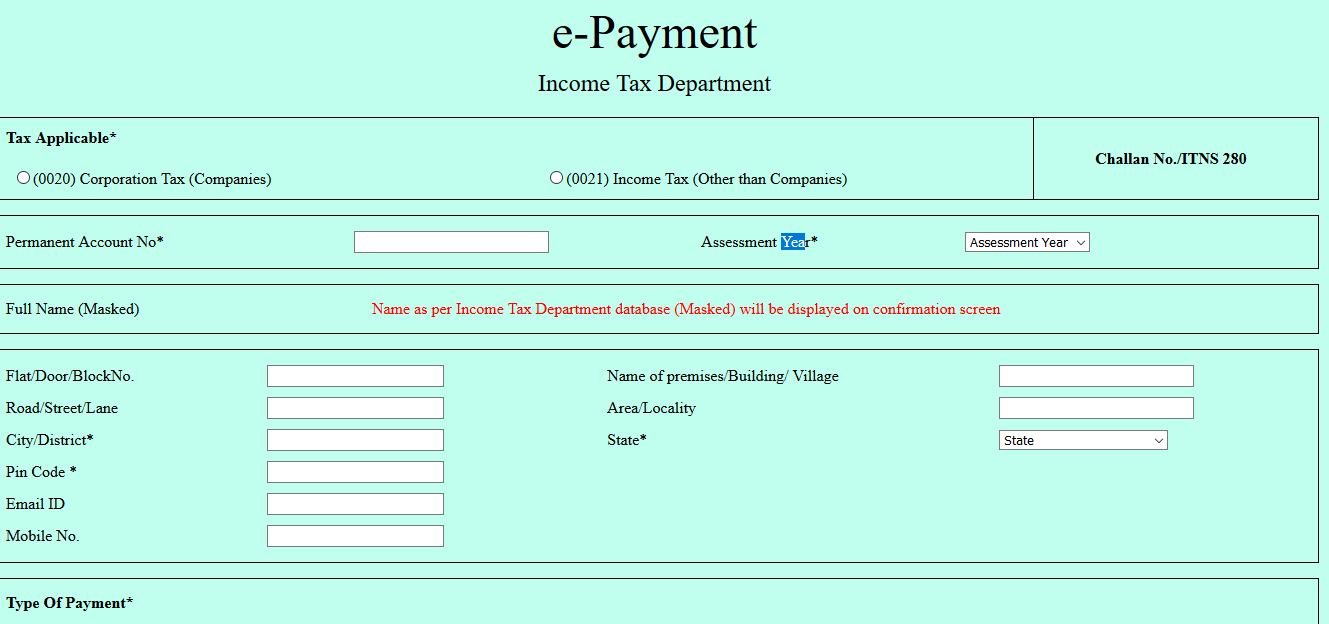

Fill all the particulars of the form.

- If you are 'Company' select 'Corporation Tax (Companies), in all other cases select 'Income Tax (Other than Companies)'

- Select appropriate assessment year.

'Assessment year' is the year following previous/financial year.

Previous year is same as financial year.

For example, if you are paying advance tax in 2018-19, then previous/financial year is 2018-19 and assessment year is 2019-20. - Fill your contact details, contact details need not match with those registered on Income tax website.

- Under 'Type of Payment' select 'Advance Tax'

You can see that same form can also be used to pay self assessment tax, except TDS. - Fields not mentioned above are self explanatory.

- Review once, and click on 'proceed'.

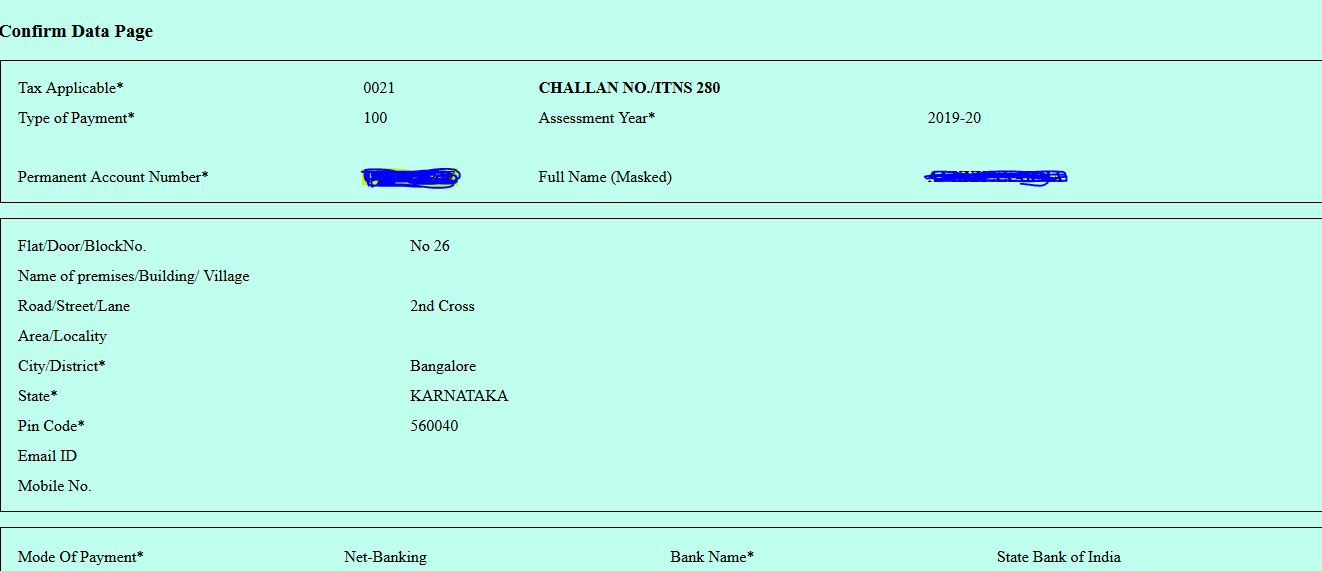

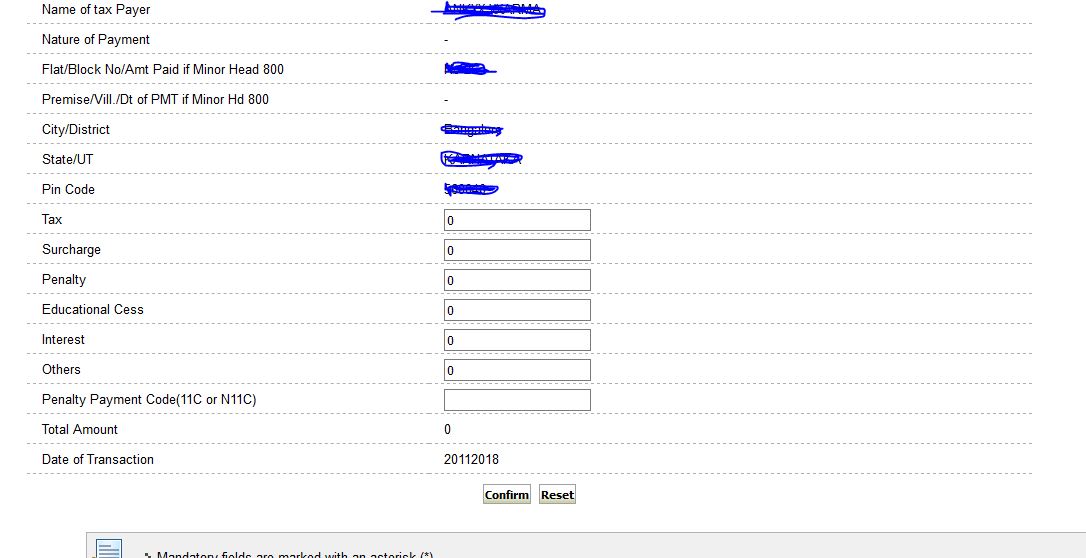

- After you click on proceed you will see below page -

See that your name and financial year displayed are correct - Click on 'Submit to the Bank'.

You will be redirected to your bank website, select mode of payment and hit 'submit'

Enter login credentials, and then you will be taken to tax payment page, where you will have to enter tax amount.

Fill tax amount, and hit 'confirm'.

In next page, you will be asked to confirm. If everything is correct, hit 'confirm'.

That's it. Download the receipt in PDF and save.

How do I pay advance tax offline, if I do not have internet banking?

To pay advance tax offline, download challan 280. Fill the form and submit it to your banker.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Extension of time limits of certain Compliances to provide relief to tax payers in view of pandemic

- Dividend Income U/s 8 of Income Tax Act 1961 new provision

- Whether 'tips' received fall within the meaning of "Salaries" to attract TDS under section 192

- Mandatory requirement of furnishing PAN in all TDS statements, bills, vouchers and correspondence between deductor and deductee [Section 206AA] | AY 2019-20 onwards

- Furnishing of statements in respect of payment of interest to residents without deduction of tax [Section 206A] | AY 2019-20 onwards

- Person responsible for paying taxes deducted at source [Section 204] | AY 2019-20 onwards

- Common number for TDS and TCS [Section 203A] | AY 2019-20 onwards

- What if TDS is not deducted or paid [Section 201] | AY 2019-20 onwards

- Duties of Person deducting income tax [Section 200] | AY 2019-20 onwards

- Credit for tax deducted at source [Section 199] | AY 2019-20 onwards

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.