Incorporation of One Person Company

Last udpated: Jan. 9, 2019, 4:27 p.m.Features of One Person Company

- It has only one person as member.

- Minimum capital required is NIL.

- The memorandum of OPC shall indicate the name of the other person, who shall, in the event of the subscriber’s death or his incapacity to contract, become the member of the company.

- The other person whose name is given in the memorandum shall give his prior written consent in prescribed form and the same shall be filed with Registrar of companies at the time of incorporation.

- Such other person may be given the right to withdraw his consent.

- The member of OPC may at any time change the name of such other person by giving notice to the company and the company shall intimate the same to the Registrar.

- Any such change in the name of the person shall not be deemed to be an alteration of the memorandum.

- Only a natural person who is an Indian citizen and resident in India (person who has stayed in India for a period of not less than 182 days during the immediately preceding one calendar year)-

- shall be eligible to incorporate a OPC;

- shall be a nominee for the sole member of a OPC.

- No person shall be eligible to incorporate more than one OPC or become nominee in more than one such company.

- No minor shall become member or nominee of the OPC or can hold share with beneficial interest.

- Such Company cannot be incorporated or converted into a company under section 8 of the Act. Though it may be converted to private or public companies in certain cases.

- Such Company cannot carry out Non-Banking Financial Investment activities including investment in securities of any body corporate.

- OPC cannot convert voluntarily into any kind of company unless two years have expired from the date of incorporation, except where the paid up share capital is increased beyond fifty lakh rupees or its average annual turnover during the relevant period exceeds two crore rupees.

- If One Person Company or any officer of such company contravenes the provisions, they shall be punishable with fine which may extend to ten thousand rupees and with a further fine which may extend to one thousand rupees for every day after the first during which such contravention continues.

- Here the member can be sole member and director.

Steps for Incorporation

Step One : Obtain Digital Signature (DSC)

For formation of Company, forms must be submitted to registrar electronically, which must be digitally signed. It is prerequisite to obtain Digital Signature certificate for formation of Company.

Subscribers to Memorandum of Association must sign the documents digitally. If member himself is becoming director of the company, then there is requirement of only one Digital Signature Certificate. However, if other person is/are to be appointed as director, then Digital Signature Certificate of all the applicants are to be taken.

Step Two : Checking availability and reservation of name

Name of the Company can not be similar to existing LLP, Company or Firm. Check our article on availability and reservation of company name.

It is not necessary to make separate application for reservation of name. Separate application is made only to check whether proposed name is available or not. Name can also be reserved by filing incorporation application, mentioned in Step Five.

Step Three : Preparation of the Memorandum of Association (MOA)

A Memorandum of Association (MOA) is a legal document prepared in the formation and registration process of a limited liability company to define its relationship with shareholders. The MOA is accessible to the public and describes the company’s name, physical address of registered office, names of shareholders and the distribution of shares. Check our article on preparation of Memorandum of Association.

Step Four : Preparation of Articles of Association

The articles of association is a document that specifies the regulations for a company's operations and defines the company's purpose. The document lays out how tasks are to be accomplished within the organization, including the process for appointing directors and handling of financial records. Check our article on this subject.

Step Five : Application for incorporation of One Person Company

For incorporation, E-form 'SPICE (INC-32)' has to be filed with Registrar.

E-Form SPICe (INC-32) is single application for -

- Reservation of name

- incorporation of a new company

- allotment of DIN (If applicant are not having Director Identification Number, then same can be obtained through this form)

- PAN and TAN.

This e-Form should be accompanied by supporting documents including details of Directors & subscribers, MoA and AoA etc. Once the e-Form is processed and found complete, company would be registered and Corporate Identification Number (CIN) would be allocated. Also DINs gets issued to the proposed Directors who do not have a valid DIN. Maximum three Directors are allowed for using this integrated form for filing application of allotment of DIN while incorporating a company. Also PAN and TAN would get issued to the Company.

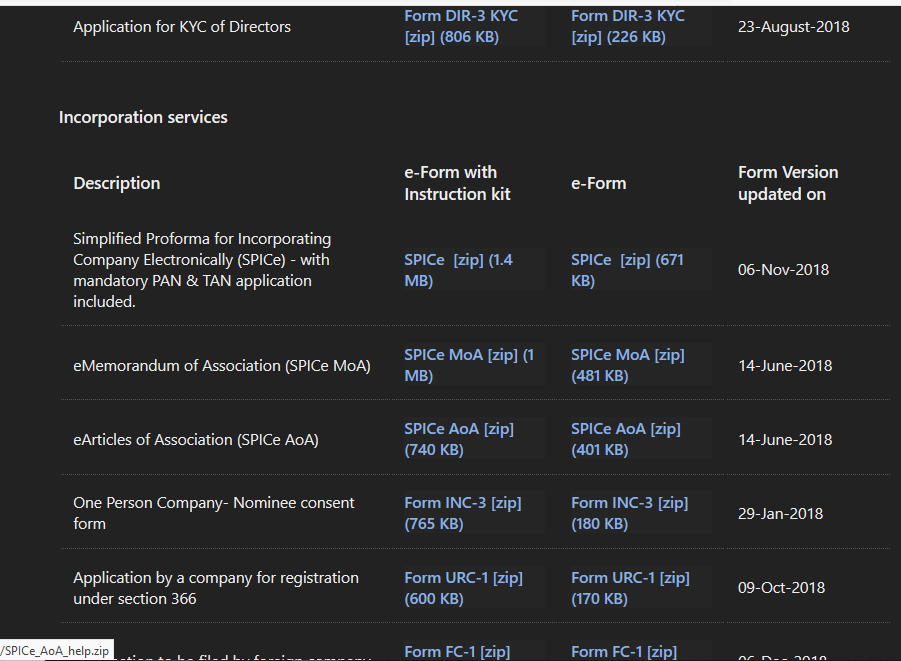

Where can we find e-Form SPICE (INC-32) for download

To download this form, visit www.mca.gov.in

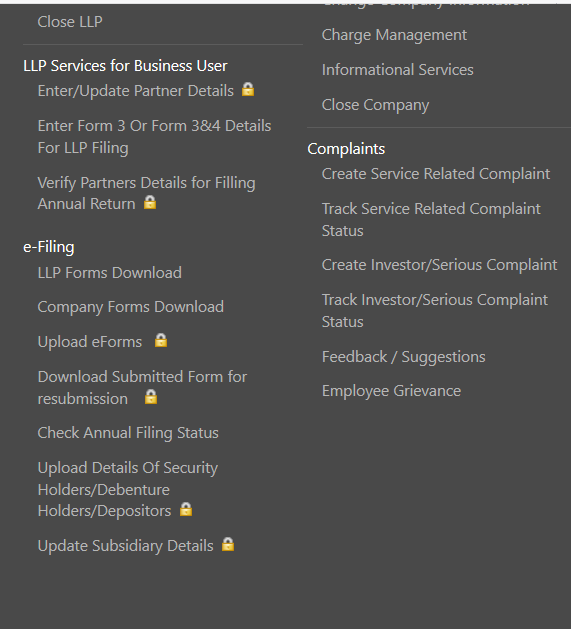

Hover on MCA Services, mega menu will be displayed, under 'e-Filing' click on 'Company Forms Download'

In next screen list of all forms will be displayed. Search for 'SPICe [zip]', click and download with instruction kit. Refer instruction kit while filling the form.

Following documents are required to be attached with the form

- Affidavit and declaration by the single member and director(s) in form INC-9, stating that -

- he is not convicted of any offence in connection with the promotion, formation or management of any company, or

- he has not been found guilty of any fraud or misfeasance or of any breach of duty to any company under this Act or any previous company law during the last five years,

- and that all the documents filed with the Registrar for registration of the company contain information that is correct and complete and true to the best of his knowledge and belief.

- Consent to act as Director in form DIR 2.

- If the address for correspondence is the address of registered office of the company, then following attachments are mandatory:

- Proof of office address

- Copies of utility bills that are not older than two months.

If place of registered office is not fixed, then director may give his correspondence address for all communication purpose. However, Company has to intimate address of the registered office to the Registrar within 30 days of incorporation by filing eForm INC-22.

- Copy of approval in case the proposed name contains any word(s) or expression(s) which requires approval from central government.

- If the proposed name is based on a registered trademark or is subject matter of an application pending for registration under the Trade Marks Act, then it is mandatory to attach:

- Approval of the owner of the trademark or the applicant of such trademark for registration of Trademark

- If proposed name requires approval from any sectoral regulator, then it is mandatory to attach (if already received), In principle approval from the concerned regulator.

- If any subscriber to the proposed company is Foreign company and/or company incorporated outside India, then it is mandatory to attach, Copy of certificate of incorporation of the foreign body corporate and resolution passed.

Note: It is optional to attach Copy of certificate of incorporation in case the subscriber to the proposed company is Body Corporate. - In case the name is similar to any existing company, then it is mandatory to attach, a certified true copy of No objection certificate by way of board resolution / resolution.

- In case any of the director has any interest in the proposed company, then it is mandatory to attach, Interest of first director(s) in other entities.

- If any of the director (including subscriber cum director) does not have DIN, then it is mandatory to attach, Proof of identity and residential address of such director.

- Consent of nominee

- Proof of identity and residential address of the nominee

It is recommended to name the attachments with proper name. For e.g. If PAN is attached as proof of identity then recommended name of the attachment is “PAN – Proof of Identity”. This should be followed while attaching any attachment.

Fill the form, refer instruction kit provided with form for any guidance, and submit it to the Registrar along with e-MOA and e-AOA. MOA and AOA are not required to be prepared manually and scanned. You have to file e-MOA and e-AOA.

Submission of the form SPICe

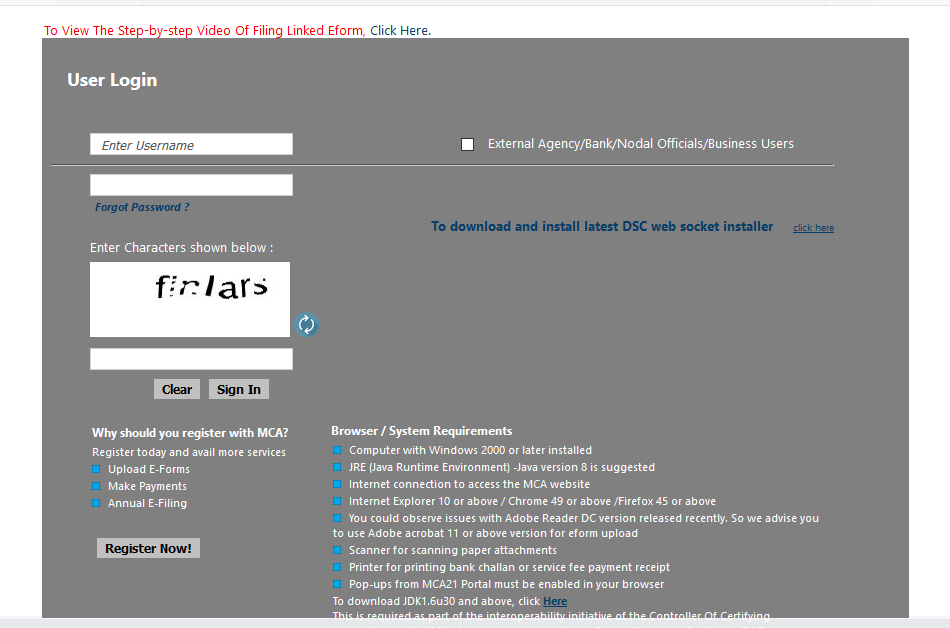

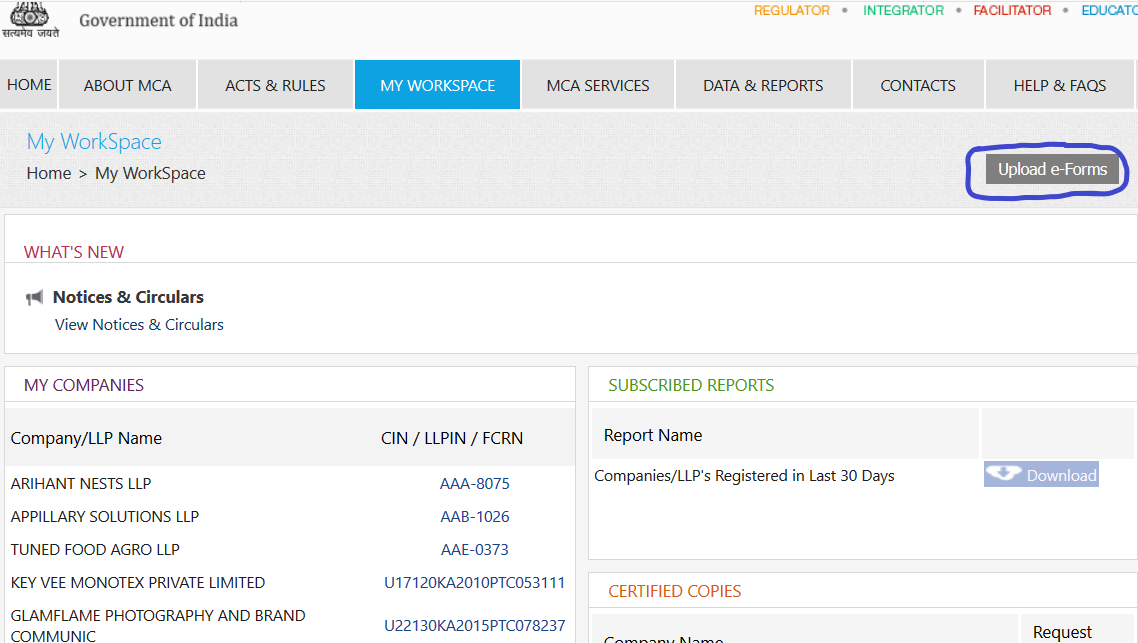

To submit the application, visit www.mca.gov.in, and log in to your account. If not registered, create your account, by clicking on 'Register' in top menu.

After you log in, click on 'Upload e-forms'

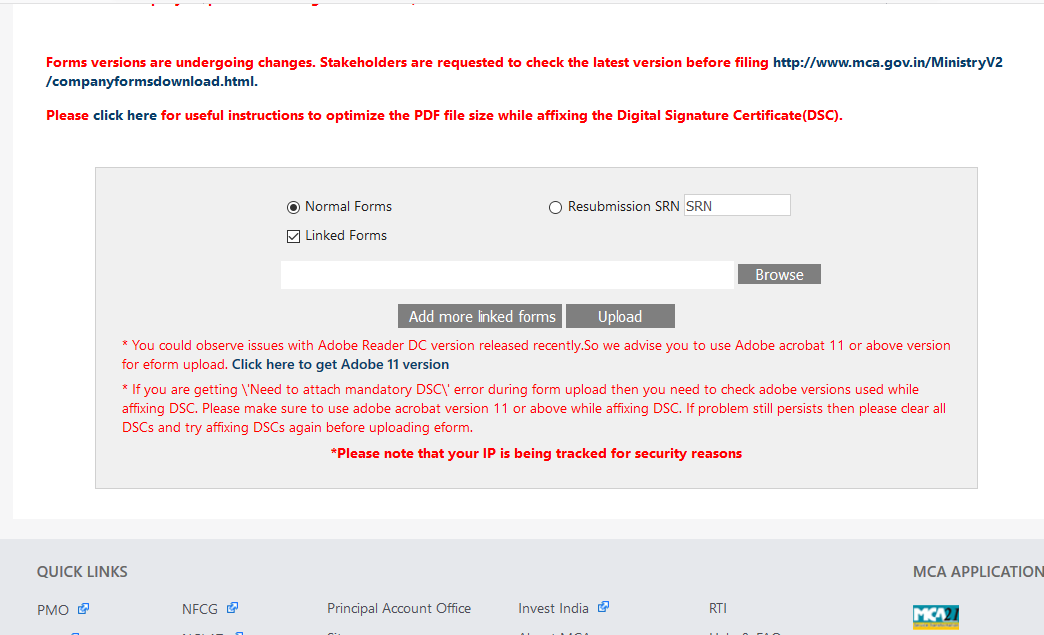

Next in Upload Form page, select 'Normal Forms' and 'Linked Forms'. Under 'Normal Forms' attach form 'SPICe', and under 'Linked Forms' attach 'e-MOA' and 'e-AOA'. Click on 'Upload'

After form is successfully uploaded, SRN will be generated. You can either choose 'Pay Now' or 'Pay Later', for payment of fees. Fees details are provided in instruction kit. Application status can be tracked with SRN.

When the eForm is processed and DIN is generated, an acknowledgement email of DIN generation is sent to the director. Further, on approval of SPICe forms, the Certificate of Incorporation (CoI) is issued with PAN and TAN as allotted by the Income Tax Department. An electronic mail with Certificate of Incorporation (CoI) as an attachment along with PAN and TAN is also sent to the user.

Finance Act, 2018 amended section 139A of the Income-tax Act, 1961 and removed the requirement of issuing PAN in the form of a laminated card. Hence, it is clarified that PAN and TAN mentioned in the COI issued by MCA shall also be treated as sufficient proof of PAN and TAN for the said company assesses.

You need to be logged in to comment.

- Free Tools

- Verify GST Number

- Search GST Number with name or pan

- Search Multiple GST numbers

- Search Multiple PAN numbers

- Top Members

- Related

- ONE PERSON COMPANY

- Annual Compliance by One Person Company

- Annual Compliance by Private Limited Company

- Annual Compliance by Limited Liability Partnership

- How to submit/file forms to MCA

- Intimation of address of registered office of the Company to Registrar

- Article of Association of the Company

- Memorandum of Association of Companies

- Incorporation of Private Limited Company

- Availability and Reservation of Company name

Never File Wrong GSTR-1

Check your GST numbers in bulk. Check unlimited GST numbers with very cheap packages.

Used by

No comments yet, be first to comment.