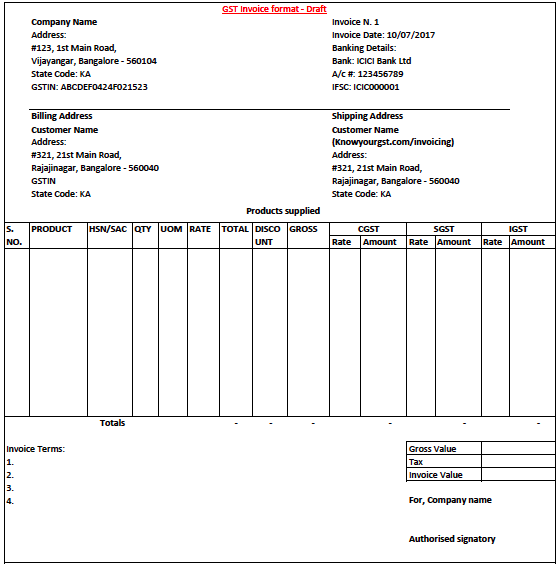

GST Invoice format in Excel and PDF

Last udpated: Nov. 4, 2017, 9:12 p.m.The government notified rules for a tax invoice. A tax invoice issued by a registered person should contain details as required.

I have drafted an invoice in MS Excel and PDF format, which you can use for reference purpose. Alternatively, you can use online invoicing software for GST.

Download GST tax invoice format in excel or PDF

I have prepared a draft invoice in excel format. You can download this excel file and change the format or designing as per your requirements.

Download GST Tax Invoice format in excel

Download GST Tax invoice format in PDF

Free GST Billing software

Here is a video about KYG-Invoicing to explain you instead of Excel format you can use a free to use billing software created by me. It is being used by more than 6,000 users and they are happy.

It is free for life time.

Analysis of Invoice rules issued by government

Details of seller/supplier

- Name,

- Address and

- GSTIN

Invoice details

- Invoice number should be continuous containing alphabets or numerals or special characters, invoice number should be unique for a financial year

- Date of invoice

Details of buyer/recipient if registered under GST

- Name

- Address

- GSTIN or UIN

- Place of supply along with state code if interstate sale

Details of buyer/recipient if not registered under GST and value of taxable supply is 50,000 or more

- Name

- Address of the recipient and the address of delivery

- Name of State and its code

Details of products to be provided in invoice

- Product description

- HSN code of goods or Accounting Code of services

- Quantity and unit of measurement

- Total value

- Taxable value

- Rate of tax for CGST, SGST, or IGST

- Amount of tax for CGST, SGST, or IGST

Invoice should be signed either digitally by a DSC (Digital signature certificate) or hand signature by the supplier or his authorised representative.

These are the basic details that an invoice should contain, export invoice, reverse charging invoices should contain the fact on invoice.

How many copies of the invoice should be prepared?

If invoice is for supply of goods, then 3 copies should be printed.

- Original copy for Recipient/buyer

- Duplicate copy for Transporter and

- Triplicate copy for Supplier/seller

In case of service 2 copies should be prepared,

- Original copy for recipient

- Duplicate copy for supplier

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

16 Comments

I have not uploaded the MS word format. You can copy the excel format and paste in word to use it in MS Word. Similarly there are many online website which can convert PDF into word.

Update: KYG invoice application is live. I suggest using this application for generating GST invoices.

Sir what are the terms in case of selling goods to unregistered person under gst and the value of goods is less than 50000.what are the details necessary to be shown in invoice?

Tax invoice formats provided in Excel are not scaled for printing. You have to adjust the margins before printing. It is only for sample purpose for those who need a format to give to their printers.

Alternatively I highly recommend using invoicing application which I have created.

Sir is there any charges to use your invoicing application?

No. It is free for small businesses.

For invoice preparing which one necessity white sheet or printed stationery?

@ Ganesh

You can any. There is no rule on this.

You can have printed stationary but tax invoice should contain details as required under the law.

PLEASE PROVIDE GST BILL OF SUPPLY format in Excel and PDF ALSO

Thankyour for this very helpful information on gst invoice format.

Dear sir, wonderful information about GST Bill format for goods,But, Please send me an excel bill format for Service bill under GST. and also clarify whether there is any strict rule for billing format under GST. Rgds Arun

There is no strict rule on format of invoice. You can design your bill in any format but should contain required details mentioned in article.

Dear Sir,

We are service provider, interior designer, based bangalore, karnataka state.

if we do design service for Tamil Nadu state and billing to Karnataka state, what will be the place supply and tax components.

http://www.lisenme.com/gst-tax-invoice-template-excel-numbers-mac-auto-increment-id-add-client-address-list/

Can I use this as pharmaceutical wholesaler

Yes you can use it. Why don't you try online invoicing software of knowyourgst?