Sir,

we have issued bill in the month of April 2018 on GST number on PVT ltd company but while filling GSTR 1 we have, due to same name i.e. one is proprietor and other is pvt ltd company we have taken GST number of proprietary concern which is wrong, We have already filed our quarterly GSTR 1 for July - Sept 2018.

Please suggest how to rectify this mistake?

Dear Bankim Desai,

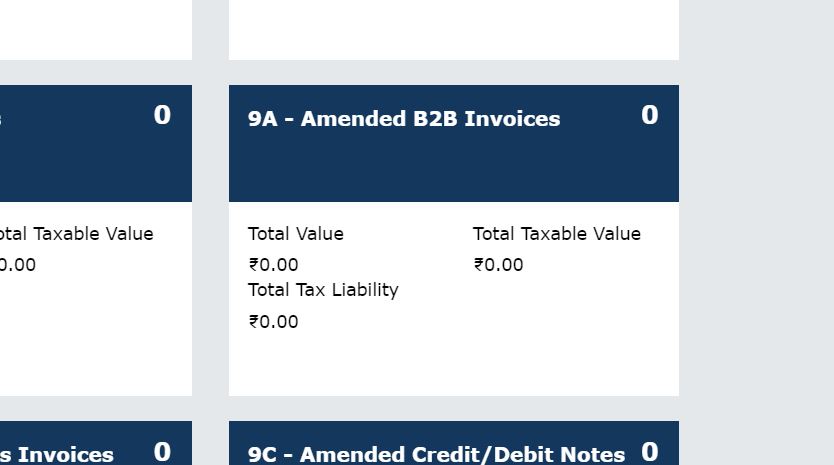

You can amend the details of B2B transaction in "table 9A - Amended B2B" in your next GSTR-1 (Oct'18 to Dec'18) return to be filed. You can ask your customer to avail the credit rightly in Private Limited company only and tell him that the issue will be resolved once next quarter GSTR-1 is filed.

JOIN LARGEST DISCUSSION PLATFORM

Sign up to discuss taxation, accounting and finance topics with experts from all over India.

Join Discussion