Form GSTR-3B for filing GST return of month July and August 2017

Last udpated: Nov. 4, 2017, 9:12 p.m.July month just got over and here we are past one month of GST being rolled out.

August 2017 is a very crucial and important month for every tax payer, as this is practically the first month everyone has to file a GST return for the supplies made during the month of July 2017.

Form GSTR-3B was announced by government which is very simple form for monthly returns of July and August month.

However, every one has to file normal returns such as GSTR-1 etc. also but only due date is extended.

Update

This is an update to this article.

I have prepared the GSTR-3B in excel file with instructions.

Download this file, this file was specifically prepared to demonstrate how the Credit needs to be netted off.

Download GSTR-3B in excel with example and instructions

Few important points

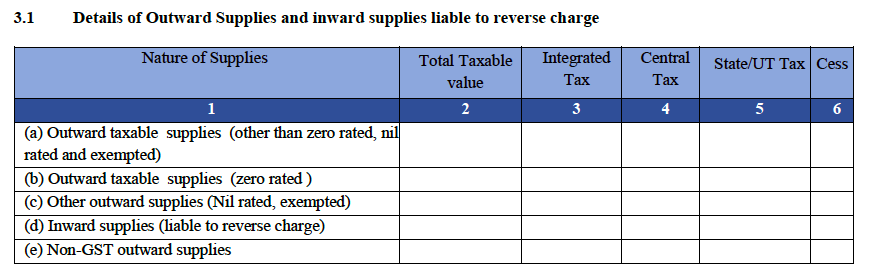

Table 3.1

- You need to provide details of your full Outward supplies here, including interstate, Exempted and Export outward supplies and Inward supply which attracts RCM

- All outward supplies means whether to registered, unregistered, interstate or composition person. For all you have to fill here.

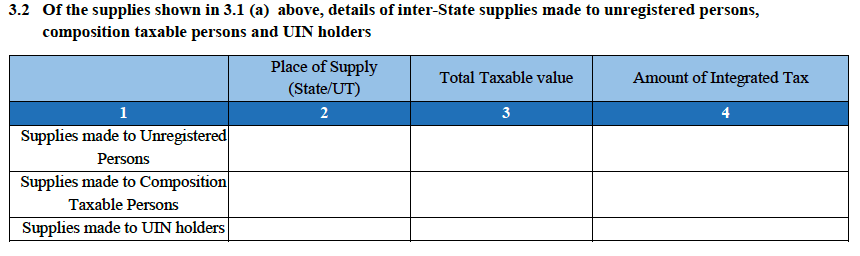

Table 3.2

- This is for only interstate outward supplies.

- Note that these details should also be included in consolidated numbers for table 3.1, as liability from this table is not captured in table 6.

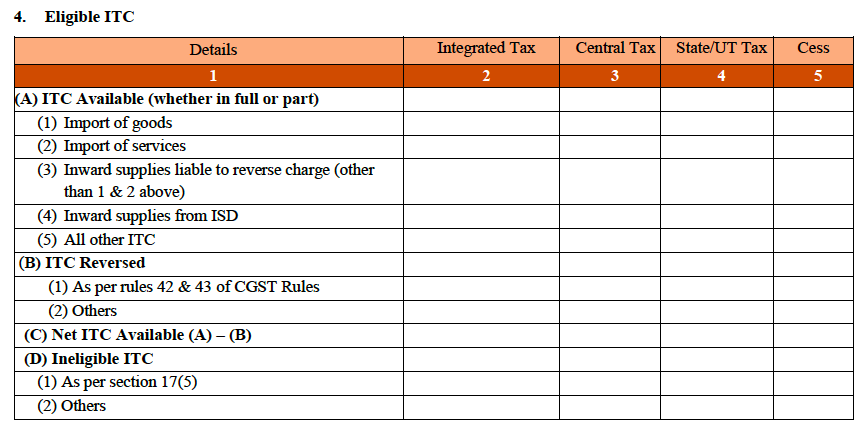

Table 4

- Provide details correctly, not that liability of different taxes is to be correctly netted off against correct tax.

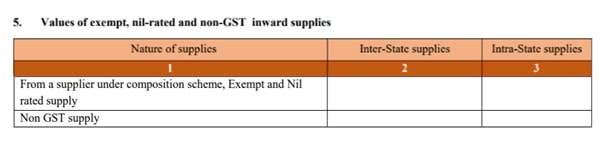

Table 5

- Provide details of inward supplies from composition person, exempted and Nil rated

- Provide details of non GST inward supplies eg.: Water supply, electricity, Petrol etc.

Table 5.1

- Details of interest in case of late payment.

- Penalty, late filing fee etc. to be disclosed here.

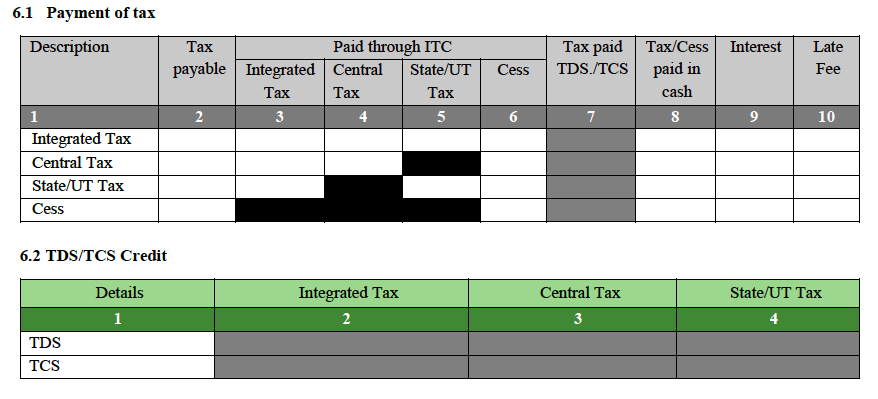

Table 6

- Here you need to setoff your taxes and link to payments made through cash.

- Note that IGST first needs to be setoff against IGST, CGST and at last with SGST.

- Cash means payment by bank or OTC

Update:

#GSTsathi (Manoj Agarwal) Updates: ALL ABOUT FILING OF RETURN IN FORM GSTR-3B FOR JULY, 2017

GST Council had earlier decided to defer the filing of return in FORM GSTR-3 and had recommended the filing of return in FORM GSTR-3B. Accordingly, the Central Government vide notification No. 21/2017-Central Tax dated 08.08.2017 had notified the last date for filing of return in FORM GSTR-3B for the month of July, 2017 as 20.08.2017.

2. Concerns have been raised by the trade about whether transitional credit would be available for discharging the tax liability for the month of July, 2017.

In this regard, attention is invited to notification No. 23/2017-Central tax dated 17.08.2017 wherein the date and conditions for filing the return in FORM GSTR-3B have been specified. Salient points for filing the said return are as follows:

A. Registered persons planning not to avail transitional credit for discharging the tax liability for the month of July, 2017 or new registrants who do not have any transitional credit to avail need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse charge) – input tax credit availed for the month of July, 2017;

II. Tax payable as per (i) above to be deposited in cash on or before 20.08.2017 which will get credited to electronic cash ledger;

III. File the return in FORM GSTR-3B on or before 20.08.2017 afterdischarging the tax liability by debiting the electronic credit or cash ledger.

B. Registered persons planning to avail transitional credit for discharging the tax liability for the month of July, 2017 need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse charge) – (transitional credit + input tax credit availed for the month of July, 2017);

II. Tax payable as per (i) above to be deposited in cash on or before 20.08.2017 which will get credited to electronic cash ledger;

III.File FORM GST TRAN-1 (which will be available on the common portal from 21.08.2017) before filing the return in FORM GSTR-3B;

IV.In case the tax payable as per the return in FORM GSTR-3B is greater than the cash amount deposited as per (ii) above, deposit the balance in cash along with interest @18% calculated from 21.08.2017 till the date of such deposit. This amount will also get credited to electronic cash ledger;

V. File the return in FORM GSTR-3B on or before 28.08.2017 after discharging the tax liability by debiting the electronic credit or cash ledger.

What is form GSTR-3B?

Form GSTR-3B is a simplified return proposed for initial 2 months, July and August to file the GST returns. However it is not a replacement of normal return to be filed under GST.

Form GSTR-3B was announced in council meeting to provide a relaxation to tax payers.

Due date to file GSTR-3B returns are:

| Month | Due Date |

|---|---|

| July 2017 | 20th August 2017 |

| August 2017 | 20th September 2017 |

How to fill and file GST return in form GSTR-3B?

Filing of form GSTR-3B is really made simple. You need to provide consolidated details of output liability and input credit available.

Below I am showing you step-wise screenshots of form released by government to file you return.

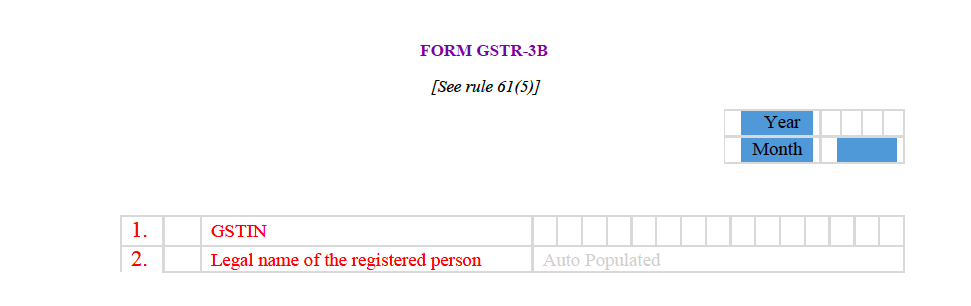

Above image is the initial screen, GSTIN number will be auto populated in the form. Year and month needs to be filled.

Details of outward supplies and inward supplied liable to reverse charge

Here you need to provide details of outward supplies made and also details of inward supplies liable to reverse charge.

A consolidated number has to be filled. For details of each supply you need to file form GSTR-1.

Details of inter-State supplies made to unregistered persons,composition taxable persons and UIN holders

Here you have to provide details of outward supply made to:

- Unregistered persons,

- Composition taxable persons and

- UIN holders

Details of Eligible ITC

Here provide details of input tax credit available on different inward supplies made during the subjected month.

Lot of people were confused whether ITC will be available on RCM or not. Here you can see the field for supplies liable to reverse charge, ITC on GST paid on RCM is available.

Values of exempt, nil-rated and non-GST inward supplies

Here you need to provide details of exempted supplies received during the subjected month.

Basically these inward supplies are to be provided in 2 categories:

- From a registered person paying under composition scheme, Exempt and Nil rated supply and,

- Non GST Supplies

Details of Payment of tax

Here you need to provide details of payment made against GST liability. You need to provide details of payment made by utilising input credit and payment made through cash.

Once the form is filled, you need to verify the form before submitting.

Instructions to file form GSTR-3B

1) Value of Taxable Supplies = Value of invoices + value of Debit Notes – value of credit notes + value of advances received for which invoices have not been issued in the same month

– value of advances adjusted against invoices.

2) Details of advances as well as adjustment of same against invoices to be adjusted and not shown separately

3) Amendment in any details to be adjusted and not shown separately.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

7 Comments

Sir how will a supplier identify which supply supplier have made to composition dealer to fill details in 3.2 ofGSTR-3B

Hi sir, june 17 me mera input tax credit balance hai. Wo input tax credit July 17 me GST liability ke samne adjust kr sakata hu ki nhi? Please reply me

Most of the GST users are suffering from one problem - signing GSTR-3B with DSC - do you know any solution or alternatives ?

You can sign with Aadhaar OTP. There is a big answer by James on this issue of DSC error. Please check that.

@Rakesh

अभी तक इस पर कोई सफ़ाई नही आइ है सरकार की तरफ़ से। हलंकी ये input सिर्फ़ TRANS-१ फ़ोर्म भरने के बाद ही मील सकता है।

देखते हैं शायद कोई अधीकरीक सूचना जारी हो इसपे फ़िलहाल आप इसका input credit नही ले सकते।

Hello sir, what if I cannot file Tran1 before 28th August ... Is there any extended time limit for delay ???

what to do if value of credit note is higher than sale taxable value