How to apply Letter of Undertaking (LUT)?

Last udpated: April 15, 2018, 10:57 a.m.You can export goods or service or both without paying IGST. To export goods without paying GST, you have to furnish Letter of Undertaking with GST department.

Earlier you had to file LUT offline in form RFD-11, however now the process to furnish LUT is being made online. Now you can apply for LUT online.

Even if you have furnished LUT offline for any financial year you can still apply online and you need to attach the offline LUT while applying online.

What is Letter of Undertaking (LUT)?

Letter of Undertaking or LUT is a form that you file with GST department promising

(a) to export the goods or services supplied without payment of integrated tax within time specified in sub-rule (1) of rule 96A;

(b) to observe all the provisions of the Goods and Services Tax Act and rules made thereunder, in respect of export of goods or services;

(c) pay the integrated tax, thereon in the event of failure to export the goods or services, along with an amount equal to eighteen percent interest per annum on the amount of tax not paid, from the date of invoice till the date of payment

LUT is to be filed by exporters to make export supplies without payment of IGST. This is required to be filed even to claim refunds of input tax credit.

How to apply Letter of Undertaking (LUT) online?

To apply for LUT online you need to login to your GST website.

In simple steps you can furnish LUT. To apply LUT, you need to:

- Login to GST website

- Click on User Service

- Click on Furnish Letter of Undertaking (LUT)

- Fill the form

- Submit with EVC or DSC

If you have already applied for LUT in offline mode, then you need to attach that form.

Below is the procedure to apply for LUT with pictures.

You first need to login to your GST account.

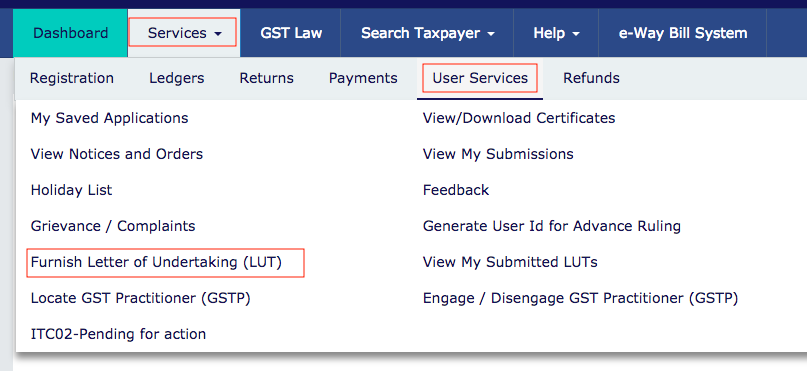

Then click on Services link.

Under Services you will see many options. Click on Furnish Letter of Undertaking (LUT).

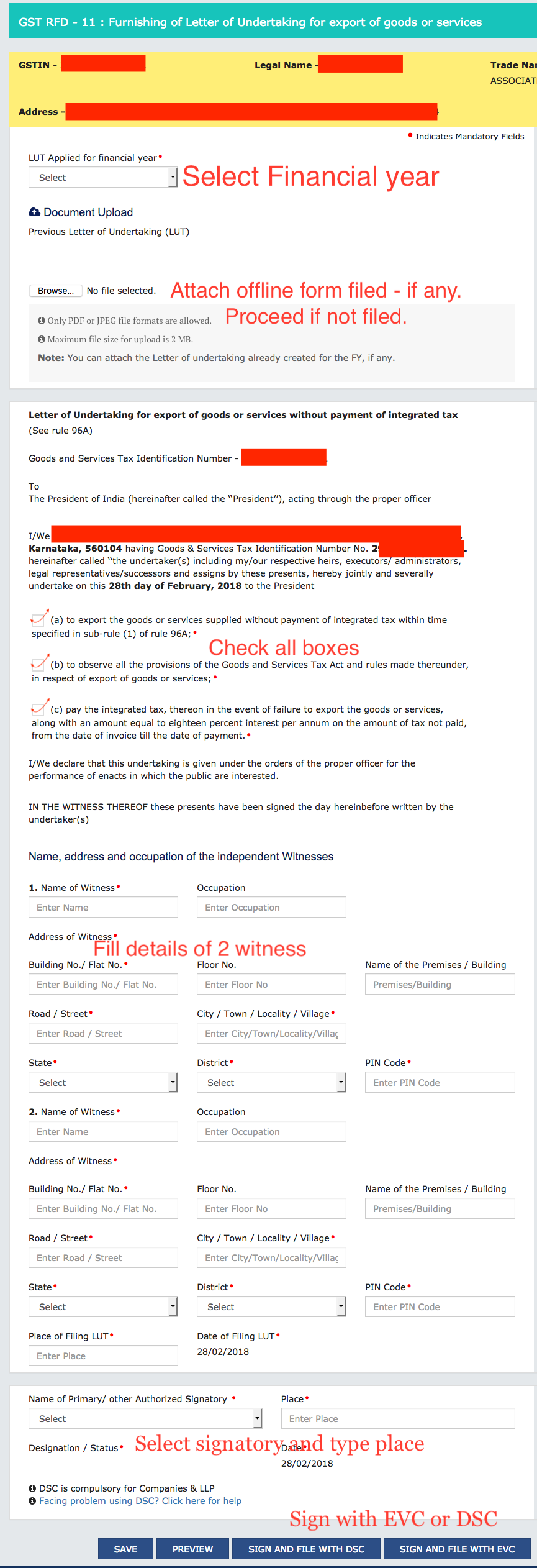

Below application will open, which you need to fill.

Steps to fill LUT form RFD-11 online on GST website

After opening application online, you need to first select the financial year for which you are filing LUT.

You can file LUT for a single financial year at a time.

After selecting financial year, next option is to attach offline application if you made earlier. If you have not applied offline then you need not to submit any document here.

Third step is to agree with all points give in application.

Fourth step is to fill the details of witnesses.

Sixth step is to select authorised signatory and place of filling application.

Last step is to submit your application. You can submit your application with EVC or DSC. Digital Signature Certificate is mandatory for companies and LLP.

If you face any issue at any time, you can ask a question on this website, will be happy to help you.

Format of Letter of Undertaking (LUT)

Letter of Undertaking for export of goods or services without payment of integrated tax (See rule 96A)

Goods and Services Tax Identification Number – GSTIN

To

The President of India (hereinafter called the ‘‘President’’), acting through the proper officer

I/We (Person name) of (address) having Goods & Services Tax Identification Number No. [GSTIN] hereinafter called ‘‘the undertaker(s) including my/our respective heirs, executors/ administrators, legal representatives/successors and assigns by these presents, hereby jointly and severally undertake on this 28th day of February, 2018 to the President

(a) to export the goods or services supplied without payment of integrated tax within time specified in sub-rule (1) of rule 96A;

(b) to observe all the provisions of the Goods and Services Tax Act and rules made thereunder, in respect of export of goods or services;

(c) pay the integrated tax, thereon in the event of failure to export the goods or services, along with an amount equal to eighteen percent interest per annum on the amount of tax not paid, from the date of invoice till the date of payment.

I/We declare that this undertaking is given under the orders of the proper officer for the performance of enacts in which the public are interested.

IN THE WITNESS THEREOF these presents have been signed the day hereinbefore written by the undertaker(s)

Name, address and occupation of the independent Witnesses

1. Name of Witness

Occupation

Address of Witness

Building No./ Flat No.

Floor No.

Name of the Premises / Building

Road / Street

City / Town / Locality / Village

State

District

PIN Code

2. Name of Witness

Occupation

Address of Witness

Building No./ Flat No.

Floor No.

Name of the Premises / Building

Road / Street

City / Town / Locality / Village

State

District

PIN Code

Place of Filing LUT

Date of Filing LUT

28/02/2018

- If you're filing LUT, please read and select all the three checkboxes for accepting the conditions prescribed in Letter of Undertaking

- Enter the details of two independent witnesses

Name of Primary/ other Authorized Signatory

Place

Designation / Status

Date

28/02/2018

The above format is taken as it is from GST website.

Approval for LUT or LUT number

Whether an officer will approve LUT submitted?

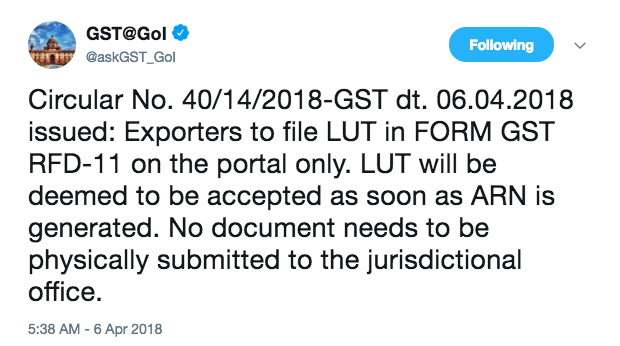

Well, I had a call with GST enquiry office and was confirmed that submission of LUT is on auto approval basis. After you have applied/furnished LUT, you can start issuing invoices without charging IGST.

There will be no approval from any jurisdictional officer. Here is Twitter confirmation by GST handle.

If you have any doubt or question, do not forget to ask them on the site. Our experts will be happy to solve your issues.

KnowyourGST is a free portal that provides you latest updates and knowledge on Indian taxes.

We have free billing software, you can use it to generate GST invoices and accounting.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

7 Comments

Sir, we have applied for LUT online in GST RFD-11 form & received acknowledgement from GST site, what next we have to do for export our consignment in GST regime, should we applied manually also or online is enough, when & how we received LUT from department.

Check status of submitted LUT. If it is approved you can export goods or services without payment of IGST.

No further visit to department for offline application required.

How do i check the status of the online LUT application?

Could someone update on how to check the status post the online submission of LUT application on the portal?

Update: Once you have filed your LUT, there will be no approval from department. It is only a declaration that you filed. You can issue invoices without IGST after filing LUT.

I applied for LUT on Portal on 15th June and I am still seeing the status, Submitted, Is there any way to get approval?

And if we get approval then will it be validated from date OR submission OR date of approval?

How do I check the status of the online LUT application