GST Reverse Charge mechanism and rules with accounting entries

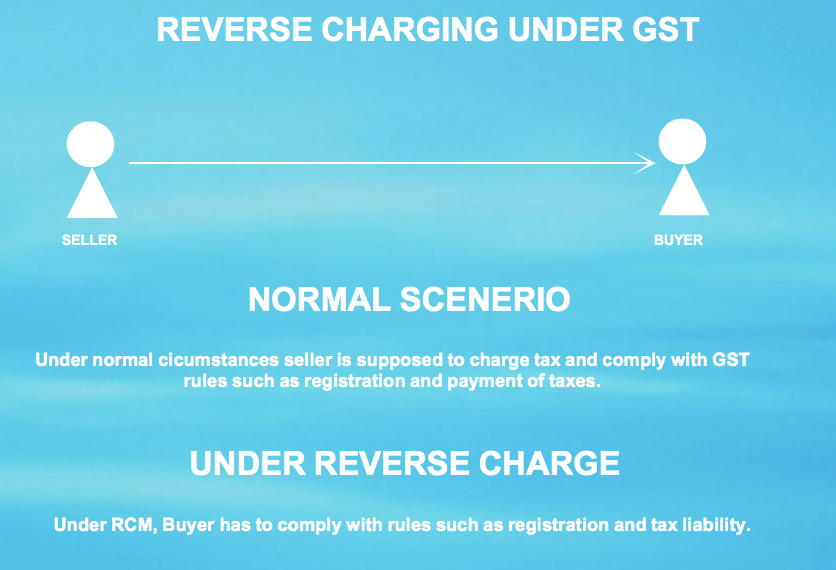

Last udpated: Nov. 4, 2017, 9:12 p.m.Reverse charging mechanism a procedural way of discharging tax liabilities and formalities by buyer of services or goods or both instead of seller.

For example, a transaction will be considered as reverse charge if tax is payable by buyer instead of seller.

GST reverse charging provisions are covered under different sections and rules. Government has also released the list of services when received tax liability should be discharged by recipient instead of service provider.

As on the date of writing this article Reverse Charging provisions are applicable to following transactions:

- Dealing with unregistered suppliers

- E-commerce operators in case of supply of services

- Supply of services notified by government with GST council

You can read reverse charging on dealings with unregistered persons.

What are the provisions applicable to buyer or recipient in case of reverse charging?

If you as a recipient of services or goods or both are liable to pay tax under reverse charge mechanism, you have to comply with all the provisions applicable under GST to a registered person.

For example, following procedural as well as documentary functions are performed when a registered person makes a supply.

- Issue a tax invoice,

- Furnishing details in monthly returns,

- Calculating and remitting the tax liability

- Documenting the charging as well as payment cycles

Above are the general functions that a registered person has to perform to comply with law. When you pay under RCM, it becomes your obligations to comply with these rules.

When the tax should be charged by buyer/recipient of goods under reverse charging (RCM)?

You must be aware that under GST tax liability arises of time of supply. So to find out the point at which you will be liable to charge tax on supplies received and fall under RCM, you first need to check the time of supply.

Time of supply becomes the tax charging point.

In case of RCM, the time of supply is earliest of:

- The date of the receipt of goods; or

- The date of payment as entered in the books of account of the recipient or the date on which the payment is debited in his bank account, whichever is earlier; or

- The date immediately following 30 days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier.

If you are not able to find the time of supply as per above list then time of supply will the date on which you account the transaction in your books of accounts.

Let us understand this concept of charging tax under RCM with an example:

| Particular | Receipt of Goods | Date of payment |

Date following 30 days |

Time of supply(Taxable event) |

|---|---|---|---|---|

| Receipt of Goods | 01/09/2017 | 10/09/2017 | 30/09/2017 | Earliest of 3 - 01/09/2017 |

| Receipt of Goods | 15/09/2017 | 01/09/2017 | 30/09/2017 | 01/09/2017 |

| Receipt of Goods | 01/12/2017 | 01/09/2017 | 30/09/2017 | 01/09/2017 |

Point of taxation under Reverse Charge Mechanism (RCM) in case of receipt of services

In case of services the time of supply should be earliest of:

- Date of actual payment or date of accounting of payment, whichever is earliest,

- Date immediately following sixty days from the date of issue of invoice or any other document, by whatever name called, in lieu thereof by the supplier.

In case of import of services from associated parties, the time of supply should be earliest of:

- Date of accounting or

- Date of payment

List of services on which tax is to be paid under Reverse Charge mechanism

- Taxable services provided or agreed to be provided by any person who is located in a non-taxable territory and received by any person located in the taxable territory other than non-assessee online recipient (OIDAR)

- Services provided or agreed to be provided by a goods transport agency (GTA) in respect of transportation of goods by road

- Services provided or agreed to be provided by an individual advocate or firm of advocates by way of legal services, directly or indirectly

- Services provided or agreed to be provided by an arbitral tribunal

- Sponsorship services

- Services provided or agreed to be provided by Government or local authority excluding, -

- renting of immovable property, and

- services specified below-

- services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Government;

- services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport;

- transport of goods or passengers.

- Services provided or agreed to be provided by a director of a company or a body corporate to the said company or the body corporate;

- Services provided or agreed to be provided by an insurance agent to any person carrying on insurance business

- Services provided or agreed to be provided by a recovery agent to a banking company or a financial institution or a non-banking financial company

- Services by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India

- Transfer or permitting the use or enjoyment of a copyright covered under clause (a) of sub-section (1) of section 13 of the Copyright Act, 1957 relating to original literary, dramatic, musical or artistic works

- Radio taxi or Passenger Transport Services provided through electronic commerce operator

Accounting entries of tax paid under RCM

As an accounting professional, the first thought that comes to our mind is how to account tax paid under reverse charge.

Before moving to accounting treatment and entries that should be posted lets understand some basic points.

- Expense needs to be booked,

- Vendor should be credited,

- Input credit is available but only after payment of tax

Considering above points, I suggest to have a separate accounting ledger specifically for tax paid under Reverse Charge and should not be clubbed with normal tax ledgers.

Normally you would have following ledgers for GST:

CGST Output Tax SGST Output Tax IGST Output Tax CGST Input Tax SGST Input Tax IGST Input Tax

In my opinion we should have different ledger for tax paid under Reverse Charge as:

SGST Output Tax-RCM CGST Output Tax-RCM IGST Output Tax-RCM CGST Input Tax-RCM SGST Input Tax-RCM IGST Input Tax-RCM

Entry to be posted at the time of supply.

Payable/Vendor A/c Credit Purchase/Expense A/c Debit SGST Output Tax-RCM Credit CGST Output Tax-RCM Credit IGST Output Tax-RCM Credit GST Input Tax-RCM Debit

At the time of payment of tax charged on reverse charge basis:

SGST Output Tax-RCM Debit CGST Output Tax-RCM Debit IGST Output Tax-RCM Debit Bank A/c Credit CGST Input Tax-RCM Debit SGST Input Tax-RCM Debit IGST Input Tax-RCM Debit GST Input Tax-RCM Credit

Above entries are a draft proposal. These can be accounted in a better manner by transferring balance of each account in a Tax Payable Ledger.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

2 Comments

thank you

Very useful information thanks.