Annual Compliance by Private Limited Company

Last udpated: Jan. 10, 2019, 12:31 p.m.Copy of financial statement is to be filed with Registrar

Every Private Limited Company has to file a copy of its financial statements including consolidated financial statement, if any, along with all the documents annexed to financial statement and adopted at AGM with the Registrar.

A company shall, along with its financial statements to be filed with the Registrar, attach the accounts of its subsidiary or subsidiaries which have been incorporated outside India and which have not established their place of business in India.

It has also been clarified vide General Circular no. 11/2015 dated 21st July 2015 that in case of foreign company which is not required to get its accounts audited as per the legal requirements prevalent in the country of its incorporation and which does not get such accounts audited, the holding or parent Indian may place or file such un-audited accounts to comply with requirements of section 136(1) and 137(1) as applicable. Further, the format of accounts of foreign subsidiaries should be, as far as possible, in accordance with requirements under the Companies Act, 2013. In case this is not possible, a statement indicating the reasons for deviation may be placed/ filed along with such accounts.

Financial statements shall be filed in form AOC-4. If the Company is also preparing consolidated financial statements, then Standalone Financial Statements shall be filed in AOC-4 and Consolidated Financial Statements shall be filed in AOC 4-CFS. However following class of companies have to file in AOC-4 XBRL (Consolidated in AOC-4 CFS) -

- All companies listed with any stock exchange(s) in India and their Indian subsidiaries, or

- All companies having paid up capital of rupees five crore or above, or

- All companies having turnover of rupees hundred crore or above, or

- All companies which were hitherto covered under the Companies( Filing of Documents and Forms in Extensible Business Reporting Language) Rules, 2011 :

Provided that the companies in banking, insurance, power sector, non-banking financial companies and housing finance companies need not file financial statements under this rule.

What is the due date of filing financial statements with the Registrar

Adopted Financial Statements should be filed within 30 days from the date of AGM.

What if Financial Statements are not adopted

Where the financial statements are not adopted at annual general meeting or adjourned annual general meeting, such un-adopted financial statements along with the required documents shall be filed with the Registrar within 30 days of the date of annual general meeting.

The Registrar shall take them in his records as provisional till the financial statements are filed with him after their adoption in the adjourned annual general meeting for that purpose.

If the financial statements are adopted in the adjourned annual general meeting, then they shall be filed with the Registrar within 30 days of the date of such adjourned annual general meeting with such fees or such additional

fees as may be prescribed within the time specified under section 403.

What if Annual General Meeting is not held

Where the annual general meeting of a company for any year has not been held, the financial statements along with the documents required to be attached, duly signed along with the statement of facts and reasons for not holding the annual general meeting shall be filed with the Registrar within thirty days of the last date before which the annual general meeting should have been held and in such manner, with such fees or additional fees as may be prescribed within the time specified, under section 403.

How to file said forms to registrar

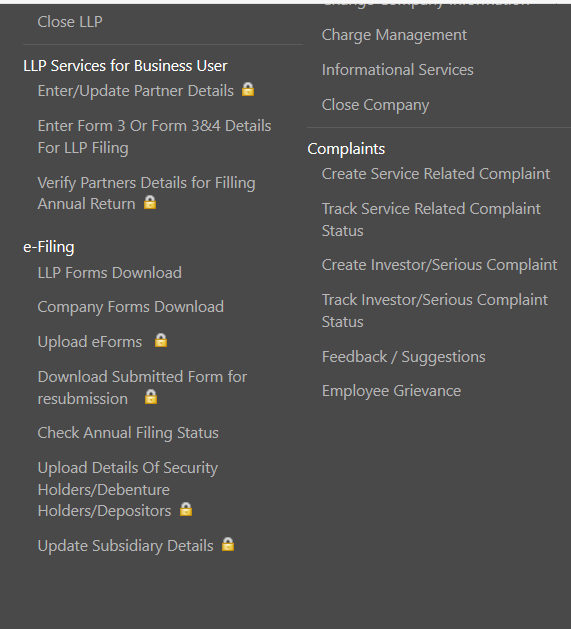

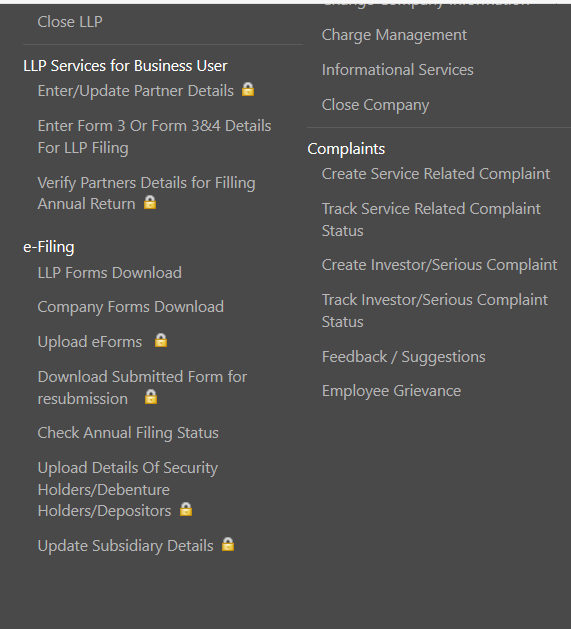

Visit www.mca.gov.in, hover over MCA services, mega menu will be displayed, under 'e-filing' click on 'Company Forms Download'

List of all company forms will be displayed. Search for required form, that is, AOC-4, AOC-4 CFS and AOC-4 XBRL, download with instruction kit.

Refer instruction kit for filling the forms, everything is explained in detail in the instruction kit.

For submission of the forms check our article How to submit/file forms to MCA

What is the Penalty if above provisions for filing financial statements are not followed

- The company shall be punishable with fine of Rs 1,000 for every day during which the failure continues but which shall not be more than Rs 10 Lacs, and

- The managing director and the Chief Financial Officer of the company, if any, and, in the absence of the managing director and the Chief Financial Officer, any other director who is charged by the Board with the responsibility of complying with the provisions of this section, and, in the absence of any such director, all the directors of the company, shall be punishable with:

- Imprisonment for a term which may extend to 6 months or

- Fine which shall not be less than Rs 1 lac but which may extend to Rs 5 Lacs, or

- Both with imprisonment and fine.

Filing of Annual return with the Registrar

Every company shall prepare an annual return in the form MGT-7 containing the particulars as they stood on the close of the financial year regarding :

- its registered office, principal business activities, particulars of its holding, subsidiary and associate companies;

- its shares, debentures and other securities and shareholding pattern;

- its indebtedness;

- its members and debenture-holders along with changes therein since the close of the previous financial year

- its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year;

- meetings of members or a class thereof, Board and its various committees along with attendance details;

- remuneration of directors and key managerial personnel;

- penalty or punishment imposed on the company, its directors or officers and details of compounding of offences and appeals made against such penalty or punishment;

- matters relating to certification of compliances, disclosures as may be prescribed;

- Shareholding pattern of the company; and such other matters as required in the form.

Due date of filing Annual return with the Registrar

Annual return shall be filed within sixty days from the date on which the annual general meeting is held.

What if Annual General Meeting is not held

Where the annual general meeting of a company for any year has not been held, annual return, duly signed along with the statement of facts and reasons for not holding the annual general meeting shall be filed with the Registrar within thirty days of the last date before which the annual general meeting should have been held and in such manner, with such fees or additional fees as may be prescribed within the time specified, under section 403.

How to file said forms to registrar

Visit www.mca.gov.in, hover over MCA services, mega menu will be displayed, under 'e-filing' click on 'Company Forms Download'

List of all company forms will be displayed. Search for MGT - 7, and download with instruction kit.

Refer instruction kit for filling the forms, everything is explained in detail in the instruction kit.

For submission of the forms check our article How to submit/file forms to MCA

What is the Penalty if above provisions for filing annual return are not followed

If a company fails to file its annual return under sub-section (4), before the expiry of the period specified under section 403 with additional fee, the company shall be punishable with fine which shall not be less than fifty thousand rupees but which may extend to five lakhs rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than fifty thousand rupees but which may extend to five lakh rupees, or with both.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- ONE PERSON COMPANY

- Annual Compliance by One Person Company

- Annual Compliance by Limited Liability Partnership

- How to submit/file forms to MCA

- Incorporation of One Person Company

- Intimation of address of registered office of the Company to Registrar

- Article of Association of the Company

- Memorandum of Association of Companies

- Incorporation of Private Limited Company

- Availability and Reservation of Company name

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.