API for getting GSTIN Details, Validate GST number

Last udpated: June 20, 2018, 4:41 p.m.Documentation are updated with following changes:

>>API_KEY will be no longer a query-string, to be included in HEADERS.

Read documentation, as you will need to add header along with GSTIN in param.

KnowyourGST has launched Application Programming Interface (API) to validate GST numbers.

You can integrate our API with your existing application to access details of any GST number.

API is designed with KEEP IT SIMPLE logic.

How to register and access GSTIN data through API?

To access GSTIN data through KnowyourGST, you need to be a registered user.

You first need to register on website. You can register with your E-mail ID or login directly using your social media accounts (Google, Facebook and Twitter).

After registering on Site, you need to visit your Developer Home Page.

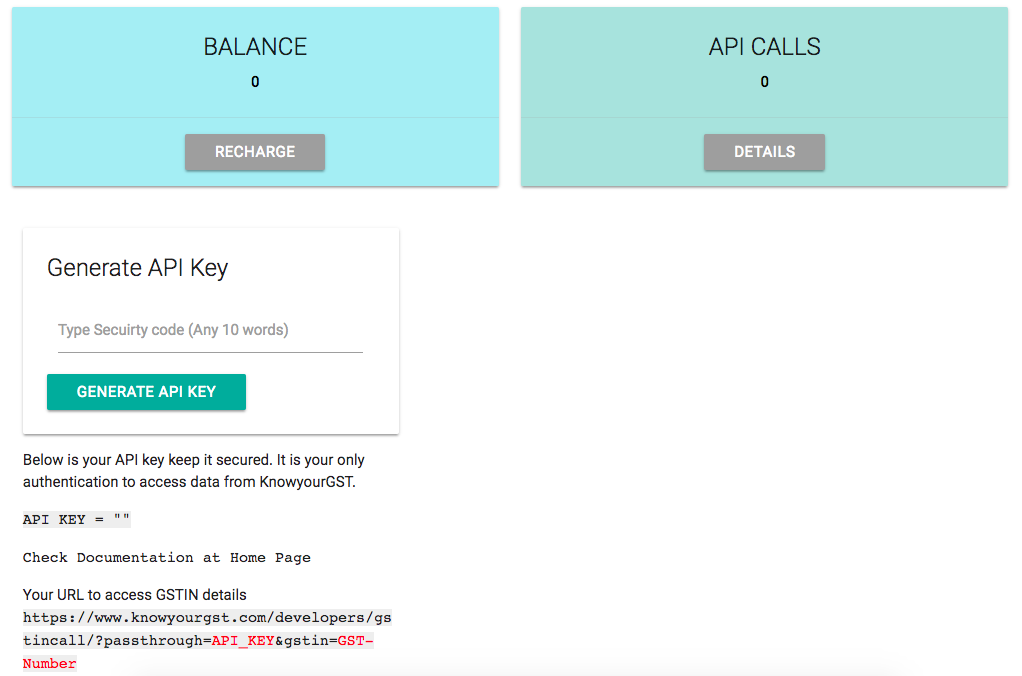

Your home page will look like as shown in below image:

Here you can generate your API_KEY.

Any request you send to KnowyourGST will be validated using your API_KEY.

To generate API_KEY you need to provide any 10 digit security code. Click on GENERATE API KEY.

Your API_KEY will be generated.

Once, API_KEY is generated, you are ready to access GSTIN data.

Getting GSTIN details through API using API_KEY

In above steps, you have generated your API_KEY.

Your API_KEY will be authenticated before you can access GSTIN details. Keep your API_KEY secured.

You can access details of any GST number using your API_KEY and GST Number.

URL with parameters to access details is:

https://www.knowyourgst.com/developers/gstincall/?passthrough=API_KEY&gstin=GST-Number

You need to pass 2 parameters to access GSTIN details:

- API_KEY

- GST Number

You will get JSON response. JSON response will be:

{

"stjCd": "AP003",

"lgnm": "MS CORPORATION",

"stj": "BCP KODIKONDA",

"dty": "Regular",

"cxdt": "",

"gstin": "05ABNTY3290P8ZA",

"nba": [

"Bonded Warehouse",

"EOU / STP / EHTP",

"Factory / Manufacturing",

"Input Service Distributor (ISD)",

"Leasing Business"

],

"lstupdt": "05/01/2017",

"rgdt": "05/05/2017",

"ctb": "Foreign LLP",

"sts": "Provisional",

"ctjCd": "AP004",

"ctj": "BCP THUMMAKUNTA",

"tradeNam": "ALTON PLASTIC PRIVATE LTD",

"adadr": [

{

"addr": {

"bnm": "ELPHINSTONE BUILDING",

"st": "10, VEER NARIMAN ROAD",

"loc": "FORT",

"bno": "10",

"stcd": "Rajasthan",

"flno": "1ST FLOOR",

"lt": "74.2179",

"lg": "27.0238",

"pncd": "400001"

},

"ntr": [

"Wholesale Business"

]

}

],

"pradr": {

"addr": {

"bnm": "KATGARA HOUSE",

"st": "15, L JAGMOHANDAS MARG",

"loc": "MALABAR HILL",

"bno": "5",

"stcd": "Maharashtra",

"flno": "4TH FLOOR",

"lt": "74.2179",

"lg": "27.0238",

"pncd": "400006"

},

"ntr": [

"Wholesale Business"

]

}

}

You can loop through this data to access details.

In case of any doubts, you can post a question at QA section of site.

Do not disclose your API_KEY, even if asked by KnowyourGST staff.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.