Compliance checklist for startups

Last udpated: Feb. 3, 2018, 10:37 a.m.If you are founder of a startup company and worried about different laws you have to comply with, this article is worth bookmarking.

Running a startup is energy consuming work and it makes sense to not waste money on government penalties. Even if you are running a one man show, it cannot be an excuse of non compliance.

As a founder you have to take care of various applicable laws and comply with rules.

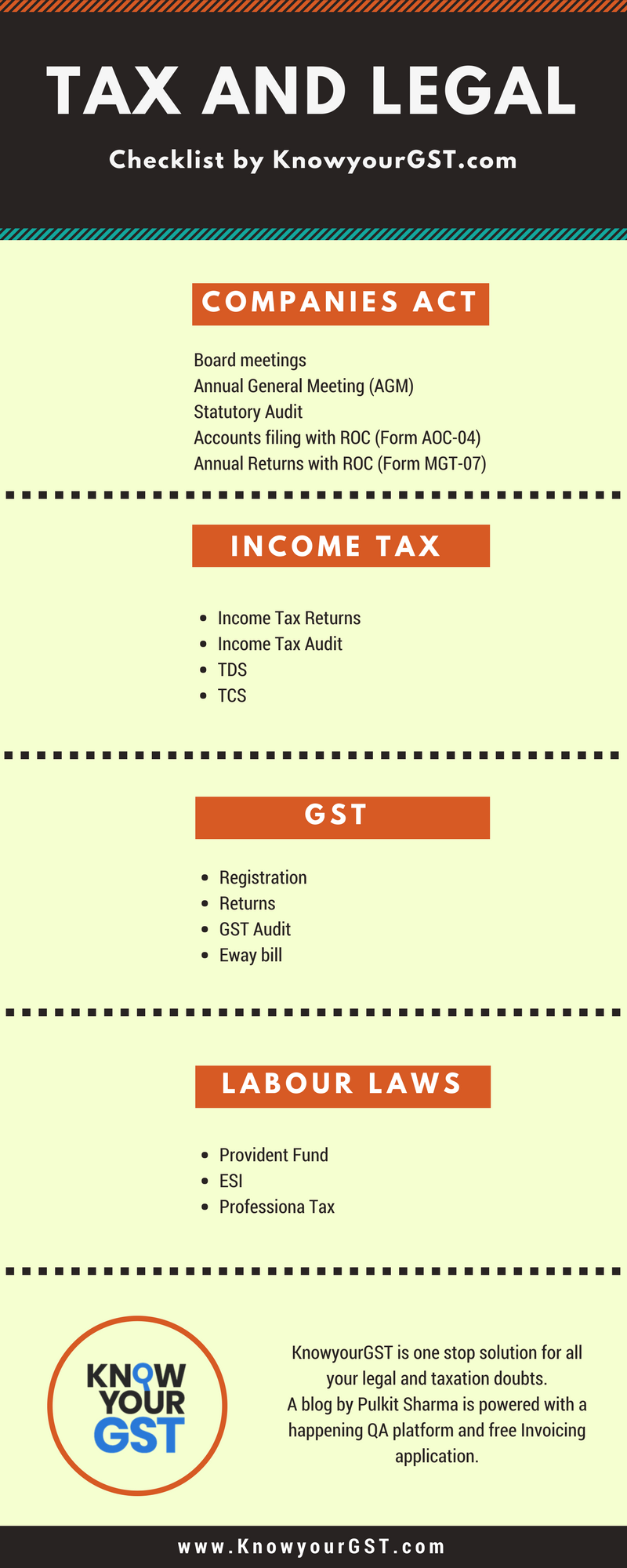

Different laws that you have to comply with are:

- Companies Act

- Income Tax Act

- Goods and Services Act (GST)

- Labour and mercantile laws

If your startup is registered as a company then you have to comply with rules and provisions contained in Companies Act, 2013.

Startups checklist to comply with Companies Act

As a company you need to follow certain rules specified in Companies Act, 2013. You have to conduct Board Meeting, Annual General meetings, get your books audited and file annual returns with ROC.

In a nutshell you need to do following things. Note that these are major tasks that you should not miss.

- Board meetings

- Annual General Meeting (AGM)

- Statutory Audit

- Accounts filing with ROC (Form AOC-04)

- Annual Returns with ROC (Form MGT-07)

These are the major compliances you should follow. Other than tasks listed above, there are many other forms that you have to file. For example, whenever you take a loan from bank, a charge is created, you need to file form CHG-01 with ROC to register your charge.

Remember there is late filing fee and penalty for non filing of statutory forms with ROC.

Audit by a chartered accountant is compulsory for every company regardless of turnover you make in a year. You have to compulsory get your accounts audited by a chartered accountant every year, whether you have done any transaction during the year or not.

Similarly you have to file Annual Returns and Accounts with ROC every year, regardless of transactions.

Startup Checklist to comply with Income Tax Act

Whether you are a startup or not, filing your income tax returns makes sense.

If your startup business is incorporated as a Company or Limited Liability Partnership (LLP), filing income tax returns is compulsory.

You have to also get your books audited by a Chartered Accountant (CA), if your turnover cross 2 crores in a year.

Audit under section 44AB is compulsory if your turnover is more than 2 crores in a year. This requirement is applicable to every entity whether you are running your business as a company, LLP, partnership or in individual form.

Similarly filing income tax return is also compulsory if your taxable income is more than basic exemption limit. In case of Company and LLP, filing income tax return is compulsory. From assessment year 2018-19 (FY 2017-18), government will charge fee for late income tax returns filed.

It is advised to file income tax returns on time to avoid any late filing fee.

Startup Checklist to comply with GST

You are lucky that now all other indirect taxes are done away and we have a simple and single indirect tax regime.

Goods and Services Tax or GST is supposed to be a simple tax and if you are from IT background, you will find it easy compared to earlier taxes we had.

You need to register under GST if your turnover cross Rs. 20 lakhs in a year. If you from special states, then you should register once your turnover cross Rs. 10 lakhs.

For online sellers, registration is compulsory. Though law after amendments brought online sellers under normal tax payers net, and they can avail 20 lakh limit benefit, but portal like Amazon do not entertain unregistered sellers.

You have to file your monthly/quarterly GST returns.

You have to file an annual return and if your turnover cross Rs. 2 crores then you have to get your books audited by a Chartered Accountant or Cost Accountant.

To summarise you have to take care of following things under GST.

- Registration on crossing exempted turnover of Rs. 20/10 lakhs

- Returns - Monthly if turnover is more than Rs. 1.5 crore, otherwise quarterly

- Annual return

- GST Audit if turnover is more than Rs. 2 crores

- Eway bill for transportation (compulsory for transportation of goods with invoice value more than Rs. 50,000)

These are main compliance that you have to follow under GST.

Startup checklist to comply with labour laws

I will cover 3 main laws, that are applicable based on number of employees you have.

Provident Fund and ESI: PF is applicable once you have more than 20 employees in your company. You have to register under PF and file returns.

Every month you have to deduct employee share from salary and pay to government along with employers share. A return has to be filed. Do not neglect PF, as it will give a long term satisfaction to your employees.

ESI works on similar manner, except that it is majorly for labours.

Both PF and ESI are for the welfare of employees. These are part of social security scheme.

Employees will get tax benefits also by investing in PF.

Some states even have Profession Tax. For, example in Karnataka if you are paying salary in excess of Rs. 15,000 then you have to deduct Rs. 200 every month and remit to government.

Conclusion and Summary

Negligence is not an excuse under any law.

You must comply with laws to avoid any penalty or offence under applicable laws.

Companies Act, Income Tax Act and GST are for your business, labour laws are for welfare of your employees.

Getting your employees covered under PF and ESI will boost their confidence.

They will feel more secured and satisfaction that some part of their salary is contributed as part of their retirement fund.

Always allocate 1% of your revenue for legal and taxation matters. Most of funding pitches that I have seen, on an average 2% of funds is allocated for legal compliances.

Hope you liked this overview of applicable laws. If you have any doubts, you can ask them on QA platform.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- SECTION 8 COMPANY

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.