Learn and understand E-way Bill rules and applicability under GST

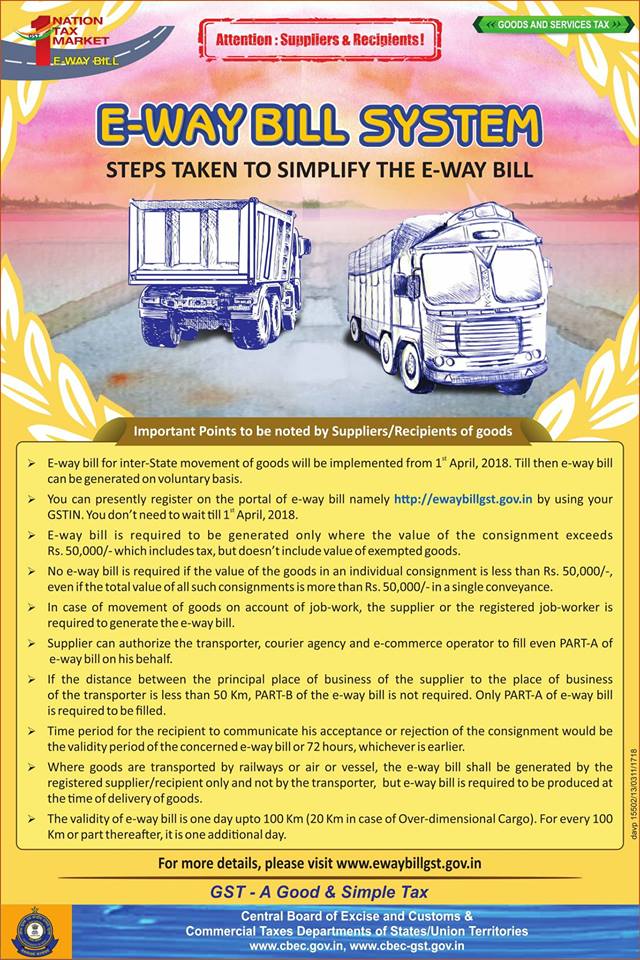

Last udpated: March 29, 2018, 9:50 a.m.Every person who makes an outward supply for goods having value more than 50,000 or makes an inward supply for goods having value more than Rs. 50,000 from an unregistered person has to issue an E-way bill.

Chapter XVI of CGST rules lay down the E-way bill rules.

Who has to issue or generate E-way bill?

Every registered person who causes movement of goods of consignment value exceeding fifty thousand rupees—

- In relation to a supply; or

- For reasons other than supply; or

- Due to inward supply from an unregistered person,

shall, before commencement of such movement, furnish information relating to the said goods in Part A of FORM GST EWB-01, electronically, on the common portal.

As explained in opening paragraph, a REGISTERED PERSON has to issue e-way bill if value of consignment exceeds Rs. 50,000. E-way Bill has to be generated if goods are purchased from an unregistered person and consignment value exceeds Rs. 50,000.

Only a registered person can issue E-way Bill (will read about transporter later in this article).

Further it should be noted that for Interstate supply by a manufacturer to a job-worker E-way Bill is compulsory and limit of 50,000 is not applicable.

If supplier or recipient of goods has not generated E-way Bill then transporter has to generate E-way bill based on the tax invoice or delivery challan if consignment value is more than Rs. 50,000.

E-way Bill can be cancelled?

Yes, if E-way bill is generated but goods are not supplied or there is any mistake in E-way bill data, E-way bill can be cancelled within 24 hours of generation.

You cannot cancel an E-way bill if it was verified during transition.

What is the validity of an E Waybill or for how many days E-way Bill is valid?

Validity of E-way bill is specified based on distance consignment has to be transported.

E-way bill is valid as below:

| Distance | Validity Period |

|---|---|

| Up to 100 KMs (Kilometers) | One day |

| For every 100 Km or part thereof thereafter | One additional day |

If under circumstances of an exceptional nature, the goods cannot be transported within the validity period of the e-way bill, the transporter may generate another e-way bill after updating the details in Part B of FORM GSTEWB-01.

Explanation.—For the purposes of this rule, the “relevant date” shall mean the date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twentyfour hours.

What documents should be carried by transporter or person in charge of conveyance along with E-way bill?

A person who is incharge of conveyance or transporting goods should carry following documents with him:

- The invoice or bill of supply or delivery challan, as the case may be; and

- A copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device embedded on to the conveyance in such manner as may be notified by the Commissioner.

A registered person can instead of carrying the invoice copy generate an invoice reference number.

Invoice reference number can be generated on GST portal by filling invoice details in form GST INV-1.

In fact if Invoice reference number is generated, in E-way bill the details will be auto-populated based on details provided in FORM GST INV-1.

Inspection, verification and detention of vehicle or goods

The commissioner or any officer authorised by him can verify e-way bill for all inter-state and intra-state goods.

Physical verification of goods can be done by commissioner or any officer authorised by him. However, if information is received where any tax is evaded physical inspection can be carried by any officer after obtaining permission from commissioner or from any officer authorised by commissioner.

When inspection is conducted by a commissioner or any other officer, the inspection report should be made available in Part A of FORM GST EWB-03 within twenty four hours of inspection and the final report in Part B of FORM GST EWB-03 shall be recorded within three days of such inspection.

Where the physical verification of goods being transported on any conveyance has been done during transit at one place within theState or in any other State, no further physical verification of the said conveyance shall be carried out again in the State, unless a specific information relating to evasion of tax is made available subsequently.

Where a vehicle has been intercepted and detained for a period exceeding thirty minutes, the transporter may upload the said information in FORM GST EWB-04 on the common portal.

How to generate Eway bill?

I have prepared a tutorial video on this topic.

To generate Eway bill you need to:

- Visit Eway bill portal of your state or common portal

- Login with you id and password

- If not registered then you need to register on portal

- After login you will be able to see the option to issue a new eway bill or cancel or edit.

Summary

- E-way bill is compulsory for goods having value more than Rs. 50,000,

- Compulsory for interstate supplies for job work regardless of value of goods,

- Transporter ID or vehicle number is compulsory,

- Invoice copy or challan copy has to be carried with goods along with E-way bill,

- E-way bill not required if transported within 10 Kms,

- E-way bill can be cancelled within 24 hours,

- Invoice reference number can be generated on portal,

- E-way bill can be inspected by GST officers listed above, goods can be physically verified and vehicle can be detained,

- E-way bill is transparent, rules have specified time limit even for officers to issue reports.

This article is very well applicable to following doubts

- How to generate E-way bill in Andhra Pradesh(Hyderabad)?

- How to generate E-way bill in Arunachal Pradesh(Itanagar)?

- How to generate E-way bill in Assam(Dispur)?

- How to generate E-way bill in Bihar(Patna)?

- How to generate E-way bill in Chhattisgarh(Raipur)?

- How to generate E-way bill in Goa(Panaji)?

- How to generate E-way bill in Gujarat(Gandhinagar)?

- How to generate E-way bill in Haryana(Chandigarh)?

- How to generate E-way bill in Himachal Pradesh(Shimla)?

- How to generate E-way bill in Jammu & Kashmir?

- How to generate E-way bill in (Srinagar-S*, Jammu-W*)?

- How to generate E-way bill in Jharkhand(Ranchi)?

- How to generate E-way bill in Karnataka(Bangalore)?

- How to generate E-way bill in Kerala(Thiruvananthapuram)?

- How to generate E-way bill in Madhya Pradesh(Bhopal)?

- How to generate E-way bill in Maharashtra(Mumbai)?

- How to generate E-way bill in Manipur(Imphal)?

- How to generate E-way bill in Meghalaya(Shillong)?

- How to generate E-way bill in Mizoram(Aizawl)?

- How to generate E-way bill in Nagaland(Kohima)?

- How to generate E-way bill in Odisha(Bhubaneshwar)?

- How to generate E-way bill in Punjab(Chandigarh)?

- How to generate E-way bill in Rajasthan(Jaipur)?

- How to generate E-way bill in Sikkim(Gangtok)?

- How to generate E-way bill in Tamil Nadu(Chennai)?

- How to generate E-way bill in Telangana(Hyderabad)?

- How to generate E-way bill in Tripura(Agartala)?

- How to generate E-way bill in Uttarakhand(Dehradun)?

- How to generate E-way bill in Uttar Pradesh(Lucknow)?

- How to generate E-way bill in West Bengal(Kolkata)?

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

5 Comments

Sir,

1)Is there need of separate E WAY BILL for each party? ( if more than one parties consignments in one vehicle)

Yes separate E-way bill is required.

Transporter can generate e-way bill separately or a consolidated E-way bill.

Individual sellers has to generate separate E-way bills.

E way bill procedure started from when?

E-way Bill will be starting from Feb 2018.

E-way bill will start from April 1, 2018 unless further deferred due to technical issues.