SIMPLE EWAY BILL BULK TOOL FOR OFFLINE E-WAY BILL PREPARATION WITH MASTERS

Last udpated: Dec. 11, 2018, 7:15 p.m.It is a simple tool for generating GST E-WAY Bills using offline facility.

The original tool provided by National Informatics Centre Bengaluru has been added with a facility for adding Master List Page and a Entrydata page. Rest of them are the same.

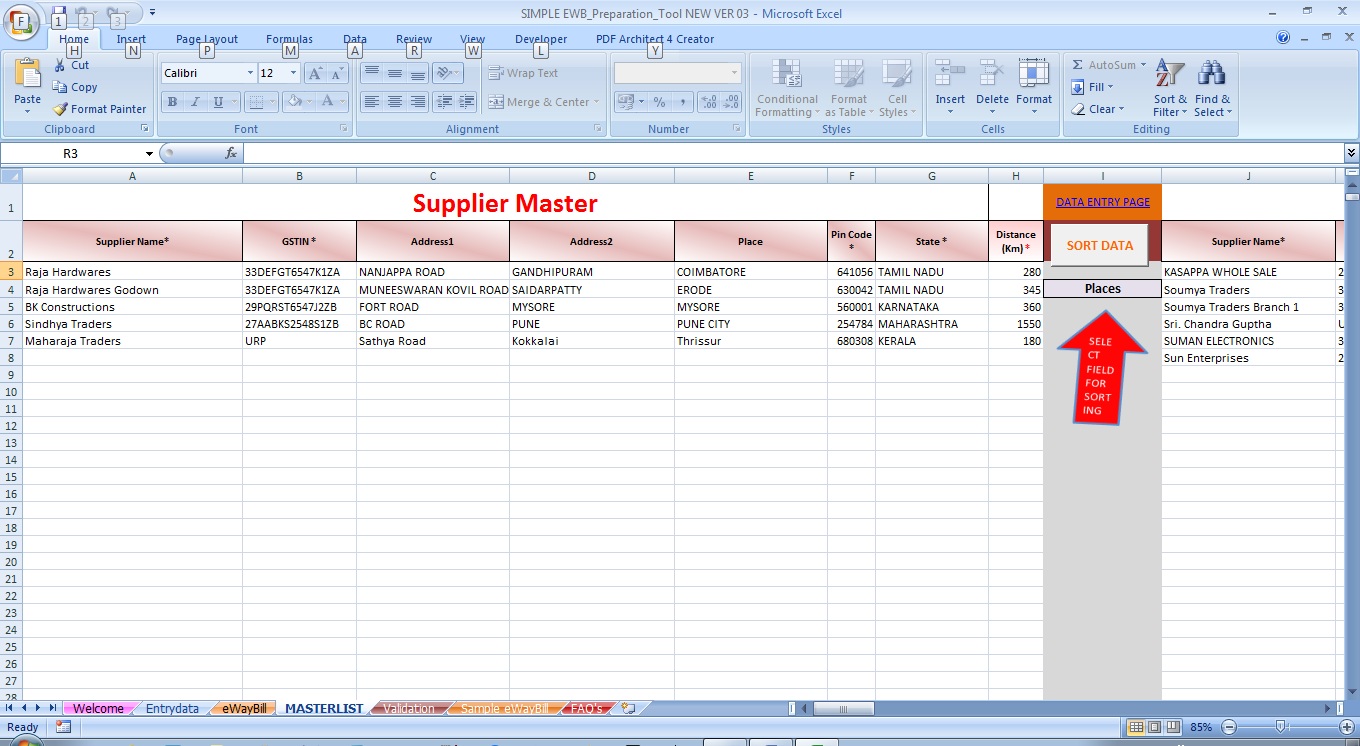

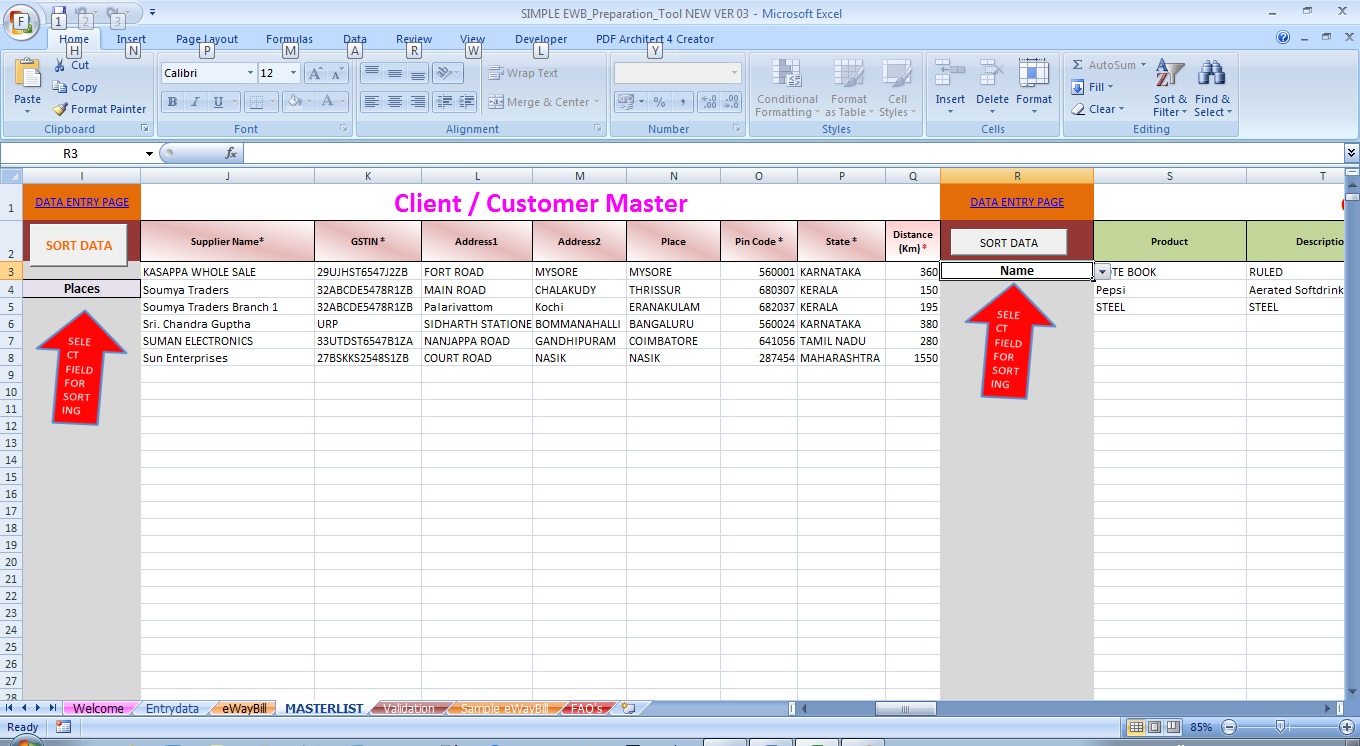

Master List Page

It is the first step for generating an eway bill for the first time. It has three parts - Dealer Master, Commodity Master and Transport Master .

Supplier Master and Client/Customer Master

As the name suggests Supplier and Client Master is meant for adding your Suppliers and Clients. Your usual Suppliers and Customers can be added here. You can add the details of the dealer which is mandatory of eway bill generation. Party Name, GSTIN, Address1, Address2 , Place, Pin code , State and distance from your business place to their business place. You can change it at any time. The list will be available as dropdown in the data entry page. Please note that if one dealer has more than one destination (branches, stocking point, job work destination etc) it should be added separately as separate entry. Also GSTIN column is mandatory field , But unregistered person can be entered with full details and "URP" in their GSTIN column.

COMMODITY MASTER

All the commodities should be first entered into the COMMODITY MASTER page.

Commodity, Description, HSN code, Unit code (UQC), GST rate (No split up required ), Cess (Motor vehicle, aerated soft drinks etc) and Cess Non Advol (mostly for cigarettes). No need to split up tax rate as CGST, SGST, IGST etc. The tool will decide it accordingly. Therefore you need not have to worry. For eg. GST rate 28% enter data as '28'. That's all.

TRANSPORT MASTER

You need to enter only Transporter Name and Transporter id..

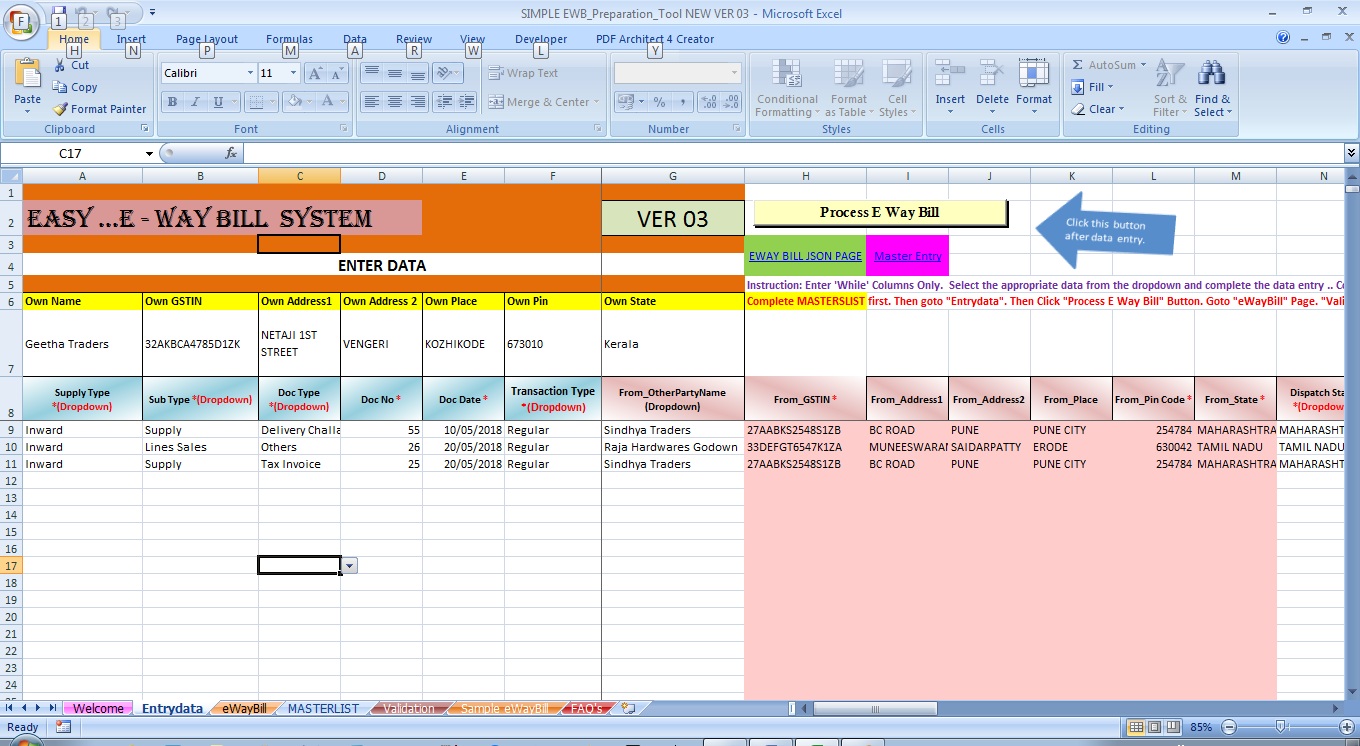

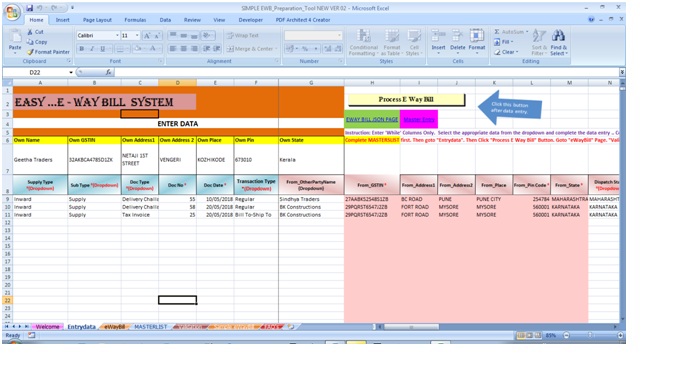

ENTRY DATA Page

This page contain upto 44 columns for data entry. Most of them are mandatory for generating eway bill. Don't worry...But data entry will be a one minute process if you enter the data in Master List first. Most of them will be available as dropdown. Some of them will be auto filled. No need to enter anything in auto fill column... the tool will do...Auto fill columns are colored columns.

Steps for data entry in each column

A. Begin the data entry from the first cell "A9" by selecting Supply Type from the dropdown menu "Inward" or "Outward".

B. Sub Supply Type: Then select corresponding "supply sub" type Supply, Import /Export, SKD/CKD/Lots, Job work, Exhibition, Own Use etc. from the dropdown. The menu will change according to column A.

C. Document Type : Select document type from the dropdown menu. The drop down menu will also change according to column B

D. Document Number: Enter the document number for the eway bill . Invoice Number, Delivery Challan Number, Bill of Entry Number, Bill of Supply Number etc.

E. Enter date of document in dd/mm/yyyy format. If your system date is in another format please change the system date in Control Panel of Windows. Detailed help file for changing date format is also attached.

F. Enter transaction type: There are four transaction type available. 1. Regular 2.Bill to Ship to 3. Billed from - Dispatch from 4. Combination of both

- 'Regular' means you are supplying goods from the Supplier's original address to the Recipients payer's original address.

- 'Billed to - Shipped to' means the Supplier sending the goods from its original address to the third party address as directed by the recipient.

- 'Bill From - Dispatch from' means the Supplier sending the goods from a third party's address (as directed by the supplier , third party sending the goods)to the recipients original address.

- 'Combination of 2 and 3' means the supplier billed from his original address and the goods are dispatched from a third party . Then the goods are send to a fourth party's address as directed by the recipient. There will be four persons involved.

G. Select the Supplier from the dropdown. The dropdown is auto generated according to the supply type. If the supply type is "Outward" the dropdown changes to YOUR Name. If the supply type is "Inward" the dropdown filled with your Suppliers name. Corresponding changes should be made in the column "O" of the sheet.

Column "H" To "M" will be auto populated according to the Supplier Name. No entry needed as it is colored column.

N. Dispatch State. If the state is same state as of the supplier no change is required. If the dispatch state is different, then select the dispatch state accordingly. eg .This may be a different states in the transaction like Billed From -Dispatches from cases

O. Select the Recipient from the dropdown. The dropdown is auto generated according to the supply type. If the supply type is "Inward" the dropdown changes to YOUR Name. If the supply type is "Outward" the dropdown filled with your Client's name. Corresponding changes should be made in the column "G" of the sheet.

Column "P" To "U" will be auto populated according to the Recipient Name. No entry needed as it is colored column.

V. Dispatch State. If the state is same state as of the recipient no change is required. If the dispatch state is different, then select the dispatch state accordingly. eg .This may be a different states in the transaction like Billed To -Shipped to cases.

W. Products .Select the product from the dropdown menu.Listed products from your Product Master list.

Column "X" To "Z" will be auto populated from the Master List.

AA. Quantity

AB. ASSESSABLE VALUE (OR TAXABLE VALUE) of the invoice. It does not include any other charges, in which no tax liability. Any other charges may be added to the 'Others" column(AI).

AC. The tax rate will be auto populated according the transaction type according to the Taxpayers state. For " Intrastate" - CGST and SGST .For " Interstate" -IGST rates will be displayed. Is it easy?

AD-CGST Amount, AE-SGST Amount, AF - IGST Amount, AG- Cess(Motor Vehicles, Softdrinks(aerated) etc), AH-Cess Advol (Mostly for Cigarettes) should be entered

AI . The others columns may be entered any nontaxable value is included in the total invoice value , like transportation charges, loading/unloading charges for tax may be not charged.

AJ. Total Invoice Value. It must be total of all columns AB to AJ (except tax rate col. AG). If the value is not correct the eway bill will not be validated. The Entrysheet also give a warning if your entry is not correct. If the entry is lower than the sum , it will show a red color and if the entry is higher the color will be green. If correct value is entered the color will be white.

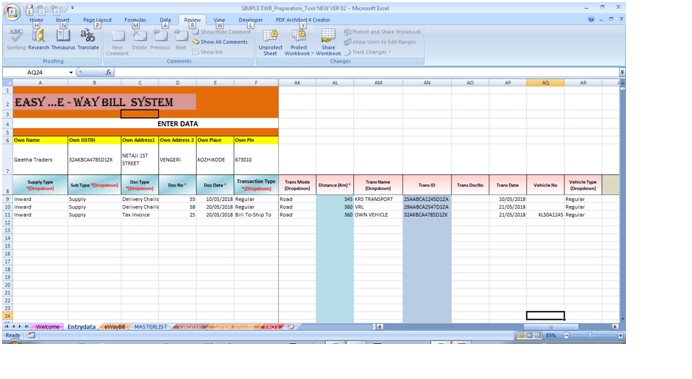

AK . MODE OF TRANSPORT

AL . Distance will be auto-populated from Master list.

AM. ,AN .AQ . Transporter Name and Transporter ID . Auto populated dropdown from your Transporter Master list. If you are transporting goods in your or leased vehicle, enter the transporter as "OWN Vehicle" and also enter the Vehicle Number in column AQ. But it is not mandatory to enter the vehicle number,if you chose own vehicle, if the transportation of goods not started. The vehicle number can later updated by yourself, when the actual movement of goods starts. The validity of the eway bill also only starts, if you enter the vehicle number. The same case also for transporters. The validity of the eway bill starts if the transporter enters the vehicle number

AP. If you know the transporter documents details , enter the details. Else left blank. Not mandatory for road transports. But this column is mandatory for Air, Railway and Vessel (Ship) as mode of transport.

AR, Vehicle type dropdown for selecting Regular or Over Dimensional Cargo(ODC). Regular. Regular vehicles will get validity for eway bills 100Kms. or part one day each. But for ODC, for every 20 Kms or part , it will be one day validity each.

PROCESS EWAY BILL BUTTON

Click the PROCESS E WAY BILL Button to copy the data to eWayBill Sheet.

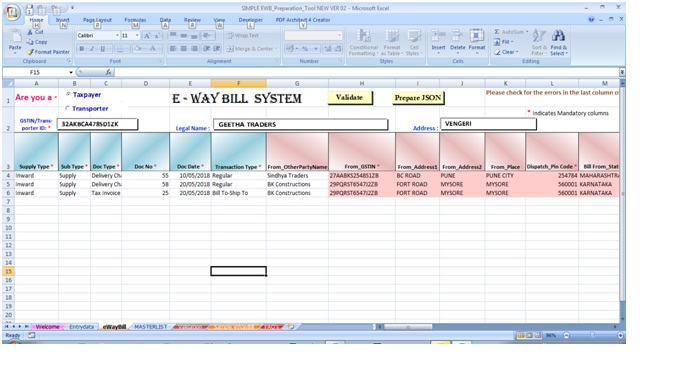

eWayBill Page

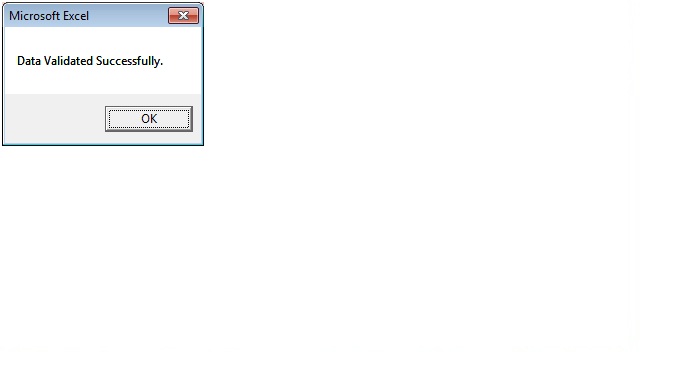

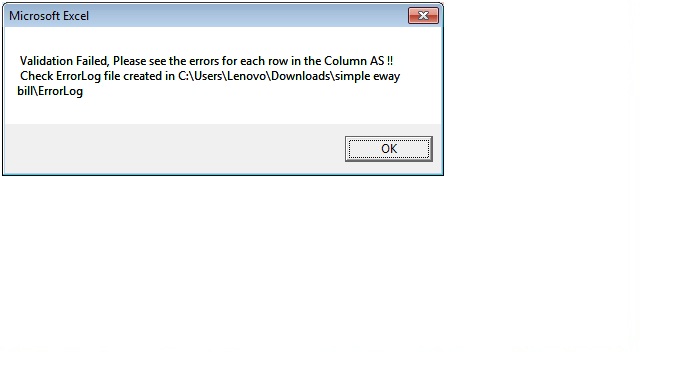

Click Validate Button to Process the data for errors. You will get the data validated message, if every data is OK.

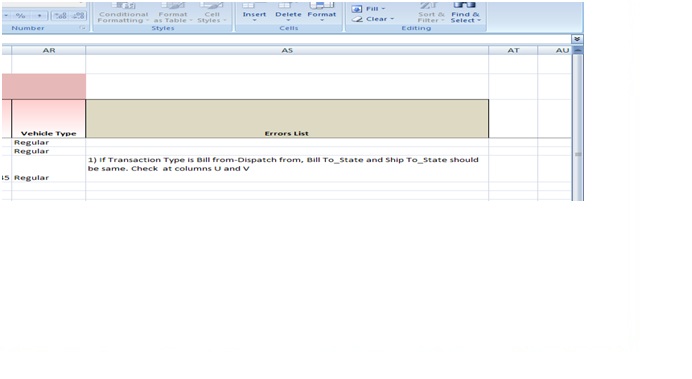

If any error in Data Entry it shows a warning window and the error messages for the corresponding rows will be displayed in the last column.

Then please rectify the error in the rows where the error occured, either eWayBill page or in Entrydata page(Recommended). Again 'Validate' data and "Prepare JSON" file.

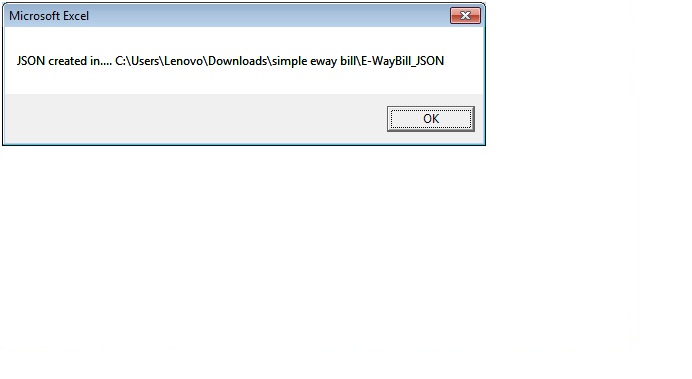

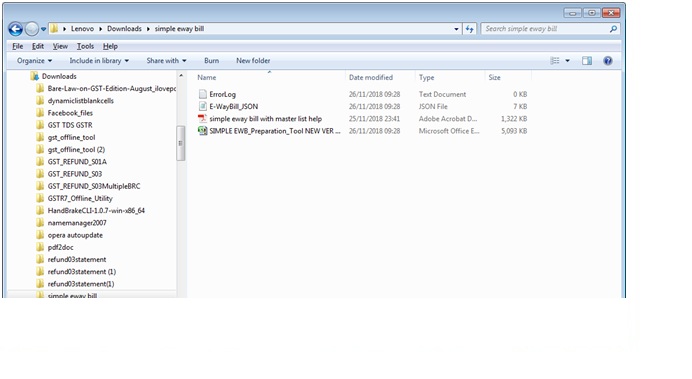

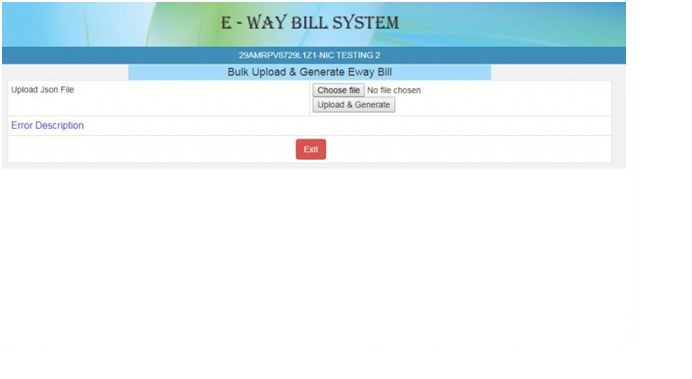

Preapare JSON AND Upload the JSON file. The following screen will be displayed.

A JSON file named 'E-WayBill_JSON.json will be generated automatically in the same folder ,where the tool is opened.

Upload the JSON file

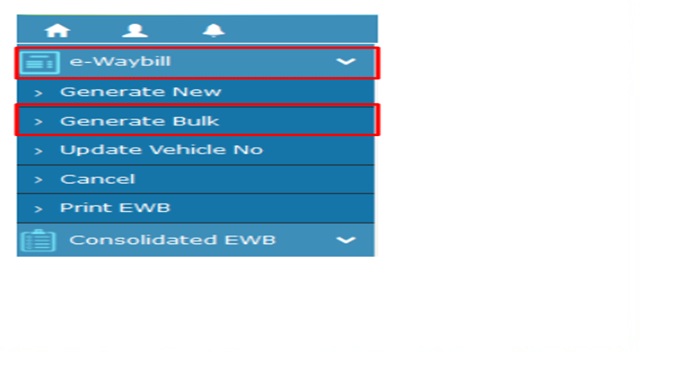

Login to the Eway Bill Portal.

ewaybillgst.gov.in

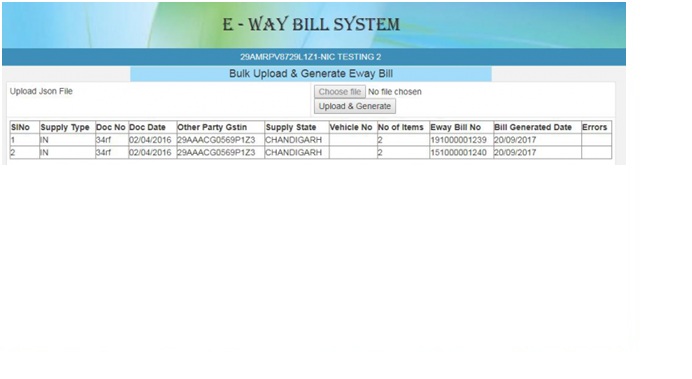

Click Eway Bill Menu and select "Generate Bulk" Menu.

Then 'Choose file' and browse to upload the created JSON file. Then click "Upload & Generate" button

The Eway Bill number will be generated on the portal. You can download the list as an Excel file.

Goto Print Eway Bill menu for printing the Eway Bills generated.

Shijoy James

ASTO

SGST Department

Kozhikode, Kerala

Email. shijoy.james@gmail.com

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.