ITC-04 for manufacturers to file details of inputs and capital goods sent and received for Job Work

Last udpated: Dec. 26, 2017, 11:30 p.m.Every manufacturer who sends goods to his job worker, needs to send goods with a challan. Details of all such challans issued during a quarter needs to be filed using form ITC-04 before 25th day of month succeeding last quarter.

For example, ITC-04 for July to September should be filed on or before 25 October (Note: July to September Quarter of 2017, due date is 31 December 2017).

Below is the exact paragraph from CGST rules.

(1)The inputs, semi-finished goods or capital goods shall be sent to the job worker under the cover of a challan issued by the principal, including where such goods are sent directly to a job-worker.

(2) The challan issued by the principal to the job worker shall contain the details specified in rule 55.

(3) The details of challans in respect of goods dispatched to a job worker or received from a job worker or sent from one job worker to another during a quarter shall be included in FORM GST ITC-04 furnished for that period on or before the twenty-fifth day of the month succeeding the said quarter.

What is form ITC-04?

ITC-04 is the form to be filled by manufacturers who deals with job-workers.

- ITC-04 is the return to be filed by manufacturers engaged with Job-workers.

- Input goods or capital goods can be sent with a challan to job worker.

- Details of inward and outward receipts of Input goods and capital goods sent for Job work has to be given in form ITC-04.

If you have sent inputs or capital goods from one job worker to another, even then you have to provide details in ITC-04.

How to file form ITC-04 on GST website?

A manufacturer has to file form ITC-04 if he has engaged in one or all of the following activities:

- If the manufacturer is sending any goods(capital or input type) to a Job Worker (JW)

- JW sends back the goods to the manufacturer

- JW sends goods to another JW

- JW sends goods out from his business premises to end customer.

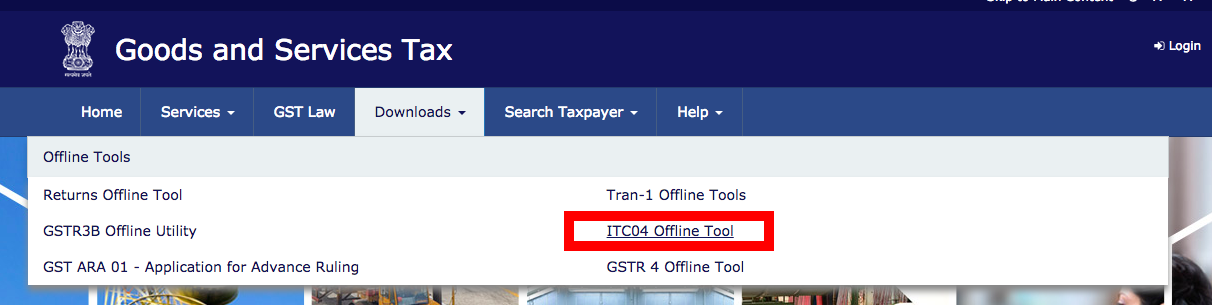

To file the return, first you have to download ITC-04 offline tool from GST website.

To download the offline tool. First you need to visit GST website. Once on site click on Downloads and then click on Offline Tools, click on ITC04 offline tool.

Once the file is downloaded.

You need to fill the excel file and generate JSON file. You need to upload this JSON file on GST portal.

Downloaded excel file have following tabs.

- Help Instructions

- Import_Export_file

- Mfg_to_JW

- JW_to_Mfg

Sheet Mfg_to_JW

In this tab you need to fill the details of input goods or capital goods sent for job work to job worker.

Details to be provided in this sheet are:

- GSTIN of Job Worker (JW)

- State (in case of unregistered JW)

- Challan Number

- Challan Date

- (dd-mm-yyyy)

- Description of Goods

- Unique Quantity Code (UQC)

- Quantity

- Taxable Value

- Types of Goods

- Integrated Tax Rate

- in (%)

- Central Tax Rate

- in (%)

- State/UT Tax Rate in (%)

- Cess

- Errors

Sheet JW_to_Mfg

- GSTIN of Job Worker(JW)

- State (in case of unregistered JW)

- Nature of Transaction

- Original Challan Number

- Original Challan Date

- (dd-mm-yyyy)

- No.

- Date

- (dd-mm-yyyy)

- GSTIN

- State (in case of unregistered JW)

- No.

- Date

- (dd-mm-yyyy)

- Description of Goods

- Unique Quantity Code (UQC)

- Quantity

- Taxable Value

- Errors

Details of goods sent from one job worker to another job worker also to be filled in sheet JW_to_Mfg.

Once you have filled individual Sheets, validate them.

After validation, click on Generate File to Upload button in Import_Export_file sheet.

JSON file will be generated.

Once JSON file is generate, you need to login to your GST account to upload this JSON file.

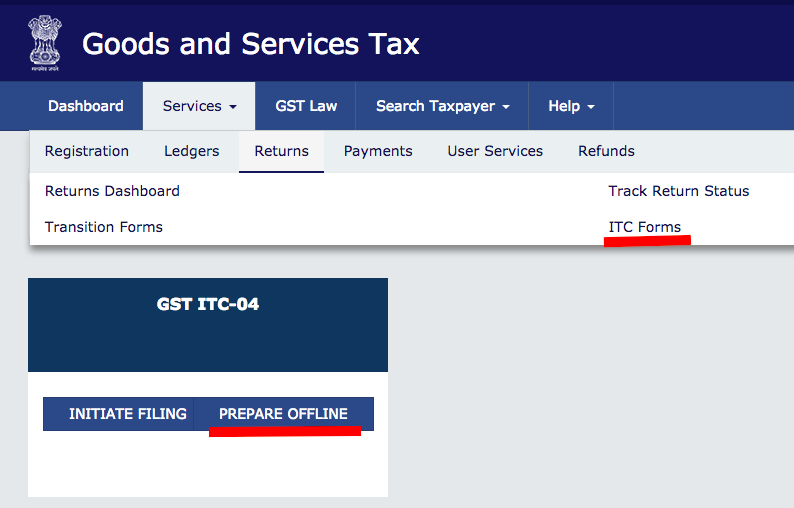

After you have logged in to your account, click on Service >> Return >> ITC Forms.

For ITC-04 will be visible. Click on PREPARE OFFLINE.

After you click on PREPARE OFFLINE, following page will open.

You need to attach JSON file and submit.

Once JSON file is successfully uploaded, you need to come back to ITC-04 selection page and click on INITIATE FILING.

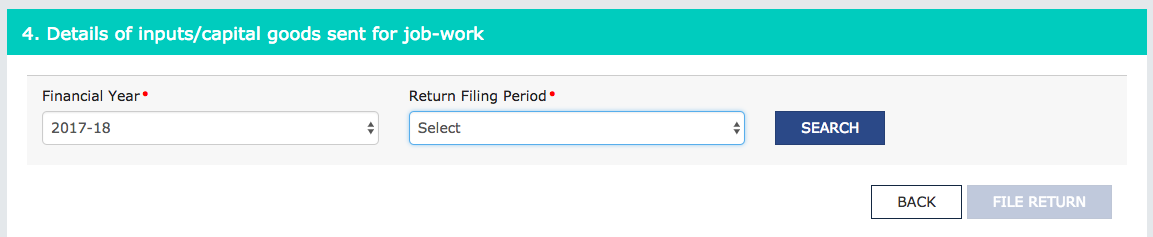

Here you need to select financial year and Return filing period.

You can file your return here.

Suggestions and help tips on ITC-04

This suggestions are to fill excel file and provided along with offline tool.

ITC-04 offline tool is an Excel based utility to prepare your ITC_04, Details of goods/capital goods sent to job worker (JW) from Manufacturer (Mfg.) and received back, and furnish the same on GST Portal.

Download the latest version of ITC-04 Offline Tool from the Download section of GST Portal.

1. Enter data in (sheet 3&4) or import and edit existing JSON file (in Sheet 1)

2. Generate output in .JSON file format (Sheet 2)

3. Upload this output file (.JSON file format) into the GST portal (www.gst.gov.in)

4. In case any error while validating or exporting, Last column named "Error" will also be filled with error message "This row has some error" and colored to red. User can follow red cells in corresponding column.

Important: Do not tamper with the excel template. This might generate erroneous JSON file and create problems while filing GST ITC-04

Important points to note while using offline utility

- It is not mandatory to fill both the sheets "Mfg_to_JW" and ìJW_to_Mfg"

- Please make sure to Empty the sheets before importing any file.

- While Opening the Excel sheet, if you see error message box like: "Compilation error in module due to incompatibility with the version, platform or architecture" (figure 1 below) please ignore this message and see if it works or not. In case it does not work, you need latest MS Office for successful export of your data.

- Please start writing data from ROW 7 and DO NOT SKIP any row. JSON creation won't read any data after any row skipped. Therefore, please fill your challan detail in continues manner.

- The row is valid only if there is any challan number for the Job Worker. File generation will not read the details after the row where, there is no challan number in that row.

- While Exporting or validating any sheet, if it says "There is an error in sheet" in first time validation, try validating again. If the error persists, then there must be some error in the sheet.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

Sir,

if some issued more than one material in same challan for example for job a saree issued saree along with beads laces etc.

there is no option to give detail of more than one material

big issue with itc04 offline excel sheet

same query for me also