How to generate GST tax invoice?

Last udpated: Nov. 4, 2017, 9:12 p.m.I will show you how to generate bills of supply and Tax Invoice. A Tax invoice is very important document, you must posses invoices of your purchases/inward supplies to claim input credit, in same manner your buyer should have the valid tax invoice to claim input tax credit.

Many people who are running business, have a common question whether printed bill books will be allowed under GST or not?

Let me be clear that printed bill books are allowed under GST. You can order printed books, if computer generated invoice is not your first choice.

However, I will recommend you to use computer generated invoice for your business. It makes you look more professional. Your bill books may get damaged, lost or tempered but with a software using proper backups and security these can be avoided.

Printed bill books vs computer generated invoices

A large number of traders have followed the practice of using printed bill books for invoicing their customers. In case you are using printed invoice books, your normal work flow looks like this:

- Issue tax invoice to customers using printed bill books and enter invoice details in handwriting

- Accountant makes monthly or weekly visit, account all bills

- Accountant file the returns

However under GST, you can continue with this practice but you should compare the advantages and disadvantages of using a computerized invoicing software.

The main question for you is whether you should continue with printed books or migrate to an invoicing software!!!

To arrive at a conclusion, first understand return filing process under GST.

- Between 1st to 10th of every month, outward supplies or sales details to be uploaded on GST portal

- Inward supplies to be matched between 10 to 15 and thereafter filing Inward supplies return

- Filing of monthly return along with tax payment on or before 20th of next month.

Earlier under VAT laws, the due date of return filing was 20th in almost all states and you had enough time to account your sales bills.

But under GST, the details must be uploaded before 10th to ensure smooth credit flow to your buyer and also to avoid negative impact on your GST compliance rating.

You must answer the following question to decide whether to continue with printed bills or invoicing software.

- Can you provide details of all tax invoices issued during the month to your accountant well in advance?

- Accountant can handle the work pressure, you are not only client of your accountant?

- Can you handle the situation post delay in filing of returns?

These are the top question that came to my mind. With specific requirements of your particular industry, you may have you own priorities. You can consider them too for your decision.

Contents of a Tax Invoice

If you have decided to go with printed bill book or a computer generated invoicing software, the step for you will be to understand the TAX INVOICE itself.

- What details a tax invoice should contain?

- Whether tax invoice should have HSN code of each product?

- Whether Invoice can be signed using a Digital Signature?

- What details of buyer should be provided in invoice?

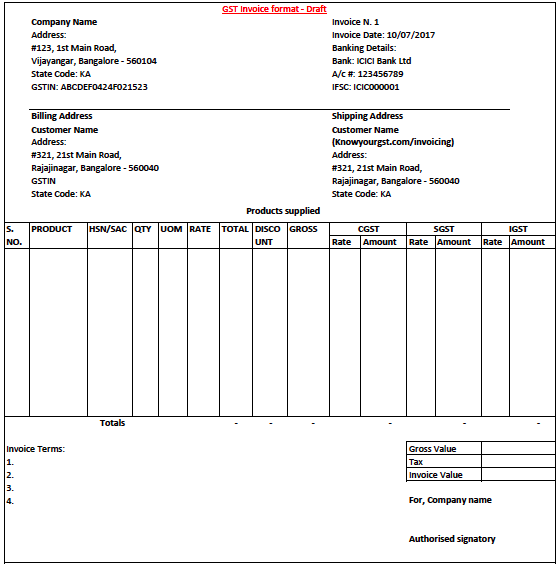

Your tax invoice should contain the following details:

Details of seller/supplier

- Name,

- Address and

- GSTIN

Invoice details

- Invoice number should be continuous containing alphabets or numerals or special characters, invoice number should be unique for a financial year

- Date of invoice

Details of buyer/recipient if registered under GST

- Name

- Address

- GSTIN or UIN

- Place of supply along with state code if interstate sale

Details of buyer/recipient if not registered under GST and value of taxable supply is 50,000 or more

- Name

- Address of the recipient and the address of delivery

- Name of State and its code

Details of products to be provided in invoice

- Product description

- HSN code of goods or Accounting Code of services

- Quantity and unit of measurement

- Total value

- Taxable value

- Rate of tax for CGST, SGST, or IGST

- Amount of tax for CGST, SGST, or IGST

You can sign your tax invoice using a digital signature or manually. Invoice can be signed by authorised representative also.

Below is a sample of Tax invoice under GST.

Difference between Tax invoice and Bill of supply

You can understand the difference between a bill of supply and Tax invoice by reading them. A bill of supply is only a bill or document for supply of goods whether Tax invoice is document with tax charged on supplies.

A bill of supply does not contain the details of tax charged on supplies.

Registered person paying tax under composition scheme, will have to issue a bill of supply because they cannot charge tax on sale/supply.

Those paying tax under normal levy will have to issue a tax invoice.

Generate a GST Tax Invoice using MS Excel

You can use MS Excel to generate GST invoices.

You can download the GST invoice format in excel, I have made this format and you can use it for free.

Generate invoice using invoicing application

To help you in GST regime, I have designed and coded an GST invoicing application.

You can use this application to generate invoice.

Instructions to use this application are provided on the homepage.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- Annual Returns under GST

- KNOW SOME INDIRECT TAXES NOT SUBSUMED IN GST

- DENIAL OF CREDIT/DEBIT OF ELECTRONIC CREDIT LEDGER UNDER RULE 86A OF CGST RULES

- All About GSTR2B

- UNDERSTANDING ON SEC-8, CGST ACT

- UNDERSTANDING ON Sec-9 CGST ACT

- UNDERSTANDING ON Sec-7 CGST ACT

- 6 digit HSN code or 4 digit HSN code

- Proposed Amendment in Sec: 16 vide Finance Bill, 2021

- E-Invoice in GST

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

4 Comments

i deals indifferent industrial gases there is no hsn code foun in list for industrial gases,can we use printed tax invoice

what is way bill

HSN has code for gases. Anyhow these chemical only. Correct me if I am wrong.

You can search HSN list on this site with proper chemical name or search with HSN description.

I got few, giving here one:

28047010

IN GST SALES INVOICES..

1. HOW DO WE SHOW FORWARDING / PACKAGING / DELIVERY CHARGES ??

2. ARE THESE CHARGES TAXABLE ? IF YES DO WE CALCULATE & SHOW THESE TAXES SEPARATELY