Intimation of address of registered office of the Company to Registrar

Last udpated: Jan. 9, 2019, 3:40 p.m.Applicability

Every Company has to intimate Registrar, address of registered office of the Company, in following two cases :

- Company at the time of incorporation did not give address of the registered office, and had given only correspondence address of the director for all communication purpose. In this case it shall choose registered office of the company, and intimate address of the same to the Registrar within 30 days of incorporation by filing eForm INC 22.

- Company has changed its registered office. In this case, Company shall intimate new address to the Registrar within 15 days of such change by filing eForm INC-22 and eForm MGT-14(if applicable).

In case the registered office of the company is shifted from the jurisdiction of one RoC office to another RoC office within the same state or otherwise then the company is required to file both eForm INC-23 for RD’s approval and eForm INC-28 (old Form 21)for notice of RD’s approval order and eForm INC-22 only once.

How to file INC-22

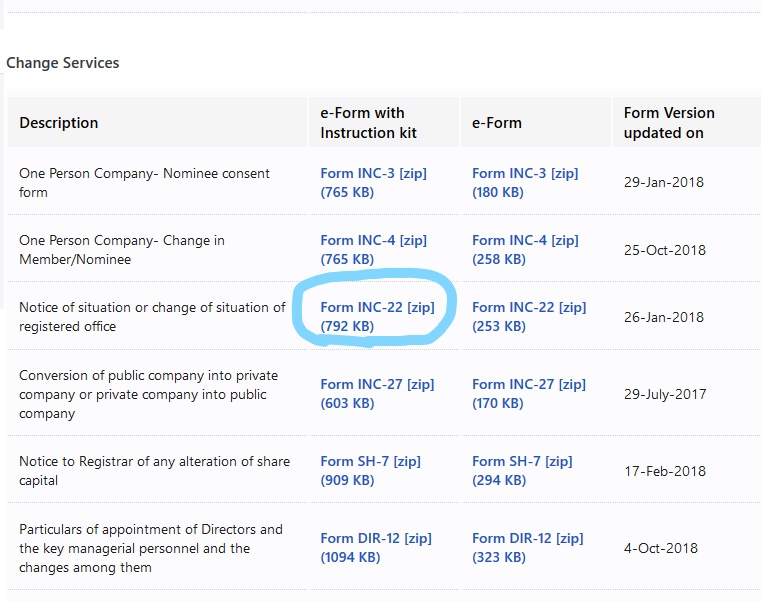

Visit www.mca.gov.in, hover over 'MCA Services', under e-filing, click on 'Company Forms Download'

Search for 'Form INC-22', and download it with instruction kit.

Documents to be attached

- Proof of Registered Office address (Conveyance/Lease deed/ Rent Agreement etc. along with the rent receipts).

- Copies of the utility bills (proof of evidence of any utility service like telephone, gas ,electricity etc. depicting the address of the premises not older than two months is required to be attached ).

- Altered Memorandum of association. This is mandatory to attach in case of shifting of registered office from one state to another within the jurisdiction of same RoC or from one state to another outside the jurisdiction of existing RoC.

- A proof that the Company is permitted to use the address. Authorization from the owner or occupant of the premises along with proof of ownership or occupancy and it is mandatory if registered office is owned by any other entity/ person (not taken on lease by company).

- Certified copy of order of competent authority. It is mandatory to attach in case of shifting of registered office from one RoC to another within the same state or from one state to another within the jurisdiction of same RoC or from one state to another outside the jurisdiction of existing RoC.

- List of all the companies (specifying their CIN) having the same registered office address, if any.

- Any other information can be provided as an optional attachment(s).

Refer instruction kit for filling the form.

Submission of the form INC-22

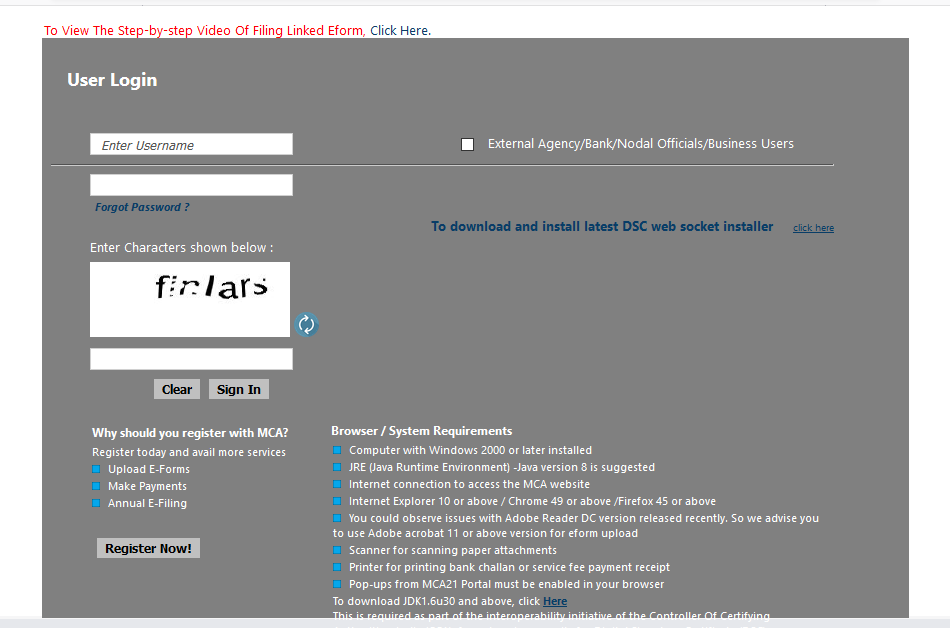

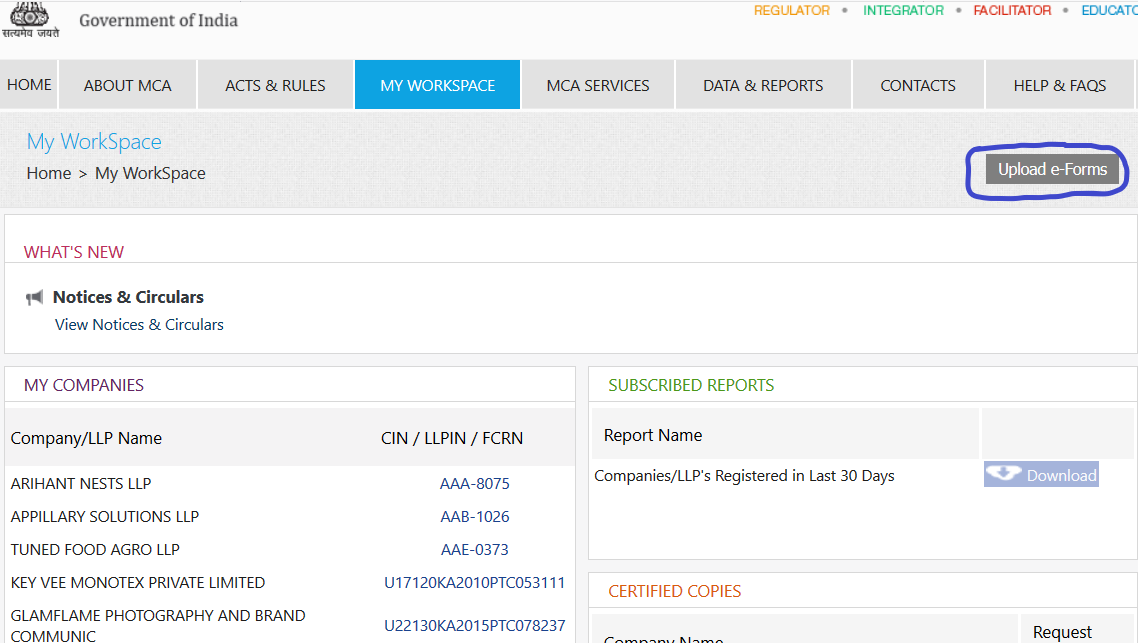

To submit the application, visit www.mca.gov.in, and log in to your account. If not registered, create your account, by clicking on 'Register' in top menu.

After you log in, click on 'Upload e-forms'

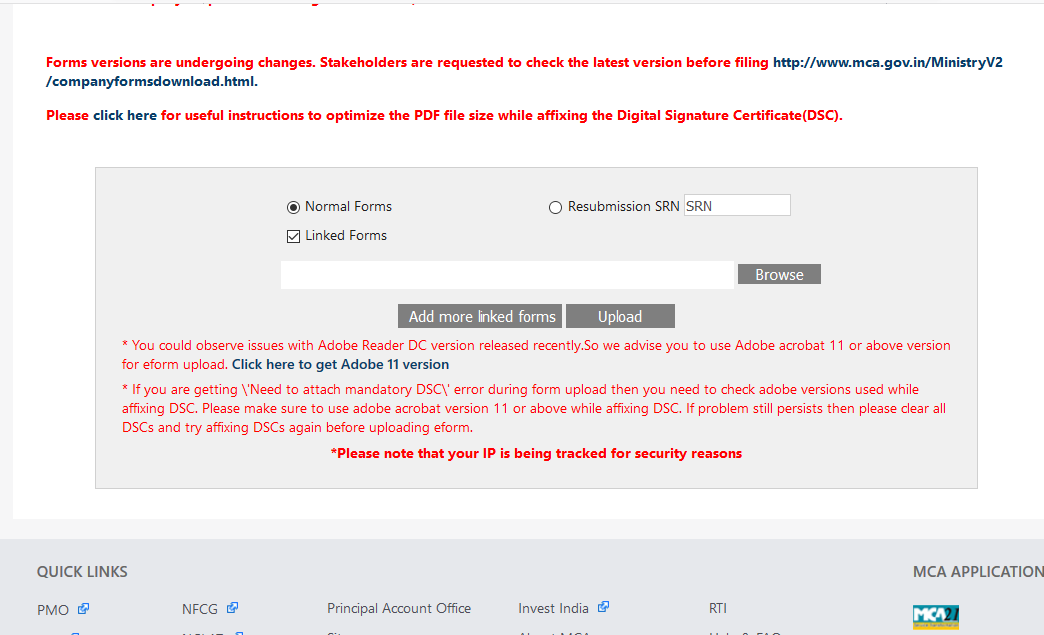

Next in Upload Form page, select 'Normal Forms', and attach form 'INC-22'. Click on 'Upload'

After submission eForm INC-22 will be processed by the office of Registrar of Companies.

On successful submission of the eForm INC-22, SRN will be generated and shown to the user which will be used for future correspondence with MCA.

On successful submission of the eForm INC-22, Challan will be generated depicting the details of the fees paid by the user to the Ministry. It is the acknowledgement to the user that the eForm has been filed.

When an eForm is approved/rejected by the authority concerned, an acknowledgement of approval/rejection letter along with related documents if there is any is sent to the user in the form of an email to the email id of the company.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- ONE PERSON COMPANY

- Annual Compliance by One Person Company

- Annual Compliance by Private Limited Company

- Annual Compliance by Limited Liability Partnership

- How to submit/file forms to MCA

- Incorporation of One Person Company

- Article of Association of the Company

- Memorandum of Association of Companies

- Incorporation of Private Limited Company

- Availability and Reservation of Company name

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.