Bill of supply and invoice for GST composition levy scheme

Last udpated: Nov. 4, 2017, 9:12 p.m.Those who have opted for composition scheme needs to provide a bill of supply instead of a tax invoice. Section 31 of CGST Act, contains the provision for issuing invoice for supply of goods or supply of services.

If you are paying tax under composition scheme, you are not required to issue a tax invoice but a BILL OF SUPPLY. A taxable person to whom the provisions of sub-section (1) apply shall not collect any tax from the recipient on supplies made by him nor shall he be entitled to any credit of input tax.

For example, if you have supplied/sold certain goods for Rs. 10,000 to your customer. You need to make a bill of supply for Rs. 10,000 without charging any tax. You need to calculate tax on bill and pay to government.

Eligibility to pay tax under composition levy scheme

First, it is not a scheme but provisions contained in section 10 of CGST Act. Following persons can opt for composition levy:

- Aggregate turnover in the preceding financial year did not exceed fifty lakh rupees

- Should not be engaged in the supply of services other than supplies referred to in clause (b) of paragraph 6 of Schedule II

- Should not engaged in making any supply of goods which are not leviable to tax under this Act

- Should not be dealing into inter-state outward supplies of goods

- Should not be selling goods online on E-commerce portals

- Should not be a manufacturer of such goods as may be notified by the Government on the recommendations of the Council.

Further if you have different business location registered with same PAN, for all your registered places you should opt composition levy.

For example, if you have business in 3 different places you can not pay under composition levy for 2 places and under normal provision for one place. For all 3 places you should either opt for composition levy or normal levy.

Bill of supply for composition levy

If you are paying under composition scheme, you should provide a bill of supply instead of a tax invoice. A bill of supply should contain the following details:

Details of supplier/seller

- Name

- Address

- GSTIN

Bill of supply should contain following details of goods supplies

- HSN Code

- Description of product

- Value of supply of goods

Bill of supply should also contain details of buyer if buyer is a registered person under GST. Details of buyer such as Name, address and GSTIN or UIN should be shown in invoice.

Bill of supply number should be consecutive serial number, in one or multiple series, containing alphabets or numerals or special characters -hyphen or dash and slash symbolised as “-” and “/”respectively, and any combination thereof, unique for a financial year.

Bill of supply should also contain date of issue. Bill of supply should be signed by supplier or his authorized representative. Bill of supply can be signed using a digital signature certificate (DSC).

Invoicing software for generating bill of supply

You need to generate bill of supply for every supply made. You can either use the pre printed invoice book or use an accounting application to generate bill of supply.

At knowyourgst we have developed a simple to use invoicing application to make bill of supply.

You can use this application to generate bill of supply online, you do not have to install any software in you computer.

You can use this invoicing application from anyplace and anytime.

Below is the procedure to generate a bill of supply using this invoicing application.

To generate a bill first you should login to knowyourgst.com.

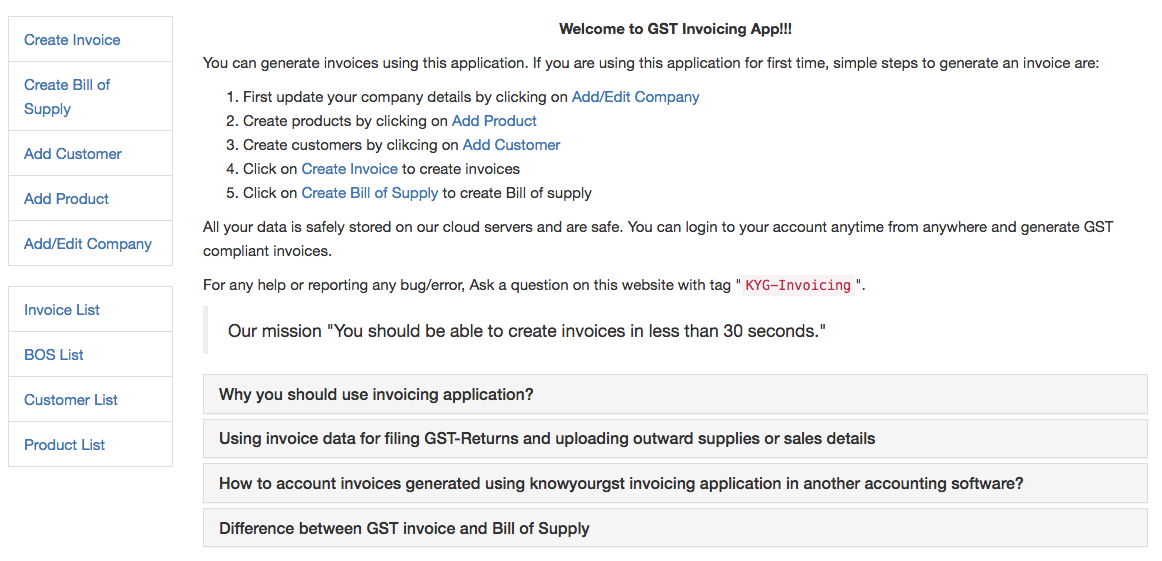

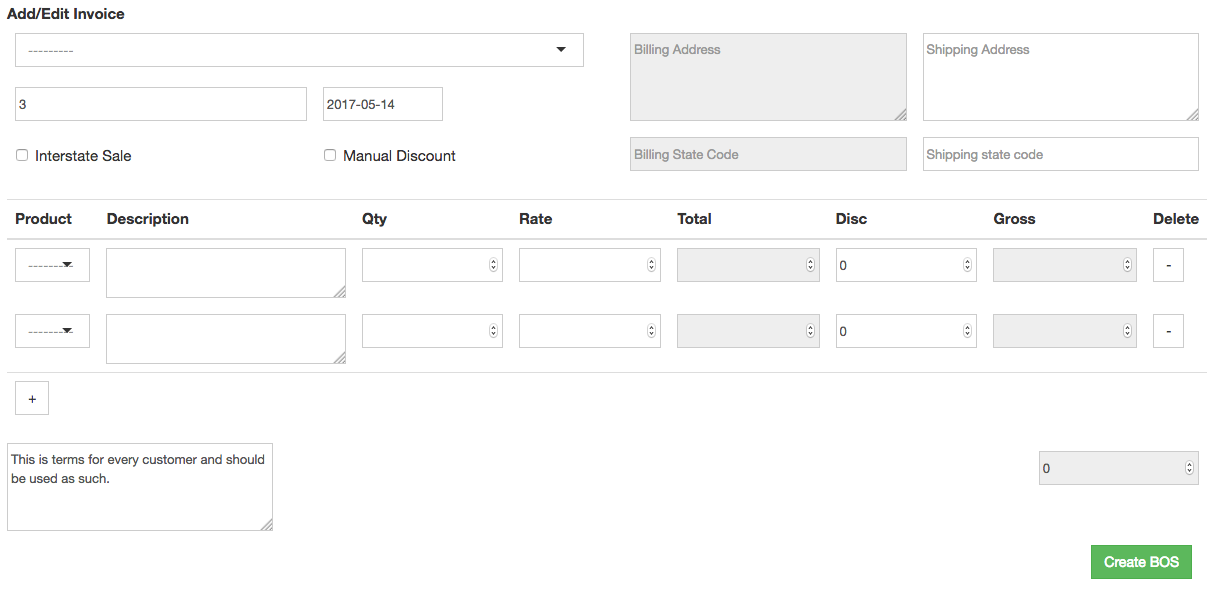

After login you need to go to invoicing application. Below image is of invoicing application homepage.

Once you are on the homepage of invoicing application. You can see various options available.

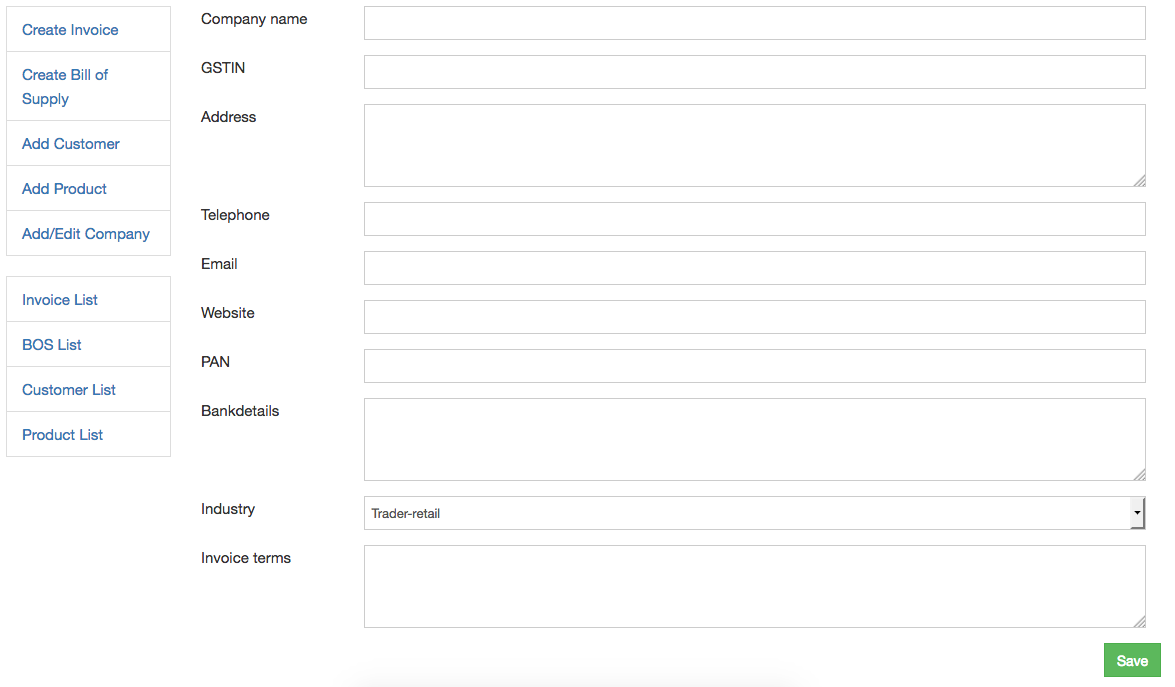

To start using this application first you should update your company details. To update company details you need to click on Add/Edit Company

.

Once you click on the link, a form will open. Fill the form and save it.

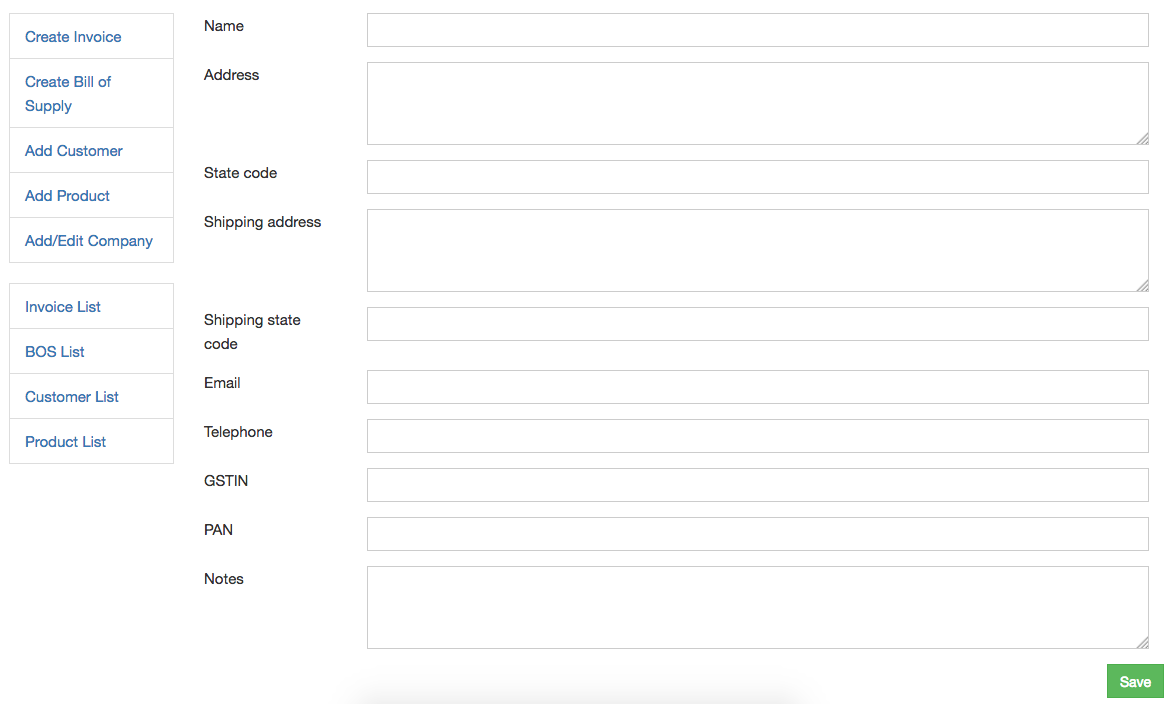

After successfully saving your company details. Next step is to update your customers details. To create a customer, you need to click on Add Customer

link.

On clicking this link a form will open for customer data, fill the form and save it. You can check the list of customer by clicking on Customer List

link.

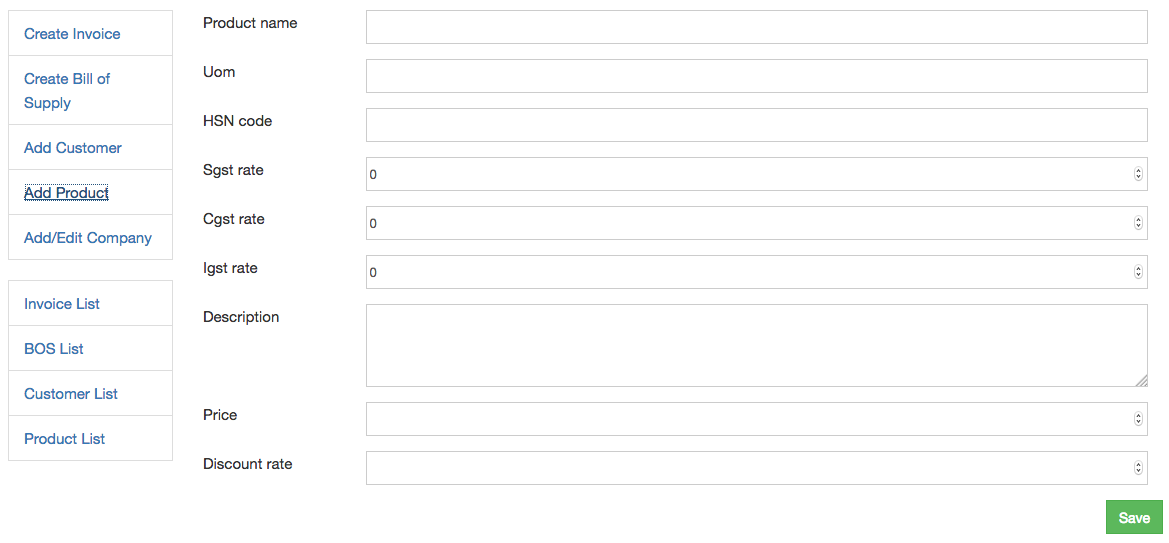

Next step is to add, products. To add products click on Add Product

link. Following form will open, you need to fill it and save.

Once you have updated company details, created customer and added products. You are ready to generate your first bill of supply.

To make a bill of supply, you need to click on Create Bill of Supply

link. When you click on this link a separate page will open.

In this form, first you need to select the customer On selecting customer, billing address and state code will be automatically filled along with shipping address provided at the time of creating customer data.

You can change shipping address if its not same as billing address or one provided at the time of customer creation.

Select product, all details will be automatically field and calculated. It will not take more than 30 seconds to generate a bill of supply. After filling the bill of supply form, you need to save it. You can print or save in PDF format by accessing to BOS List

link.

In invoicing application on the left hand side, different links are provided to view the database of customers, products, bill of supply etc.

If you face any difficulties (I am sure you will not) you can ask a question on this website using tag KYG-Invoicing.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

Thank you for such a site you hosted for us to know all about GST and guides lines, Q & A , Invoicing software for taxpayer.

I am a mere commerce graduate with sound knowledge in computer software on major accounting and inventory management software packages and providing my clients GST related service like Installing Software package for various GSTR / Return filing.

I have tried your Invoicing software and want to use offline for my clients as internet connectivity in our locality is very poor, they could not be able to connected on-line.

Therefore, Sir, I will be very helpful if there is any solution for above issue.

@ A.K. Das

Thank you very much for you appreciation. However as of now the invoicing software is not available for offline usage.

As you know the billing application is for free and a community project.

I am looking for a tech member who can help for offline version. I am good at web development and designed this application.

Soon will come with offline version.