Annual Compliance by Limited Liability Partnership

Last udpated: Jan. 10, 2019, 12:06 p.m.| S No | Document | E-Form | Due Date |

| 1 | Statement of Account & Solvency | Form 8 | 30th October |

| 2 | Annual Return | Form 11 | 30th May |

| 3 | Income Tax Return | ITR 5 | 31st July if not tax audit. 30th September if tax audit is required. |

Filing of Form 8 - Statement of Account & Solvency

Visit www.mca.gov.in

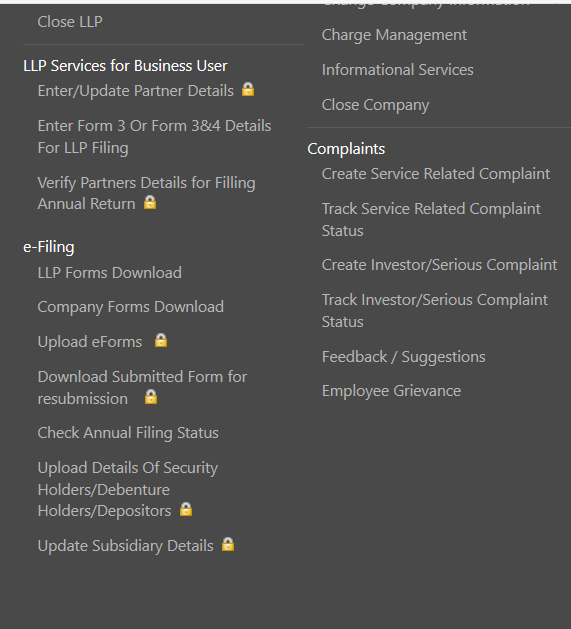

Hover on MCA Services, mega menu will be displayed, under ‘e-Filing’ click on ‘LLP Forms Download’

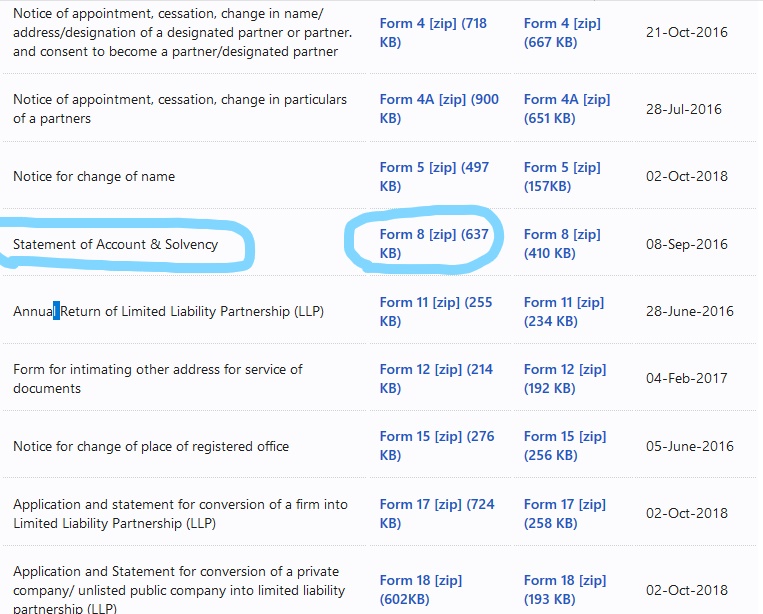

In next screen list of all forms will be displayed. Search for 'Form 8 [zip]', click and download with instruction kit. Refer instruction kit while filling the form.

Form 8 can be filled with the help of instruction kit. All the field in the form are self explanatory.

Select ‘Annual’ or ‘Interim’ for information to be provided in statement of Account & Solvency. In case ‘Interim’ is selected, ‘Appendix to statement of account and solvency’ is to be filled in the form.

Applicable in case of ‘Annual’ statement of account & solvency

Attachments

- Disclosure under Micro, Small and Medium Enterprises Development Act, 2006 is a mandatory attachment.

- In case contingent liabilities exists; Statement of contingent liabilities to be attached.

- Any other information can be provided as an optional attachment.

Signing

The eForm should be digitally signed by minimum two Designated Partners of LLP or Authorised Representatives of FLLP.

Enter the Designated partner identification number (DPIN) in case the person digitally signing the eForm is DP.

Enter income-tax PAN in case the person signing the eForm is authorised representative.

Certification

In case total turnover of the LLP/ FLLP exceeds Rs. 40 lakhs or partner’s obligation of contribution exceeds Rs. 25 lakh, then the eForm should be certified by the auditor of the LLP/ FLLP. In other cases, the eForm is to be certified by the Designated Partner in case of LLP and by Authorised Representative in case of FLLP.

Enter the details of person certifying the eForm. Enter the DPIN in case the certificate is given by Designated partner, income tax PAN in case of authorised representative or membership number in case of auditor.

System shall automatically display the name and address of the designated partner or authorised representative. In case of auditor, these details shall have to be entered.

Professional Certification

In case the form is certified by a designated partner or authorised representative (i.e. total turnover of the LLP/ FLLP does not exceed Rs. 40 lakhs and partner’s obligation of contribution does not exceed Rs. 25 lakh) then the eForm is to be additionally certified by a practicing professional.

Select the relevant category of the professional and whether he/ she is an associate or fellow.

In case the professional is a chartered accountant (in whole-time practice) or cost accountant (in whole-time practice), enter the membership number. In case the practicing professional is a company secretary (in whole-time practice); enter the certificate of practice number. Professional certification in Form 8 includes

- Verification of particulars filled in the forms from the records of the LLP or FLLP as true and correct;

- Verification that the statement of assets & liabilities and income and expenditure and other documents attached with the forms are true, correct and complete; and (iii) All the required attachment(s) have been completely attached to the forms.

Applicable in case of ‘Interim’ statement of account & solvency

- In case of LLP, enter the ‘Limited Liability Identification Number’ (LLPIN). In case of FLLP, enter the ‘Foreign Limited Liability Identification Number’ (FLLPIN).

- Refer instruction kit for filling.

Attachments

- Instrument(s) of creation or modification of charge is a mandatory attachment in case of creation or modification of charge.

- In case of acquisition of property, already subjected to charge; instrument evidencing creation or modification of charge is a mandatory attachment in case of creation or modification of charge.

- In case of joint charge and consortium finance; particulars of other charge holders should be attached.

- Letter of charge holder stating that the amount has been satisfied (Mandatory in case of satisfaction of charge)

- Any other information can be provided as an optional attachment.

Signing

The eForm should be digitally signed by the charge holder and by the following -

- In case of LLP by the designated partner of the LLP.

- In case of a FLLP by an authorized representative.

- In case the charge is modified in favor of the asset reconstruction company (ARC) or assignee then; the eForm should also be digitally signed by such ARC or assignee. In such case, the digital signature of the DP or authorized representative is optional.

In case of LLP, enter the DPIN of DP and in case of FLLP, enter income-tax PAN of authorized representative, if applicable.

In case of charge holder, ARC or assignee; enter the designation of the person digitally signing the eForm.

Certification

The eForm should be certified by a chartered accountant (in whole-time practice) or cost accountant (in whole-time practice) or company secretary (in whole-time practice) by Digitally signing the eForm.

Select the relevant category of the professional and whether he/ she is an associate or fellow.

In case the professional is a chartered accountant (in whole-time practice) or cost accountant (in whole-time practice), enter the membership number. In case the practicing professional is a company secretary (in whole-time practice); enter the certificate of practice number.

Note

- After the eForm has been filled, click the Prescrutiny button to pre-scrutinise the eForm. If the eForm is not pre-scrutinised, it shall be rejected when you attempt to upload the eForm.

- This eForm shall be taken on record through electronic mode without any processing at the office of Registrar. Ensure that all particulars in the eForm are correct. There is no provision for resubmission of this eForm.

Submission

For submission of the form, check our article on how to submit/file forms to MCA

Filing of Form 11

Visit www.mca.gov.in

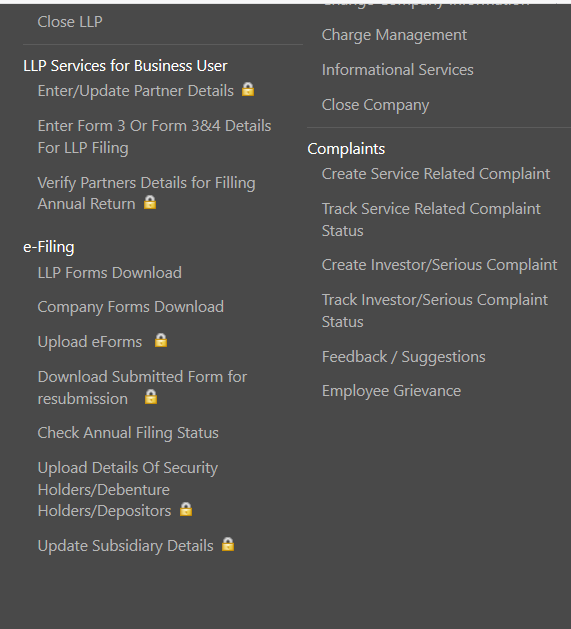

Hover on MCA Services, mega menu will be displayed, under ‘e-Filing’ click on ‘LLP Forms Download’

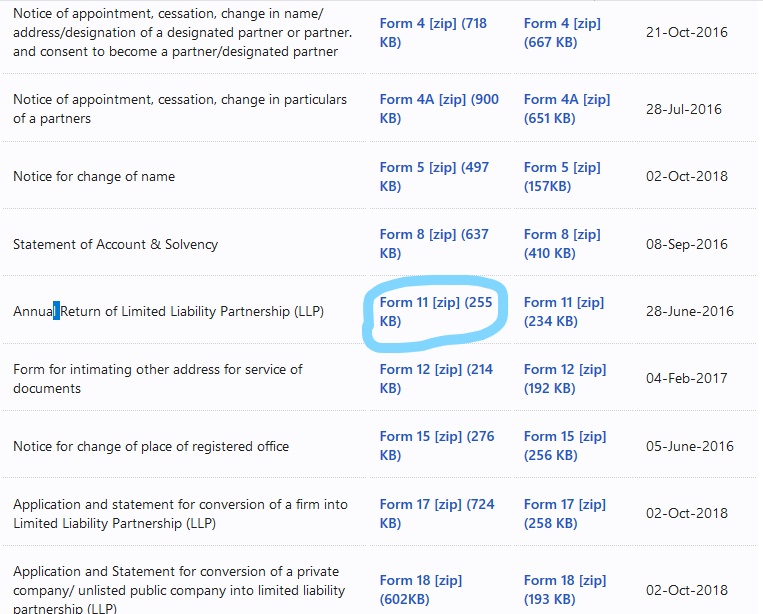

In next screen list of all forms will be displayed. Search for ‘Form 11 [zip]’, click and download with instruction kit. Refer instruction kit while filling the form.

Form 11 can be filled with the help of instruction kit. All the field in the form are self explanatory.

Documents to be attached

- Details of LLP and/ or company in which partner/ designated partner are a director/ partner (It is mandatory to attach this detail in case any partner/ DP is a partner in any LLP and/ or director in any company)

- Any other information can be provided as an optional attachment to eForm.

Signing

The eForm should be digitally signed by the designated partner (DP) of the LLP. Enter the DPIN (Designated partner identification number) of the DP.

Certification

In case total obligation of contribution of partners of the LLP exceeds Rs. 50 lakhs or turnover of LLP exceeds Rs. 5 crores, then the eForm needs to be certified by a Company Secretary in whole time practice. Enter the certificate of practice number and select whether he/ she is associate or fellow.

In case total obligation of contribution of partners of the LLP does not exceed Rs. 50 lakhs and turnover of LLP does not exceed Rs. 5 crores, then the eForm needs to be certified by the designated partner of the LLP. Enter the DPIN of the DP.

Pre-scrutiny

After the 'check' eForm is successful and required documents have been attached, pre-scrutinise the eForm. This is a mandatory step.

Submission

For submission of the form, check our article on how to submit/file forms to MCA

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- ONE PERSON COMPANY

- Annual Compliance by One Person Company

- Annual Compliance by Private Limited Company

- How to submit/file forms to MCA

- Incorporation of One Person Company

- Intimation of address of registered office of the Company to Registrar

- Article of Association of the Company

- Memorandum of Association of Companies

- Incorporation of Private Limited Company

- Availability and Reservation of Company name

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.