Article of Association of the Company

Last udpated: Jan. 9, 2019, 3:20 p.m.What is AOA

The articles of association is a document that specifies the regulations for a company’s operations and defines the company’s purpose. The document lays out how tasks are to be accomplished within the organization, including the process for appointing directors and handling of financial records.

As per Section 2(5) of the Companies Act, 2013―articles means the articles of association of a company as originally framed or as altered from time to time or applied in pursuance of any previous company law or of this Act.

Section 5 of the Companies Act, 2013 seeks to provide the contents and model of articles of association. The section lays the following law -

- Contains regulations : The articles of a company shall contain the regulations for management of the company.

- Inclusion of matters : The articles shall also contain such matters, as are prescribed under the rules. However, a company may also include such additional matters in its articles as may be consider ed necessar y for its management.

- Entrenchment

- Contain provisions for entrenchment : The articles may contain provisions for entrenchment (to protect something) to the effect that specified provisions of the articles may be altered only if conditions or procedures as that are more restrictive than those applicable in the case of a special resolution, are met or complied with.

- Manner of inclusion of the entrenchment provision : The provisions for entrenchment shall only be made either on formation of a company, or by an amendment in the articles agreed to by all the members of the company in the case of a private company and by a special resolution in the case of a public company.

- Notice to the registrar of the entrenchment provision : Where the articles contain provisions for entrenchment, whether made on formation or by amendment, the company shall give notice to the Registrar of such provisions in such form and manner as may be prescribed.

- Example : If ABC Company subscribes by investing in XYZ, a Private Ltd. company in 20% terms, tomorrow if XYZ private limited approaches any Bank for a loan, the bank officials would read the Articles & would ask to get the consent of ABC Company. Now, if there is no entrenchment provision, then ‘XYZ’ may, after passing a special resolution remove the minority right and can borrow beyond the limit.

In order to control it, the entrenchment provisions are usually compelled by the minority to make the majority responsible and the minority in these provisions can get incorporated a clause saying that borrowing beyond a particular limit or issuances of shares is to be done only after the requisite consent of minority has been obtained.

- Forms of articles : The articles of a company shall be in respective forms specified in Tables, F, G, H, I and J in Schedule I as may be applicable t o such company.

- Model Articles : A company may adopt all or any of the regulations contained in the model articles applicable to such company.

- The provisions of Companies Act shall have overriding effect on provisions contained in memorandum or articles or in an agreement or in resolution passed by the company in the general meeting or by its board of directors, whether they are registered, executed or passed before or after the commencement of this Act.

Any provision contained in any of the above mentioned document, shall be void, to the extent to which it is inconsistent to the provisions of this Companies Act.

Filing of E-AOA

Companies filing form ‘SPICE’ for incorporation are required to file e-AOA along with the form. e-MOA is pre-filled.

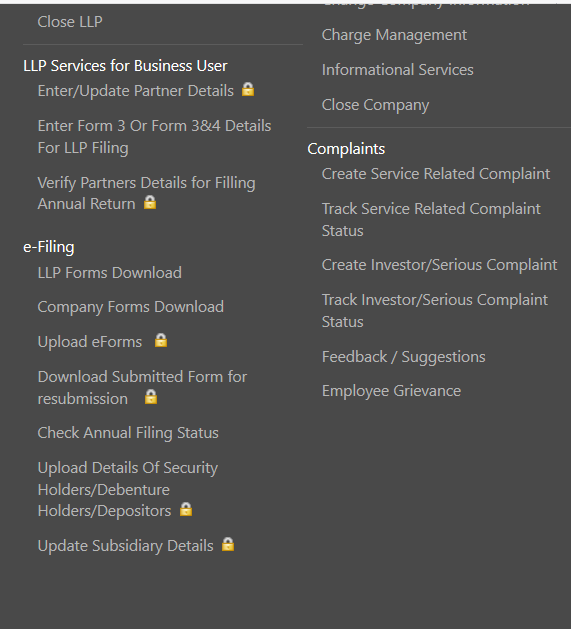

Visit www.mca.gov.in. Hover over ‘MCA Services’, mega menu will be displayed. Under e-Filing, click on ‘Company Forms Download.

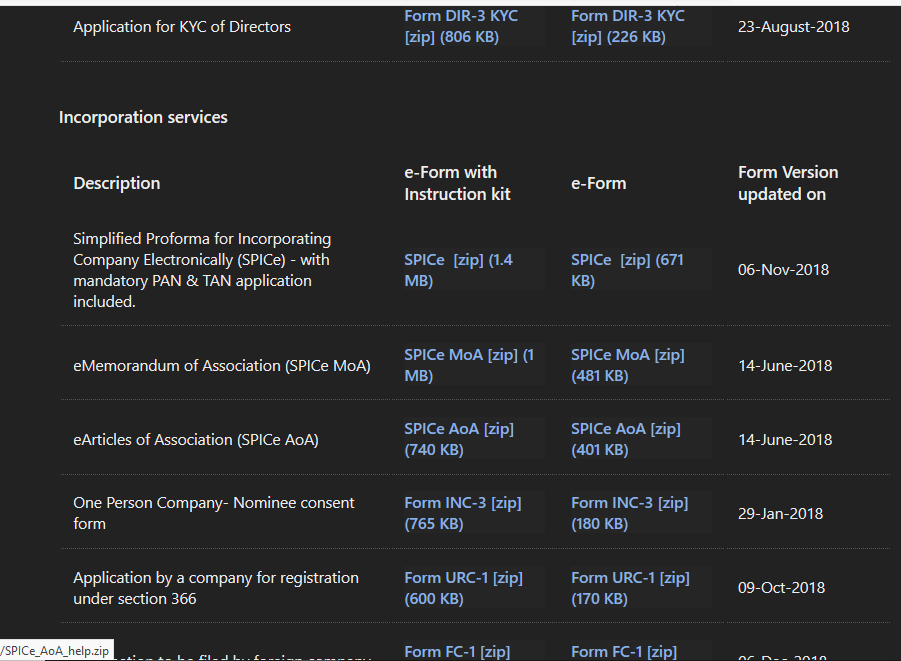

In the next screen all the forms will be displayed, search for ‘SPICe AOA’, click and download the form with instruction kit.

For filling the form refer instruction kit. This form has to be filed along with form ‘SPICE’. Check filing process of form SPICE.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- ONE PERSON COMPANY

- Annual Compliance by One Person Company

- Annual Compliance by Private Limited Company

- Annual Compliance by Limited Liability Partnership

- How to submit/file forms to MCA

- Incorporation of One Person Company

- Intimation of address of registered office of the Company to Registrar

- Memorandum of Association of Companies

- Incorporation of Private Limited Company

- Availability and Reservation of Company name

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.