How to file income tax return for salaried employee using ITR-1

Last udpated: May 7, 2018, 9:27 a.m.Filing income tax return for a salaried person is very simple.

If you are earning only from employment and do not have any other source of income except interest on saving bank accounts, you need not to hire any consultant for filing your income tax return.

I will show you steps to file your income tax return. You can file your own return for free.

If you are earning from employment, you have to file return using form ITR-1.

To file your return successfully keep following documents/information ready.

- PAN number/PAN card

- Date of Birth (DOB)

- Form 16 from employee

- Passbook or bank statement containing details such as account number, IFSC code

- Aadhaar number

- Details of investment under section 80C (if these already not claimed in form 16)

Aadhaar number is compulsory to file income tax return.

To file your income tax return using form ITR-1, you have to follow below steps:

- Register on Income Tax website (If you have already registered then follow second step)

- Login to your Income Tax account (PAN will be userid)

- Select form ITR-1

- Fill the form

- Submit the form

- E-verify or Post the acknowledgement copy to CPC, Bangalore

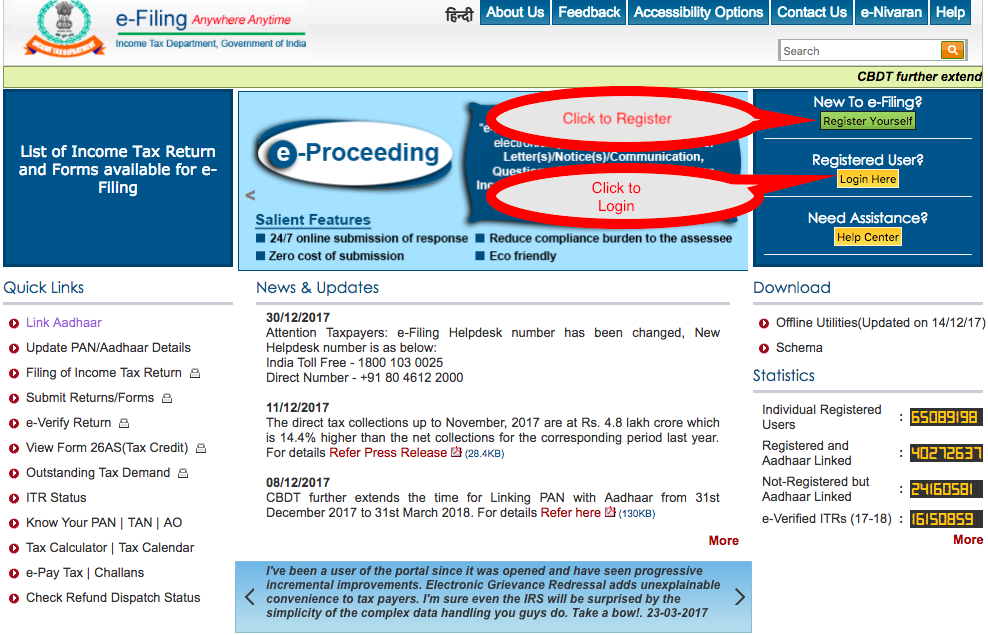

Step 1. How to register on Income Tax India website for filing return?

To register on income tax website first you have to go to incometaxindiaefiling website.

You will see the following screen (04/01/2018).

You can click on Register to register yourself.

When you click on Register button, you will be redirected to a form to select your status, you have to select individual and click on submit.

In next screen you will see the options to enter you PAN, DOB, Resident status, Mobile, Phone etc. fill the details and submit.

Next you will be asked to fill you contact details.

Please note that mobile and email should be accessible as OTP will sent for verification.

Normally the following information will be asked on income tax website.

- Basic details

- Registration form (Address etc.)

- Registration verification (OTP will be sent)

- Registration successful message page

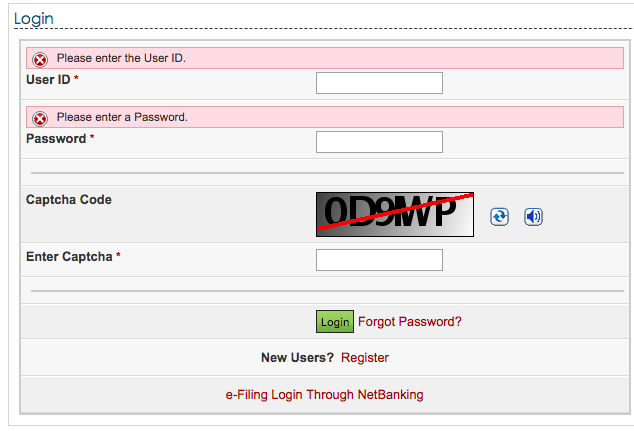

Step 2. How to Login to incometax website for filing return?

To login you have to visit income tax website and click on Login button.

A login form will open.

Your user id will be you PAN number.

Fill the password and enter captcha and click on Login button.

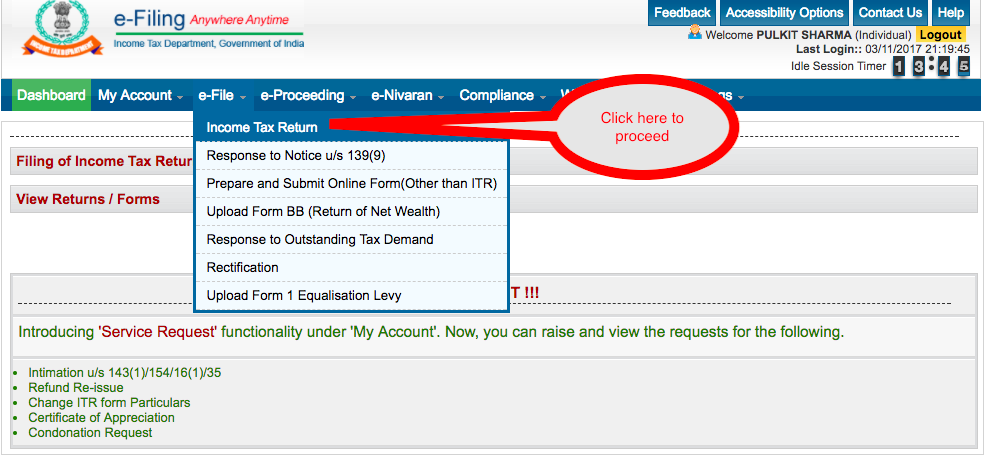

Step 3. Filing ITR-1 for salaried person

Once you have logged in to your account.

You will see the dashboard.

To file your return, you have to click on e-File menu on top header bar.

A drop down list will be visible, click on Income Tax Return.

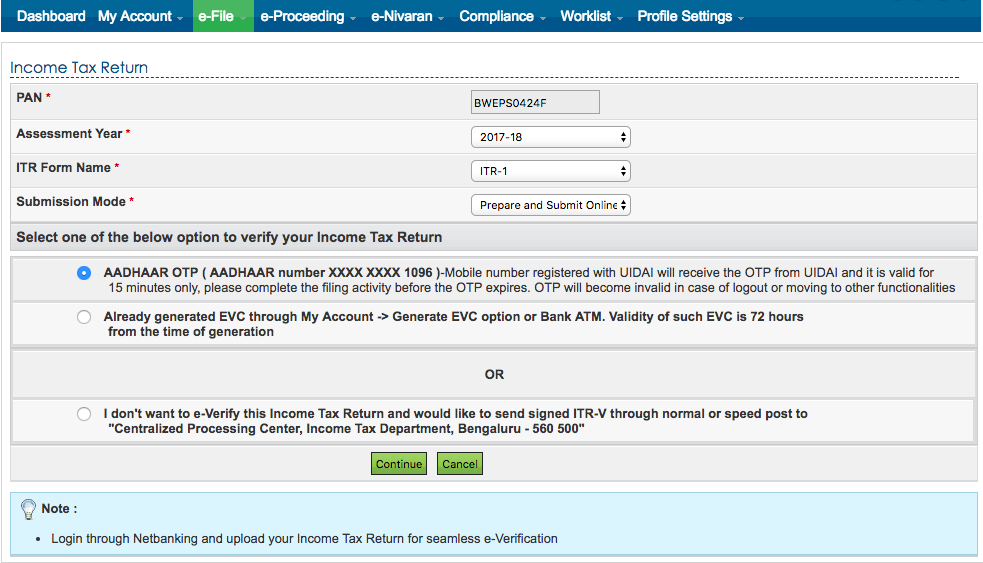

Once you followed above steps you have to select Assessment year, ITR form, submission mode and verification mode.

Select Assessment year 2018-19 (if filing for financial year 2017-18).

Select form ITR-1.

Submission mode should be prepare and submit online.

You can select Aadhaar based OTP for e-verification. You receive OTP on your mobile which will be valid for next 30 mintues.

Once these details are filled click on Submit button.

The next screen will open with ITR-1 form.

ITR-1 form will have following tabs:

- Instructions

- PART A GENERAL INFORMATION

- INCOME DETAILS

- TAX DETAILS

- TAXES PAID AND VERIFICATION

- 80G

I will not discuss Instruction and Part A as these are self explanatory. You have to provide basic details such as address here.

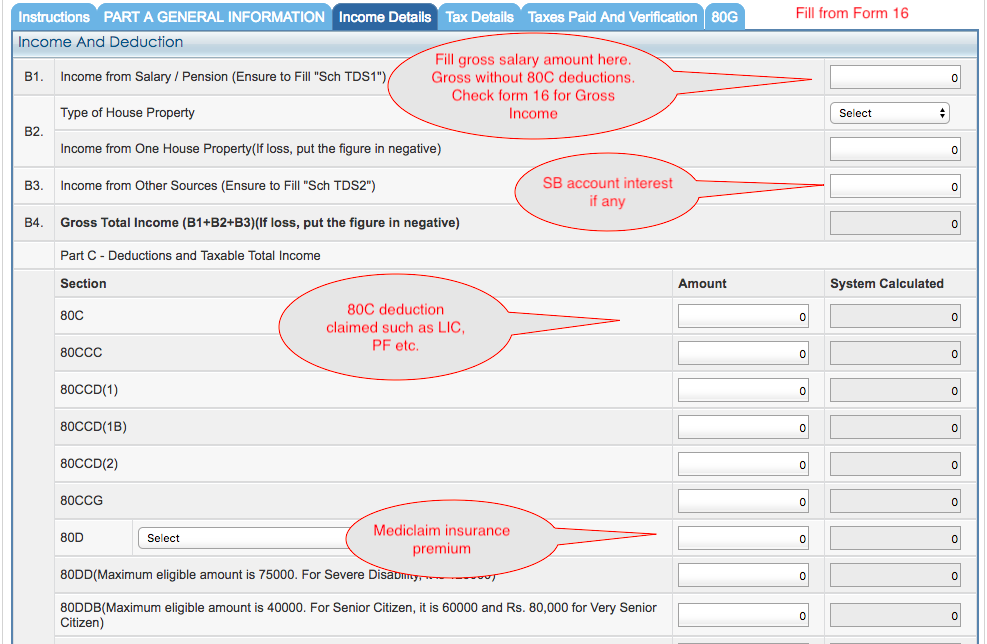

How to fill salary details in ITR-1?

To fill salary details click on Income Details tab of ITR-1 form.

In this tab, first option B1. Income from Salary/Pension is the right cell for you.

You to fill your income from salary here.

Note, fill gross taxable salary as per Form 16. Many make mistake of filling net taxable salary which is after deducting 80C investments.

You have to fill salary before claiming Chapter VI deductions.

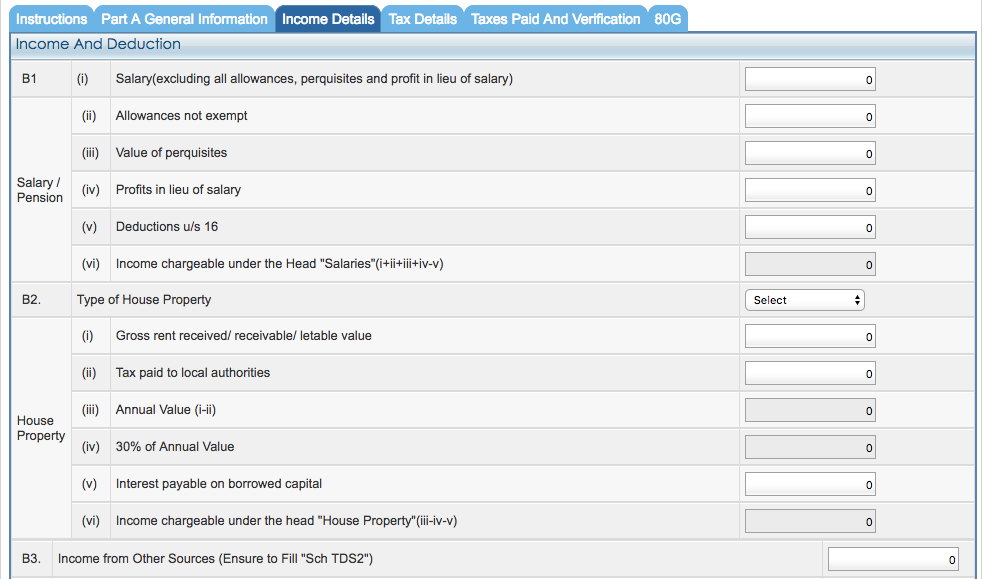

Update: The form for AY 2018-19 has changed for reporting incomes. Now salary components are to be reported and even House details are to be provided.

Changed input form is as below.

80C and other deductions can be filled in cells provided in Part C.

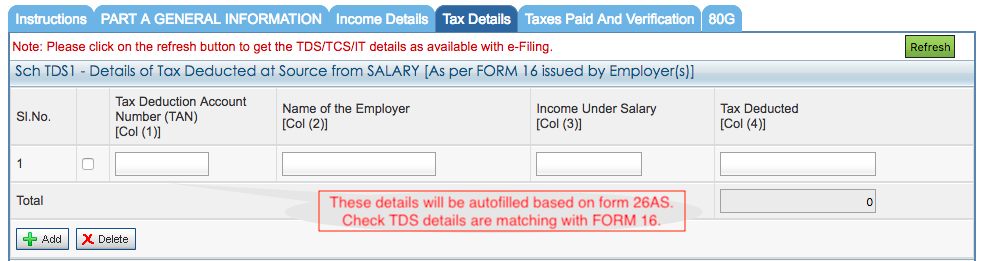

Next thing you have to do is to fill tax details. Click on Tax Details tab.

Here details will be autofilled, but make sure that TDS amount is matching with Form 16 given by your employer.

Companies deduct taxes from salary and pay it to government and file their TDS returns. Based on TDS return, tax credit is given to deductee.

If your TDS details were filed wrong you will not get the credit here. You need to talk with your company to correct the TDS details.

In case these are not autofilled, that means your company made mistake in filing TDS return. If you fill details manually and proceed then return will be processed with demand information.

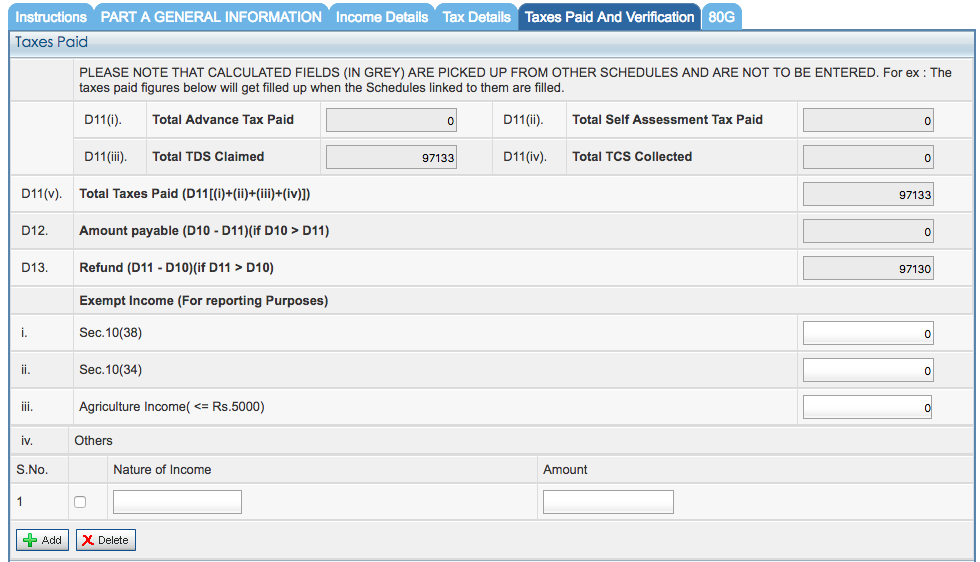

After this tab next you have to click on Taxes Paid and Verification Tab.

Here you will find summary of your tax liability and taxes you have paid.

Make sure that amount payable is 0. Otherwise return will not be filed.

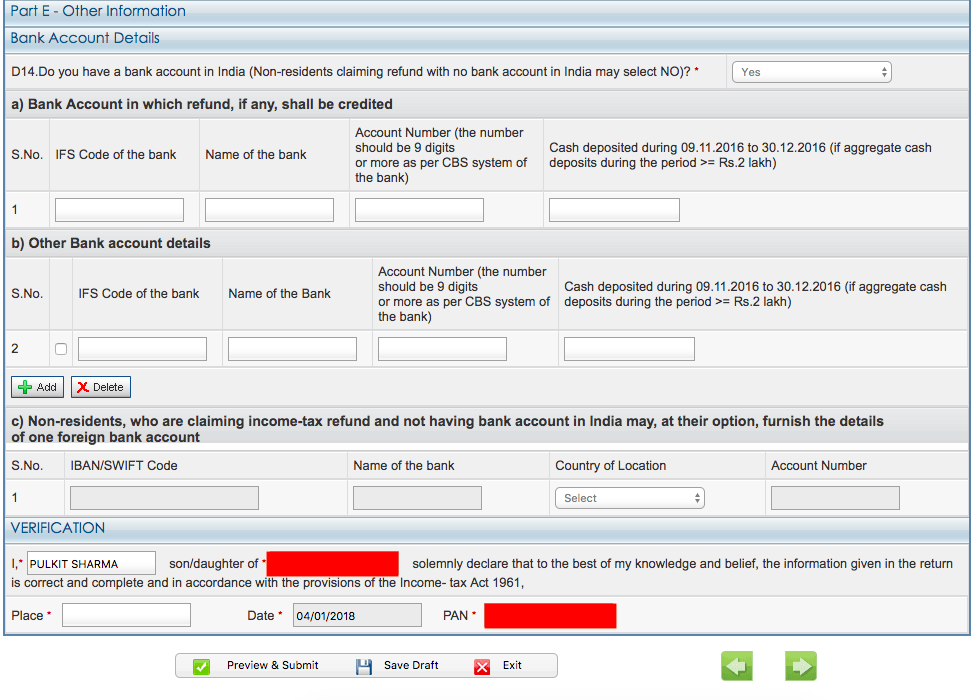

Next you have to provide your bank details in same tab.

Here you have to provide details of all your bank account.

In verification part fill the name of your Father and Place.

Once the form is filled completely, you can proceed with Preview & Submit button.

Once clicked on preview and submit button, complete form with filled details will be made available. If everything is perfect you can submit your return.

Step 4. Verifying you return

Once you have submitted or filed your return you have to verify your return within 120 days otherwise return will not be processed.

You can verify you return with following options:

- Sign with EVC (bank based OTP)

- Sign with Aadhaar based OTP

- Sign and send the hard copy of acknowledgement to CPC Bangalore (address will be given in acknowledgement footer)

The best method is to sign with Aadhaar OTP.

Once you verify your OTP. The process is complete.

If you have any further doubt, please login and ask a question, I will be happy to help you.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Extension of time limits of certain Compliances to provide relief to tax payers in view of pandemic

- Dividend Income U/s 8 of Income Tax Act 1961 new provision

- Whether 'tips' received fall within the meaning of "Salaries" to attract TDS under section 192

- Mandatory requirement of furnishing PAN in all TDS statements, bills, vouchers and correspondence between deductor and deductee [Section 206AA] | AY 2019-20 onwards

- Furnishing of statements in respect of payment of interest to residents without deduction of tax [Section 206A] | AY 2019-20 onwards

- Person responsible for paying taxes deducted at source [Section 204] | AY 2019-20 onwards

- Common number for TDS and TCS [Section 203A] | AY 2019-20 onwards

- What if TDS is not deducted or paid [Section 201] | AY 2019-20 onwards

- Duties of Person deducting income tax [Section 200] | AY 2019-20 onwards

- Credit for tax deducted at source [Section 199] | AY 2019-20 onwards

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

1 Comment

This is so far the best tutorial to teach filing of IT return by employees using form 16.