Download Advance Tax Calculator in MS Excel

Last udpated: April 3, 2018, 11:17 a.m.Under Income tax act, advance tax is the mechanism by which Central Government collects taxes payable in the assessment year in previous year itself.

Under Income tax act, advance tax is required to be paid by all the assessees, if there is a tax liability in their hands, except -

-

Advance tax is not required to be paid if total income tax estimated for the year is less than Rs 10,000/-

-

Senior Citizens are required to pay advance tax only if their total income includes income under the head ‘Profit and Gain from Business or Profession’

So, senior citizens are not required to pay advance tax even though their tax liability is Rs 10,000 or more.

They are required to pay advance tax only if they are having income from business or profession, and tax liability is Rs 10,000/- or more.

Advance tax by the Corporate and non-corporate assessee is payable in four instalments, except assessee opting for section 44AD or 44ADA.

Advance tax computation -

|

Estimated Gross total income for the relevant previous year |

XXXX |

|

Less: Estimated deductions under chapter VI-A |

XXX |

|

Total income |

XXXX |

|

Tax as per rate in force in relevant assessment year |

XXX |

|

Less: TDS and TCS, only if actually deducted or collected |

XX |

|

Estimated Net Tax Payable for the whole year |

XXX |

Note: Under Income tax act, for computing advance tax, TDS and TCS can be deducted only if they are actually deducted or collected. They cannot be deducted on an estimated basis.

Net tax payable for the whole year is not to be paid at one shot, it must be paid in four instalments.

Instalments for payment of Advance Tax -

For corporate and non-corporate assessee, except those opting for section 44AD and 44ADA -

|

On or before 15th June |

15% of the Estimated Net tax payable for the whole year |

|

On or before 15th September |

45% of the Estimated Net tax payable for the whole year, less tax already paid in the previous installment |

|

On or before 15th December |

75% of the estimated net tax payable for the whole year, less taxes already paid in prior installments. |

|

On or before 15th March |

100% of the estimated tax less taxes paid in prior installments. |

Estimated Net Tax Payable must be reassessed in every quarter, and TDS and TCS should be deducted if they are actually deducted or collected.

Tax paid after 15th March but before 31st March is also treated as advance tax under Income Tax Act.

If advance tax is not paid as per provisions, then interest will have to be paid under section 234B and 234C. So, it very pertinent to pay advance tax on time.

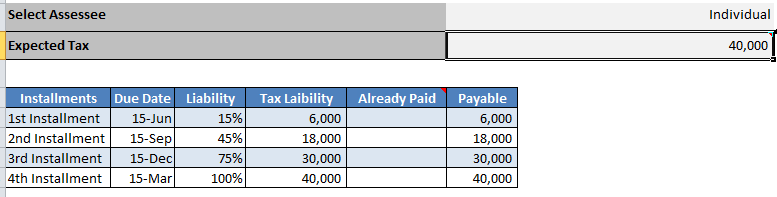

Download Advance tax calculator for Individuals/HUF FY 2018-19 (AY 2019-20)

Unlike prior years, individual too are now required to pay advance tax in four installments, except assessee opting for section 44AD and 44ADA. Assessee opting for 44AD and 44ADA are required to pay only last installment.

Download Advance tax calculator for FIRMS FY 2018-19 (AY 2019-20)

Unlike prior years, Firms too are now required to pay advance tax in four installments, except assessee opting for section 44AD and 44ADA. Assessee opting for 44AD and 44ADA are required to pay only last installment. Firm include LLP, and LLP cannot opt for section 44AD and 44ADA.

Download Advance tax calculator for Company FY 2018-19 (AY 2019-20)

For Companies there is no change in advance tax liability, Companies have to pay advance tax in four installments.

Download Advance Tax calculator in excel

How to use income tax advance tax calculator?

Download the above attached, advance tax calculator excel file.

After downloading, open the advance tax calculator file in excel.

You need to fill the tax liability in Expected Tax cell. You can calculate your tax liability using tax calculator for individuals.

Once you have filled expected tax liability, advance tax calculator will show you advance tax liability for each quarter.

You can fill details of already paid taxes in Already Paid column.

Calculator will calculate and show exact advance tax liability for each due date.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Extension of time limits of certain Compliances to provide relief to tax payers in view of pandemic

- Dividend Income U/s 8 of Income Tax Act 1961 new provision

- Whether 'tips' received fall within the meaning of "Salaries" to attract TDS under section 192

- Mandatory requirement of furnishing PAN in all TDS statements, bills, vouchers and correspondence between deductor and deductee [Section 206AA] | AY 2019-20 onwards

- Furnishing of statements in respect of payment of interest to residents without deduction of tax [Section 206A] | AY 2019-20 onwards

- Person responsible for paying taxes deducted at source [Section 204] | AY 2019-20 onwards

- Common number for TDS and TCS [Section 203A] | AY 2019-20 onwards

- What if TDS is not deducted or paid [Section 201] | AY 2019-20 onwards

- Duties of Person deducting income tax [Section 200] | AY 2019-20 onwards

- Credit for tax deducted at source [Section 199] | AY 2019-20 onwards

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

1 Comment

A very good advance tax calculator in excel. It can be kept as a permanent document to track advance taxes paid during the year and liability at each due date.

Can you further improve it with extra columns to enter tax paid details such as challan and payment date.

Also you can design it further to calculate interest under section 234A, B and C.

Thank you