GST Accounting with ledgers and double entry system

Last udpated: Nov. 4, 2017, 9:12 p.m.With Goods and Services Tax law there will be changes in way you account your business transactions and maintain tax records. One benefit every tax payer will have is availability of Electronic tax ledger at GST portal.

Your accounting data should match the details available at GST portal. Accounting GST accurately will not only be need of the business but also to maintain your ranking at GST portal.

Accounting in simple terms is a system of preserving the business information in a quantifiable manner.

Accounting is all about maintaining the transnational details every financial event occurred in organisation.

Impact of poor accounting system

You have to be extremely careful with respect to accounting of GST. GST compliance score is not only reason to have proper and timely updated accounting system but for various reasons which could have impact on bottom line should be considered.

Let's understand how bad or improper accounting can have a significantly negative impact on existence of your business.

Mr. A purchased certain goods of worth Rs. 10,00,000 from an unregistered person. You are suppose to pay tax on reverse charge basis whenever you buy from an unregistered person.

Mr. A created the liability of output tax, however he took input credit of output tax liability during same month without payment of tax.

Books of accounts of MR A had following entry:

GST Output Tax A/c Cr - 1,80,000 GST Input Tax A/c Dr - 1,80,000

By looking at above entry, nothing seems wrong. Input credit was availed against output liability.

However Mr. A received an assessment notice after 3 years of this transaction where assessing officer rejected the input credit and demanded output tax with penalty and interest.

Here Mr. A was demanded tax amount with penalty and interest due to following reasons:

- You can not avail input credit of tax payable under Reverse charge unless output liability is paid

- Even if Mr. A pays the tax upon demand notice, he cannot claim input credit due to elapse of time.

In above example, if the profit margin was below 18% Mr. A would have suffered huge loss.

There seems to be nothing wrong in above accounting entry, but it does not make sense for following reasons:

- It is not clear whether tax liability relates to RCM or normal levy,

- Whether payment is already made to avail input tax credit

We can not solely blame insufficient knowledge of law but even if entries are not posted in properly named ledgers, there will always be chances of wrongly availing input credit or wrong payment of taxes.

Another interesting and classic case will be transacting with E-commerce operators. These operators are supposed to deduct TCS, credit of which will be available only after operator uploads details on GSTN portal.

In case if sellers selling goods online through these portals solely depend on data uploaded by operator, they may suffer loss if operator makes mistake in uploading of data or wrong data gets uploaded. Online sellers will not be able to avail credit of TCS deducted by operator.

Accounting ledgers for different taxes under GST

Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST) and Integrated Goods and Services Tax (IGST) are different tax headings under which taxes will be paid.

As an accountant the main object should be to:

- Accounting accuracy all output taxes,

- Accounting accuracy of input taxes,

- Accurate payments of tax liabilities,

- Proper records of input credit and setting off with output liabilities,

- Proper details of all customers, suppliers

Special care has to be taken by E-commerce operators, Online sellers on platforms provided by operators and person charging tax on reverse charge basis.

Under normal conditions, accounting entries and ledger creation should follow the traditional approach. Tax regime has changed and not the accounting concepts. Main aim of accounting is always to provide accurate and up to date information of business transactions.

There is not going to be any changes in your Accounting charts, except creation of new ledger accounts for indirect tax (GST).

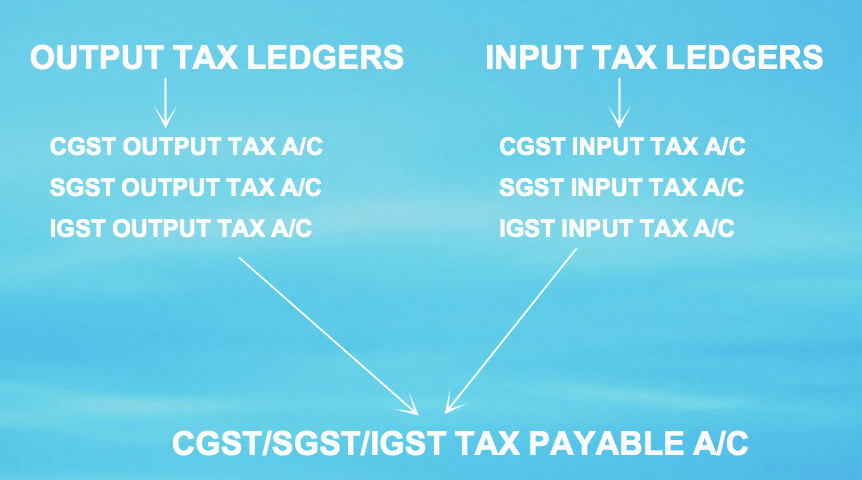

For accounting GST transactions, you need to create following ledgers for recording output tax liability.

- CGST Output Tax A/c

- SGST Output Tax A/c

- IGST Output Tax A/c

However, if you paying tax under reverse charge than I suggest you to read accounting of Reverse Charging mechanism transactions.

To record all tax paid on all your supplies, you should create following ledger accounts.

- CGST Input Tax A/c

- SGST Input Tax A/c

- IGST Input Tax A/c

These ledger names are for explanation purpose only, you name them as per your convenience.

In addition to above ledgers, you should also have following ledgers for recording the liability for each month.

- CGST Payable A/c

- SGST Payable A/c

- IGST Payable A/c

If any CESS is imposed on commodities you deal with, then you should create ledgers in similar manner as suggested above.

How to post entries of GST charged on outward supplies (Sales) in books of accounts?

Example: Mr. A made a supply of goods for Rs. 1,00,000 and charged CGST and SGST at 18%. Mr. A also made an interstate supply of goods for Rs. 1,00,000 and charged IGST at 18%

We will consider above example to post entries in books of accounts of Mr. A.

Before passing the entries, first have a look at records to be maintained by Mr. A.

- Sales Register

- Stock Register

- Tax accounts

A sales register contains details of all outward supplies. Stock register will contain details of stock movement and stock in hand. Tax ledgers should have details of tax liability and input credit along with tax payment details.

You can use the GST invoicing application provided on this site to maintain your sales and stock register for all your outward supplies.

Entries to be posted in books of accounts of Mr. A for above outward supplies made.

Accounting entries for local sales

Receivable/Debtor A/c Dr. 1,18,000 CGST Output Tax A/c Cr. 9,000 SGST Output A/c Cr. 9,000 Sales A/c Cr. 100,000

Accounting entries for interstate sales made

Receivable A/c Dr. 1,18,000 IGST Output Tax A/c Cr. 18,000 Sales A/c Cr. 100,000

How to post entries of GST charged on inward supplies (Purchase) in books of accounts?

Example: Mr. A made an inward supply of goods for Rs. 50,000 and paid CGST and SGST at 18%. Mr. A also made an interstate inward supply of goods for Rs. 50,000 and paid IGST at 18%

With above example we will post the purchase entries in books of accounts of Mr. A.

Accounting entries for local purchase

Payable/creditor A/c Cr. 59,000 CGST Input Tax A/c Dr. 4,500 SGST Input A/c Dr. 4,500 Purchase A/c Dr. 50,000

Accounting entries for interstate purchase made

Payable/creditor A/c Cr. 59,000 IGST Input Tax A/c Dr. 9,000 Purchase A/c Dr. 50,000

Month end entries to transfer liabilities and availing input credits of GST

At the end of every month, you should transfer balance of each tax ledger to a common liability account.

For example, CGST output and CGST Input should be transfer to CGST Payable account. Similarly SGST and IGST balances should be transferred to SGST Payable and IGST Payable accounts.

Reason for recommending this extra entry is to help you analyzing the tax flow in simple manner each month.

For example, If you generate monthly reports of any tax ledger in SAP. The summary report with month and debits, credits will give you correct numbers and you need not to go to each month of ledger scrutiny.

With above example, let us transfer balance of output and input ledgers to payable ledgers.

CGST Output Tax A/c Dr. 9,000 CGST Input Tax A/c Cr. 4,500 SGST Output Tax A/c Dr. 9,000 SGST Input Tax A/c Cr. 4,500 IGST Output Tax A/c Dr. 18,000 IGST Input Tax A/c Cr. 9,000 GST Tax Payable A/c Cr. 4,500 SGST Tax Payable A/c Cr. 4,500 IGST Tax Payable A/c Cr. 0

With above entries the balance in payable ledgers will be your final tax liability.

You can further enhance the process by setting off input of CGST or SGST against IGST.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

In 2 way Account, Which Account will be againt sales account /purchase Account.

Ex if purchase account --118000

CGST A/c 9000

SGST A/c 9000

Party 100000

Which A/c Will be againt purchase a/c and Party

as cgst payable a/c is against CGST Input/output A/c